There has been a tremendous increase in the demand for organized reporting of trades (a.k.a trade journaling) in the last ~2 years. A lot of this increase in trading can be attributed to reasons like:

- Increase in commissions-free brokers

- Funded accounts/Prop firms

- Easier than ever access to trading terminals and information to help trade

- Introduction of ways to bring in smaller traders: fractional shares/micro future contracts

These are our guesses on why the market will continue to have an influx of fresh traders - even in unstable times like (increasing rates etc.,).

The next natural effect is increased trading activity - not only via a single broker but from many brokers. On TradesViz, the average trading accounts per user has increased by 50% in just the last 1 year.

Current trader's requirements & most requests features

We will cut to the chase. We've had conversions with thousands of traders since our launch and everyone is different. The list of most frequently discussed or requested features might not something you agree with, but we guarantee that at least one of your requests or pain points will be addressed here or will be present in this list:

- Auto-sync of trades from all brokers: No one wants to work with csv/excel etc. It's the age of automation and traders expect their trades to be automatically organized, charts added, statistics calculated and be ready to view when they check their journals. This has been the #1 reason why traders are hesitant to start a journal: the cost and time spent in maintenance. This is also the first question most users ask us: "Can I sync trades from {XYZ} broker?" - other than a handful of brokers in the US and from other countries, most do not have an open API.

This has become such an important deciding factor for users that we have seen many cases of users switching brokers due to a lack of availability of sync/API features.

- Price: Of course, a journal is a record of your trading - how well it can influence and improve your trading is up to you. As with all tools, the value of a journal is proportional to the effort you put into it. Also, factors like responsive support, constantly updating features, advancements in analysis/charting, and more are taken into account by most users.

If a journal can offer a simulator, options flow, seasonality, etc., and other features that most traders have separate subsections for, it's a no-brainer to choose the journal as an all-in-one tool and save money in subscriptions and time spend navigating between multiple platforms.

- Flexibility in dashboard design: Users who have been using simple tools like Excel/google sheets look for more flexibility when it comes to how they want to view their data. Naturally, a fully customizable dashboard is not an easy technical feat to pull off considering how varied each trader's needs are and how much data we are dealing with.

- Simplicity and ease of use: To some, this may be contradictory to the feature above, and to some, it's a must. Again, satisfying every single trader is impossible. Also, the background and experience of each trader are so varied that this makes the UI/UX design very hard to do.

A lot of experienced traders appreciate the level of detail, the drill-down charts, the various charts, dropdowns for customizations, etc., whereas, some traders just want to view their pnl calendar, their trades table, and some basic stats.

- Charting of trades (OHLC): Since the era of TradingView, almost every trading platform has integrated with them and traders are very used to their interface. Because of this, charting of trades and execution in TradingView charts has become such an important feature - especially for intraday traders.

We are even seeing demand and requirement from traders for charting for derived assets like options. Features like being above to view multiple trades in a single chart, viewing all trades in a chart-based view, etc., are become important to traders.

- Tables/charts and statistics: Charts have become boring. Why? Most platforms seem to think simple pnl charts are enough for traders. This has given most traders the notion that they can get a full picture of their trading and understand their performance by just glancing at the chart until they learn it's not enough and they start disregarding the charts.

Understanding trading performance and analysis is an art. It's not simple and it's sad that most competitors and similar platforms have taken no efforts on this front to educate traders. This is why they have fallen in popularity and in priority when in fact, they should be at the top.

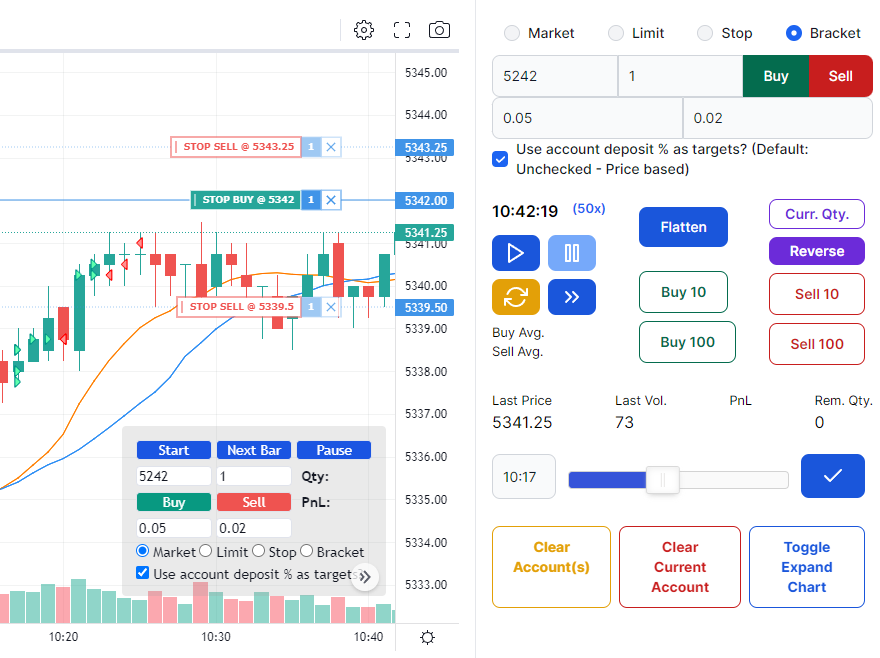

- Misc. features: Some journals have started adding simulators to their offering - albeit a very limited stock-only simulator with restricted features. This has become a good selling point and also works well with the journal perspective because after all, a platform that can record and let you practice your trades is indeed very useful.

However, this is not enough. To provide traders with the full experience, a poorly-built simulator or data visualization tool can only make the user experience poor.

These are the most discussed features/requests from traders regarding a trading journal. Are we missing something? Let us know: [email protected]

Where does TradesViz stand here?

With respect to [1] and [2] - there really isn't much we can do. We've added all the brokers that offer an API to TradesViz (TradesViz is the #1 in the world when it comes to no. of brokers available for auto-syncing). Whether more brokers want to open up their APIs or not - it's up to them. Pricing - TradesViz's base price will never change. Existing users will always be grandfathered/will retain old pricing if there is ever an increase. Again, TradesViz is the lowest-priced online trade journal for the features we offer.

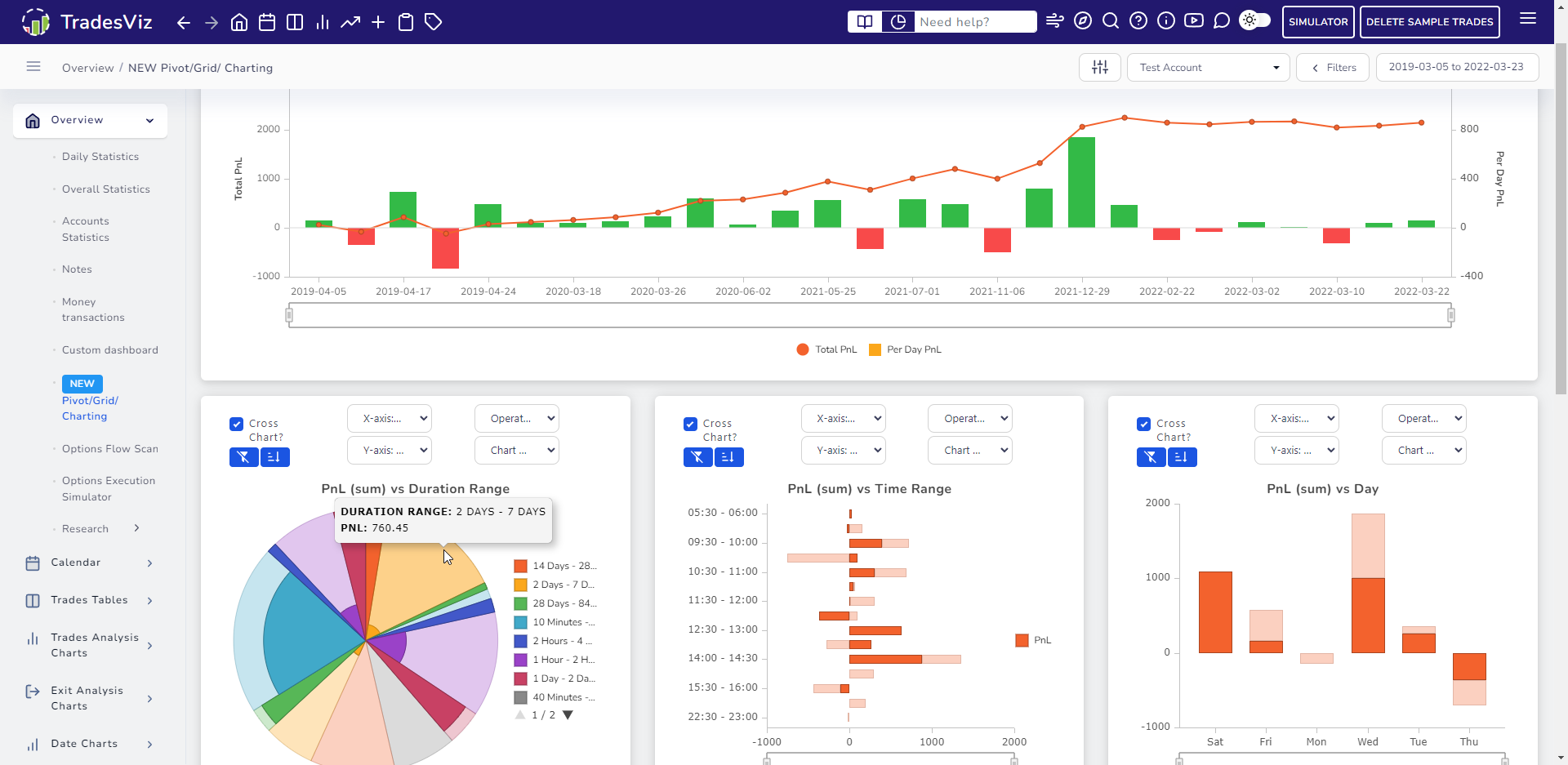

[3] (Flexibility) & [4] (Ease of use): The custom dashboard and the pivot grid of TradesViz trumps every single competition out there.

In a field (online trade journaling) that has existed for more than 10 years, there have never been advancements like this before. In fact, we are starting to see other competitors slowly start adding some features based on our implementations since our launch in just the last 2-3 years. This is the effect TradesViz has had on a decade-old field in just a couple of years.

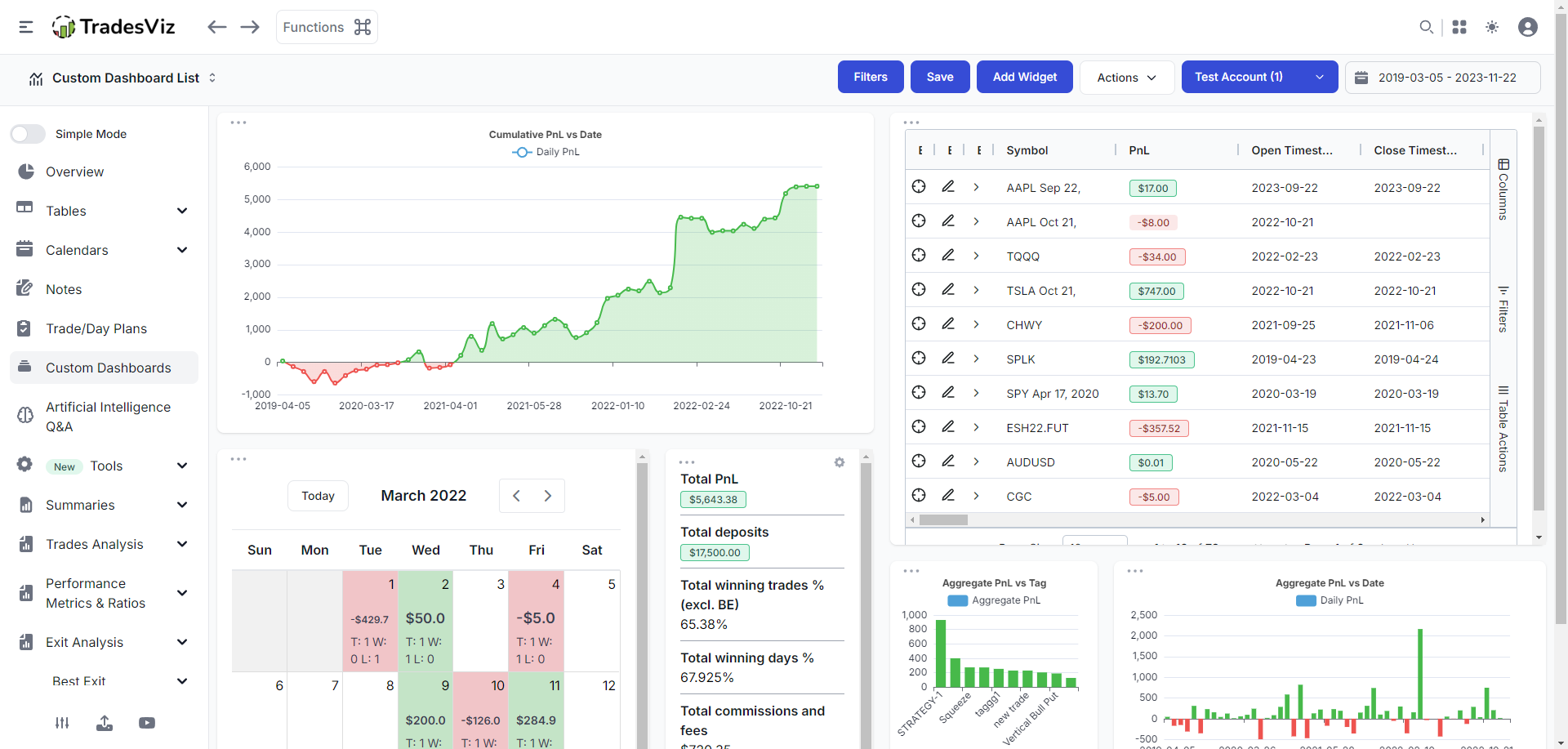

Doesn't matter what type of a trader you are, what you trade, what size account you trade with, or what stats are important to you, you can use the custom dashboard to create a dashboard from over 400 UNIQUE WIDGETS and set it as your home page.

Similarly, with over 70 statistics per trade, there is no chart or visualization that you can't create with the pivot grid.

While the pivot grid has a little bit of a learning curve (that pays itself back exponentially if you take the time to learn it), the custom dashboard requires almost no learning and probably a few minutes of effort from your side to make TradesViz your own.

Flexibility is not only concerned with the visuals/dashboard etc. but also with data. How is your data processed? How should your trades be grouped? How can you manage 10+ accounts? How can you easily sync 20+ connections? How can you export any data whenever you want? How can you tag/add comments etc., to 100+ trades at once?

etc., etc.

The list goes on. This is data management flexibility where, again, TradesViz excels at. Check your account settings: tradesviz.com/accounts/settings - almost every part of your account is customizable: format of dates, timezone, currency, how to process custom commissions/targets, etc.,

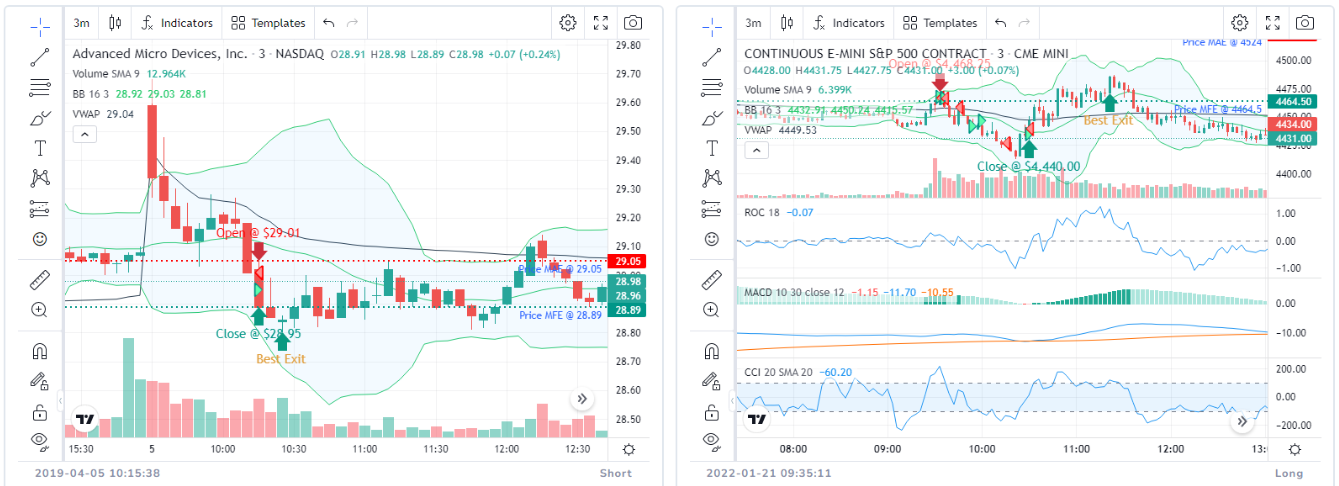

[5] Charting - TradesViz is the FIRST trading journal to have full integration with TradingView for viewing data in fully interactive charts for ALL asset types ACROSS multiple exchanges from 4 countries.

Let's take a step back and check all the places where chats are part of your dashboard:

1. Trade explore: Explore each trade in full detail

2. Chart view: View multiple trades of any input symbol

3. Table's chart view: View all your trades as charts in a grid format

4. Options charts: View not only underlying, but also the exact opinion leg's OHLC data

5. Options simulator: Multiple leg OHLC - World's only trading journal to have combined OHLC for any combination of option legs

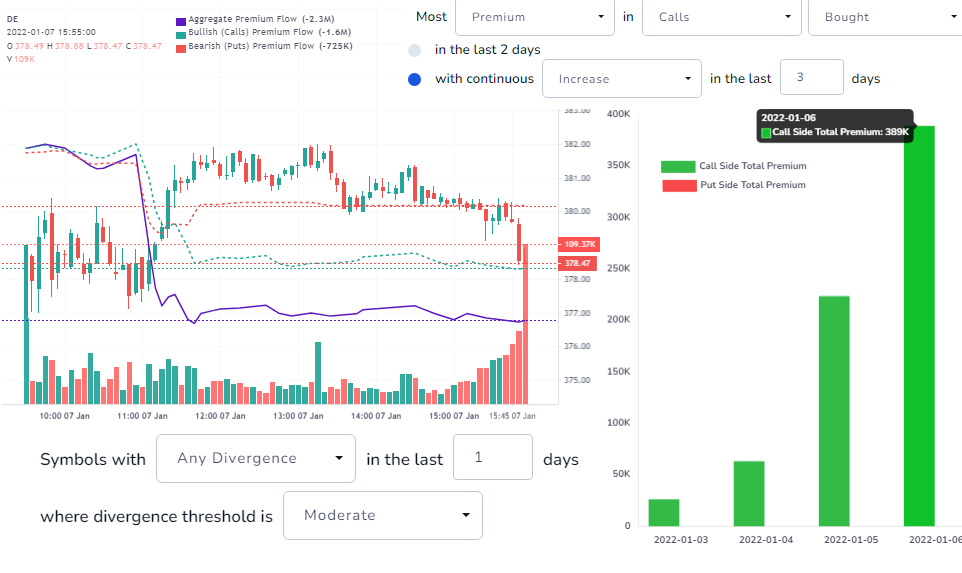

6. Options flow: First trading journal to have options flow integration showing call/put/cumulative flow

7. Simulators: Simulate stock, future, forex in the same TradingView chart and replay any of your trades.

On top of this, all the drawings and chart commentary you do for each trade are saved. Every chart can be modified by pre-saved templates that you can create anytime. Finally, You can apply a global chart template so that all your trade charts in your main dashboard automatically show the correct timeframe and indicator you want.

There is no other journal or analytics platform with integration that focuses on providing this much flexibility in the trader's hands.

[6] Tables/Charts

Once again. Our most recent pivot table trumps everything out there.

But even before that, TradesViz is the first trading journal to have:

- Multiple trades table grouped by symbol, day, etc.,

- Logic-expressions-based searching in the table

- Most advanced group/bulk operation function

If you are looking for an upgrade from a spreadsheet, this is the only next viable upgrade that allows you to have nearly the same amount of freedom and flexibility but without the effort or learning curve that Excel sheets require from you.

[7] Misc. features

TradesViz has long evolved from being just a trading journal. Since our inception, we have added:

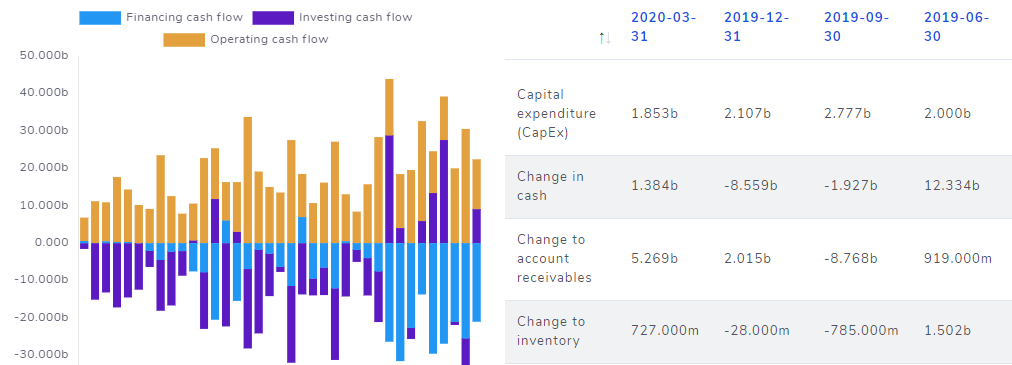

- Fundamentals analysis

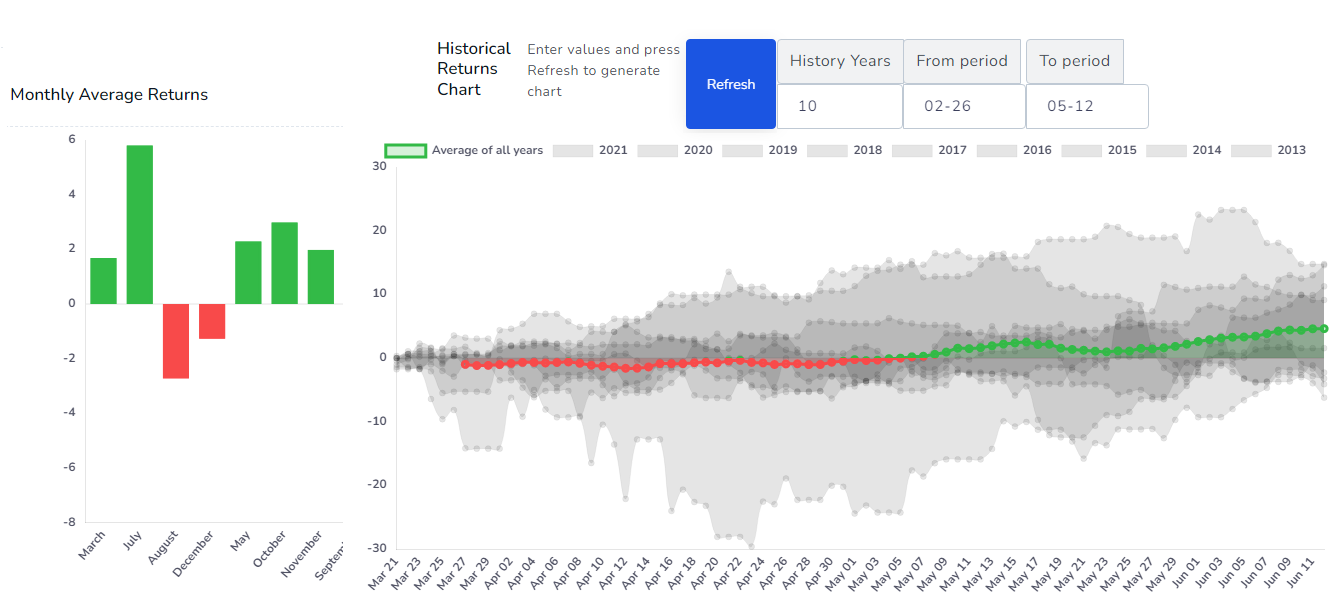

- Seasonality analysis

- SEC 13F filings analysis

- In-depth Options flow

- Options flow screener

- Stock + Futures + Forex trading simulator (multi-chart/multi-timeframe advanced simulator)

Some of these features have also been directly integrated into the dashboard for easy analysis and unification of data.

All of these features exist as a separate dedicated tab with extensive guides on how to use and benefit from them.

All of these features were added at ZERO extra cost to traders.

This is why TradesViz has become not only a top trade journaling solution but also a beginner-friendly, pocket-friendly trading analysis and data visualization platform for traders from all over the world.

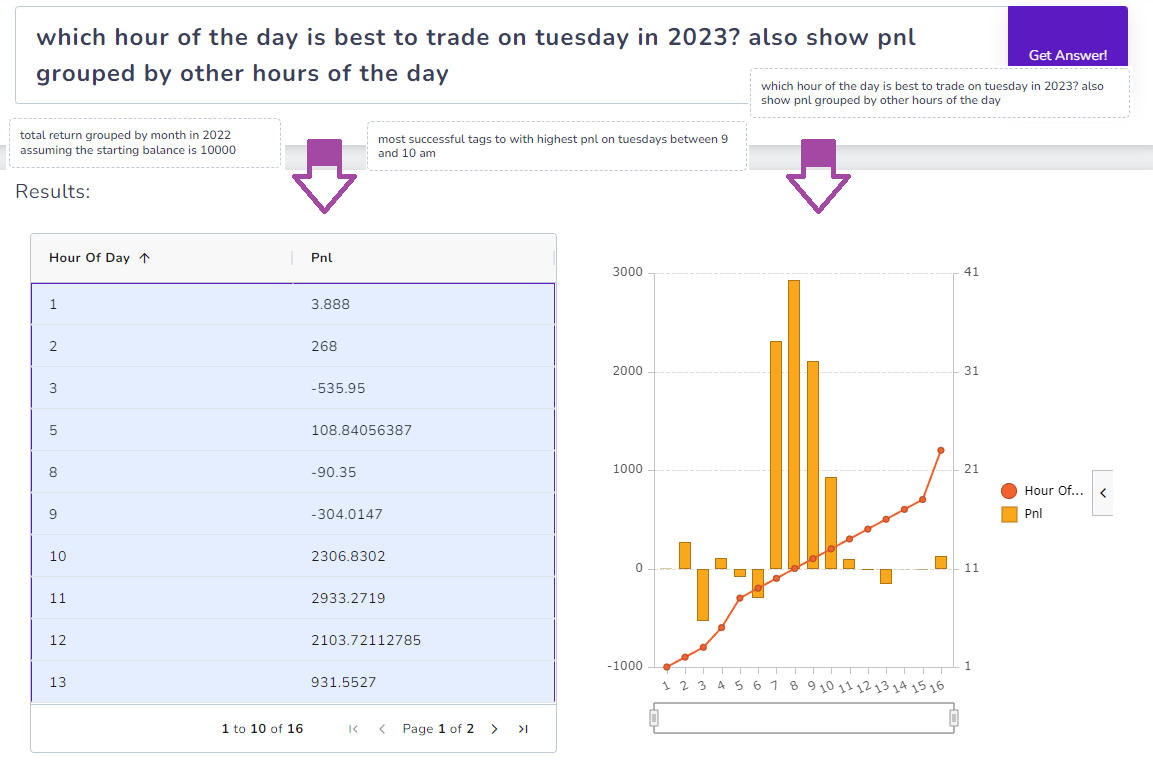

Tired of charts? tables? Just type in what you want to find or ask. TradesVi Q&A powered by OpenAI will give you the answers you are looking for. We believe AI to be our next frontier in trade journaling. Advanced statistics -> Charting -> Pivot & charting -> AI [We are here]. We have a lot of AI features planned for the coming months and can't wait to share them with you.

Asset-specific importance and features in TradesViz

Gone are the times when journals were just for stock traders only.

These days, we see traders having individual accounts for multiple asset types - mainly stock, options, and futures. Heck, we are even seeing PLENTY of Forex and CFD traders utilizing so many features of TradesViz - no just for journaling, but for analysis, backtesting insights, and practice using a simulator.

Single-asset journals are no longer viable.

Traders are shifting from one asset type to another in mere weeks. Journals need that level of flexibility.

Options traders are usually the ones left behind due to the complexity of handling options data which most (still, even now) journals do not want to bother with.

At TradesViz, we try to design features with ALL asset types in mind. Not just stocks or futures, but also, forex crypto, even CFDs, etc.,

Here are some of the asset-type-specific features:

Forex: All features + Dedicated forex simulator for replay and practice

Futures: All features + Dedicated futures simulator for replay and practice + super-granular charts (up to 5-sec) + sub-minute MFE/MAE /Best exit analysis

Stocks: All features + Dedicated stock simulator for replay and practice

Options: All features +

- Options greeks analysis

- Options flow

- Options executions simulator

- Intraday option execution OHLC charts

Cryptocurrency: All features

(*All features = Charting, table, filters, statistics features work with these asset types)

Current competition overview

Here's the TL;DR version: Just sign up for TradesViz.com: https://tradesviz.com/signup ;)

Ok, let's be serious. Looking around, it's a bit sad that there have been ZERO improvements across the board in ANY other competitor.

Can you show or prove otherwise? Let us know: [email protected]

We pretty much stopped updating our competitor analysis after our first year of launch: https://www.tradesviz.com/blog/?category=Product%20comparison

We took the 3 most popular trading journals and compared them.

But here's the twist: Instead of creating our own feature list, we simply used their most extensive list and compared it to ours. TradesViz won every single comparison - with zero compromises. This was 2 years ago.

This is why we stopped updating those pages. Here are those pages:

https://www.tradesviz.com/blog/competitor1-alternative-tradesviz-comparison/

https://www.tradesviz.com/blog/competitor2-alternative-tradesviz-comparison/

https://www.tradesviz.com/blog/competitor3-alternative-tradesviz-comparison/

- We have seen some journals include simulators (only stock).

TradesViz offers stock, futures, and forex with a new asset type coming soon)

- We have seen many small journals that focus only on crypto or forex with very limited features.

TradesViz supports all asset types with the highest no. of integrations. Almost all features can be used with any asset type.

- We have seen at least 4 journals proclaiming to be #1 in the world with zero updates in the last 2 years. Let's be honest here, shall we?... Traders deserve better.

- We are seeing many journals propagating a lot of platitude sayings and teaching misleading analysis with lots of market hype around it which is giving new traders false hope that everything is going to be smooth sailing.

- Most of the journals have non-existent support (where did we hear this from? Our customers :) )

We know this almost sounds like a rant from us, but we implore YOU - the trader, to compare the features yourself and decide.

Let's talk price.

A price increase can be justified if there are more features. Stale software can't sell at the same price forever.

However, we are seeing $50+/mo journals with less than 1/10th of the features of TradesViz being created - for what purpose?...

We are all in for competition that PROMOTES innovation and REDUCES prices. Not the other way around...

As the trader, and as the consumer, it is with your support that TradesViz has a chance to show other traders that better solutions exist.

- Auto-sync of trades from all brokers: Some crypto-specific journals have connections with crypto exchanges, and some forex journals have connections with forex brokers. Generic journals barely support 5-6 brokers - that too with a lot of sync issues, unfortunately.

- Price: Complete fail here. Everything is priced WAY above what is offered to the users. sub-40 should be the MAX.

- Flexibility in dashboard design: Extremely limited in some and non-existent in most.

- Simplicity and ease of use: Subjective - we will leave this to the users to decide.

- Charting of trades (OHLC): Journals are *just* starting to integrate TradingView charts. Even the ones that already have them are buggy and do not have any features to do modifications/customize the charts.

- Misc Features: Other than a trading simulator (stock only) in some journals, there are no extra features worth mentioning.

What do you think? Do you have different opinions? Let us know: [email protected]

Conclusion

While trade journaling has a limited audience - not all traders are using training journals (although they should be if they make at least 10+ trades a month), this has become a neglected field due to low reward/ROI.

This, unfortunately, has forced traders to use poorly built outdated solutions for a very long time. We want to change that.

Based on our analysis and comparison, there is no single solution compatible with TradesViz if you are serious about trading analysis and performance improvement. With the advent of new technologies and more advanced ways to analyze data, we hope to see better solutions for traders and we are also constantly in the process of thinking of and building the next generation of trade journaling features.

In order to drive more interest in the journaling field, it would also be better if other FInTech verticals think about integrations with journals to offer a better experience to users. Brokers would need to open their APIs, and allow users to easily connect with well-recognized journals and similar platforms.

Our current opinion is that a lot of these tools are separate - meaning, it requires a trader to buy and manage multiple subscriptions and spend time on each platform instead of focusing on their trading and letting a single platform do the heavy lifting for many use cases. For example, an excellent screener platform can integrate with TradesViz to create auto-watchlists based on users' past trading preferences.

The opportunities are definitely there and we are open to collaborating to bring more value to retail traders. The question is: are other companies of the same mindset? do we share a common goal of improving the quality of tools available to traders worldwide?...

- More automated imports (need brokers to open up APIs)

- Lower pricing

- Supporting a wide range of assets and having global exchanges support

- More integration to bring the best tools (working on strengths)

- Better/more comprehensive education (no BS hype/marketing)

- Trading analysis/journaling to be an important part of any trading course/education

As always, we are open to your feedback, feature requests, and opinions. Without your support, we would not exist and trade journaling would still be an underdeveloped field. You are the reason for this revolution and we hope you will continue the practice of trade journaling to journal and keep improving your trading.