First, we wish everyone a very Happy New Year!

At TradesViz, there's always some brewing and to start this year off, we're launching a massive new feature that is going to help ALL stock and options traders - both to see how their trades would have performed using data that is not accessible anywhere + help traders to learn correlations between options contract(s)/spreads pricing vs underlying.

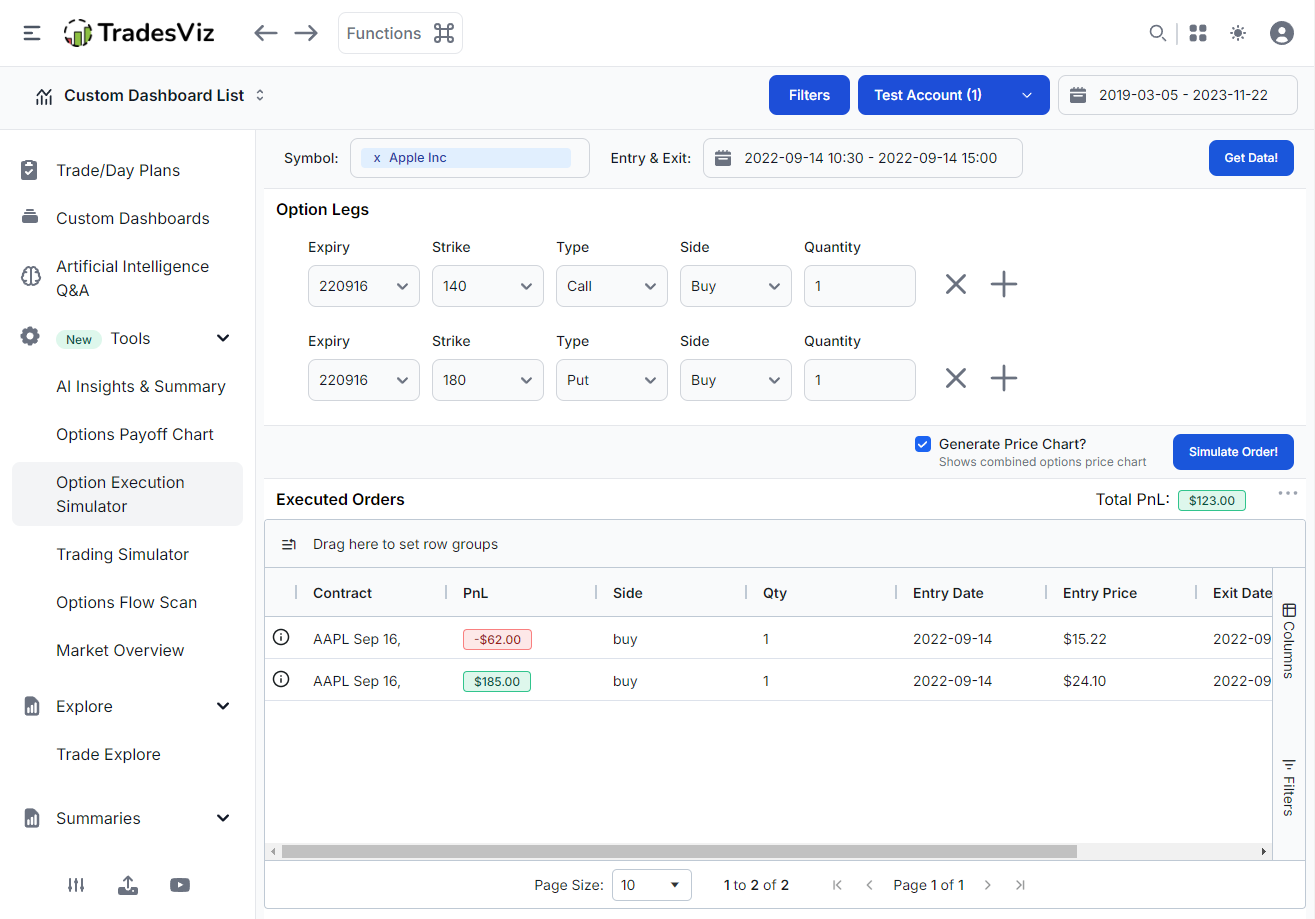

All of this is available in a new tab in your dashboard called "Options executions simulator" under the Overview tab.

There are 4 sections in this tab with the first 2 sections hidden until you choose a symbol and get data.

- Symbol/date selection area

- Option strategy legs creation and PnL summary area

- Underlying chart for the selected date and symbol

- Combined options price chart for all the legs created as part of the simulation

The first section is simple enough: enter your symbol and the date and time of entry and exit. We only allow 1 entry date and 1 exit date for simplicity. After you make the selection, click on "Get Data". This will automatically add the first leg as a sample. From here on, you have the ability to add up to 10 option legs of any available strike and expiry.

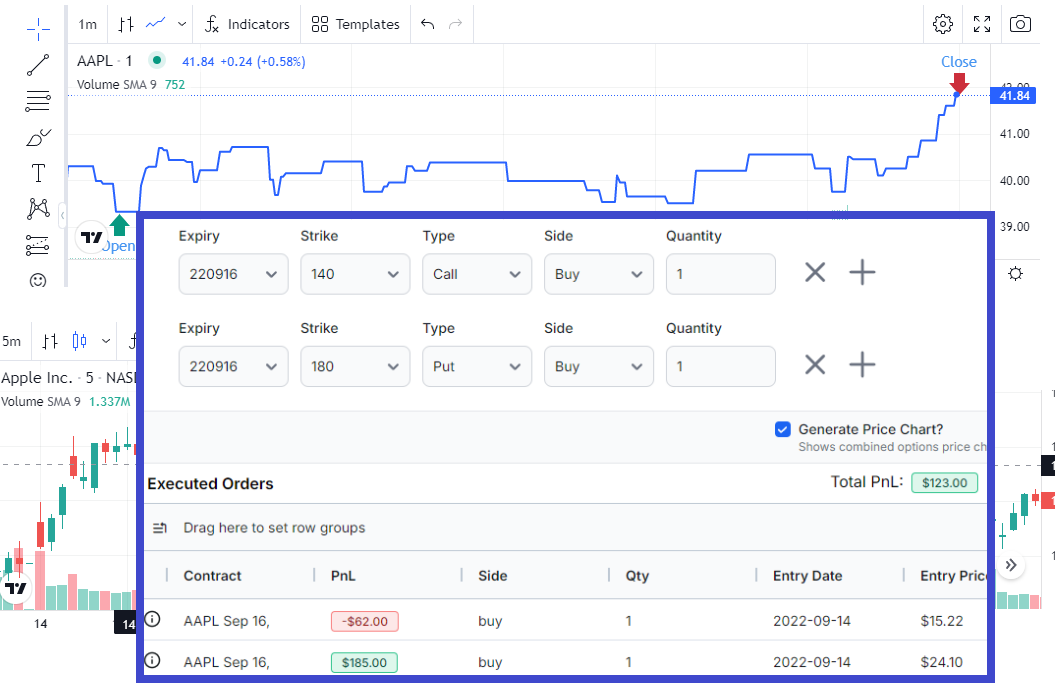

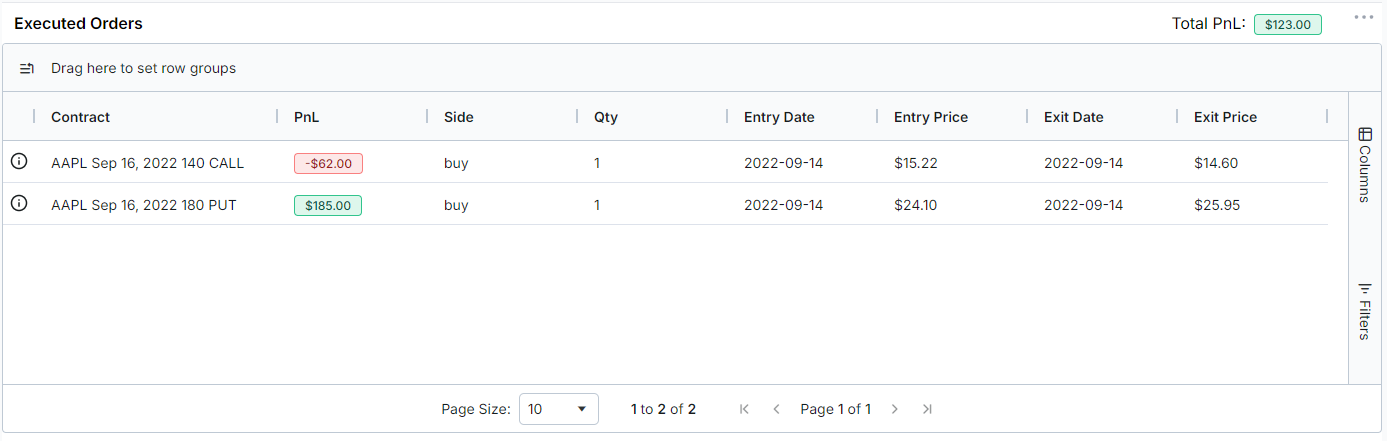

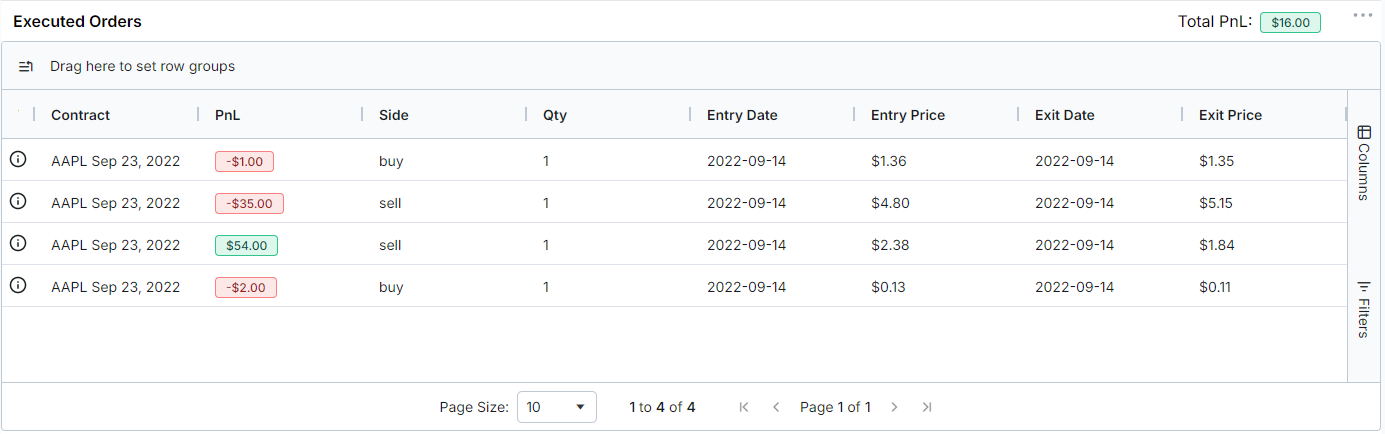

Once you are done adding the option legs, click on the "Simulate" order. This will take some time depending on how many legs you have added as we're accessing data from a very large database. When the results arrive, first you will see the PnL for each contract which is shown below.

The entry price, exit price, PnL-per-contract, and total PnL are what the simulator churns out for any given configuration of option contract legs/strategies.

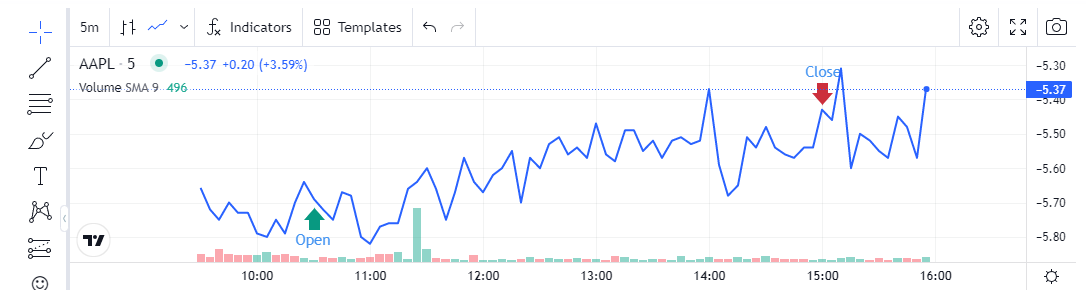

The last section shows the underlying price chart and right below is the combined options price chart.

What is the combined options chart?

In this example, we are simulating buying a spread of AAPL Sep 16, 2022, 140 Call/180 Put on 14th Sep 2022 (this is defined in the section below). This takes the individual options contract prices for the given timeframe and sums it up based on whether the contract is bought or sold. For example, if the price of AAPL Sep 16, 2022, 140 Call at 14:45 is $1.5 and AAPL Sep 16, 2022, 180 Put is $3.0, the chart would show $4.5 if we're buying both options. If we are selling only the 140 call, then the price at 14:45 would be (-3.0)+4.5 = $1.5.

(Note: You can also view the individual contract's price by clicking on the chart on the leftmost side of each row/contract in the PnL section)

The second chart plots exactly this - but for the entire duration of the trade. This is very helpful and is often never shown even in the brokers you trade with. This lets you understand exactly how the price of the entire position moves with respect to the underlying of the contract - all on the same page.

Why is this important? or How can I use this?

The benefits can be divided into 2 parts: backtesting & understanding. You can, for example, simulate the exact charts, PnL, and prices for ANY optionable US equity from Jan 2022 for ANY configuration of option strategy. This level of granularity is not found anywhere - even in advanced options analysis platforms or platforms that brokers let you trade on. All of this is built into your TradesViz account. You have access to entire US options contract pricing data that you can use to analyze and backtest any options strategy you want.

The important use of this feature is to simulate option spreads and even single contracts to learn the correlations between price movements of underlying and the options contract. If you combine this with the intraday advanced options flow we have, you have the most powerful options analytics tool at your fingertips.

- How does a condor work when a stock's price is behaving in a certain way? Would another strategy be better?

- What strikes should you choose? What expires should you choose? How does DTE affect the trend of options prices?

- What if you try different hedging positions with multiple DTEs?

You can come up with countless questions like the above when you are dealing with options trading because options trading is very complex. There isn't a tool that can help you visualize options in the way TradesViz does. The focus of journaling is usually patterns understanding from your trades - but why stop there? Why not expand/extend that into simulating scenarios where you can learn even more? This is how you approach trading analysis in a holistic way in 2023 and we're trying to make it as easy as possible.

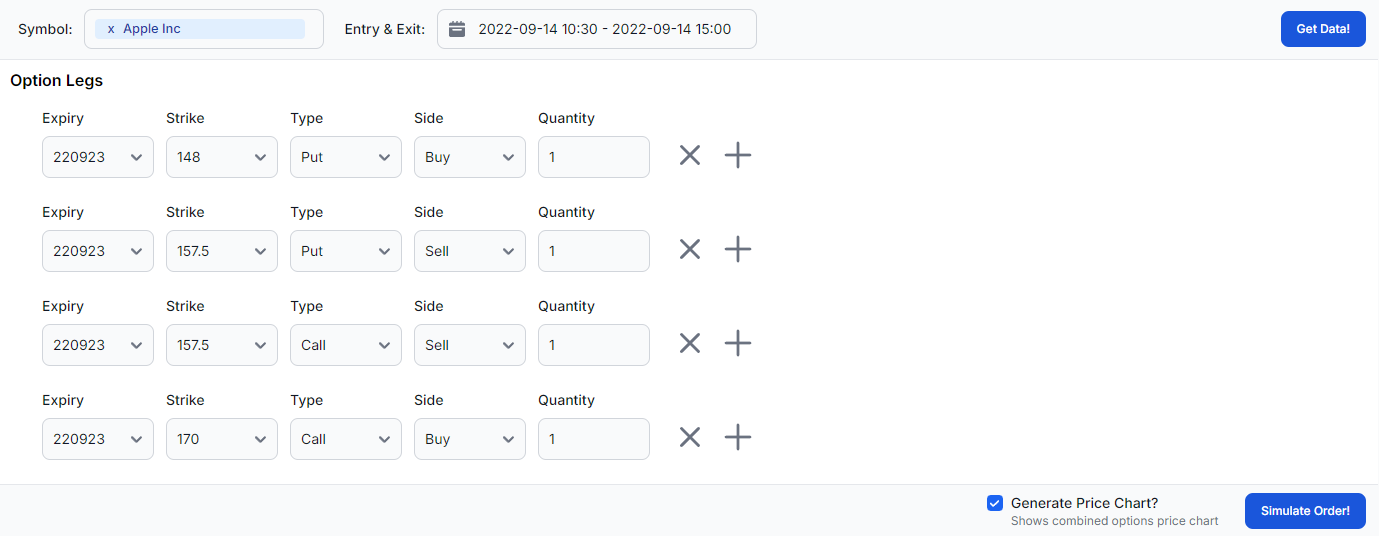

An AAPL Iron condor example

We're going to see how to use this tool to simulate an AAPL Iron condor bought on Sep 14th, 2022. Here are the options legs:

Here's the PnL result:

Here are the charts - underlying and the options contract summed charts are shown below. Have you ever seen the price chart of your options spreads? and have you compared it with the underlying? You can now do so with this feature in the TradesViz trading journal.

If you are interested in seeing the prices of each of the 4 legs:

|

|

|

|

We highly recommend using line charts for visualizing the options prices as most contracts are very lightly traded and it's hard to make sense of OHLC bars.

Soon, there will be more extensions and unifications of options flow with this which will augment your learning. Instead of simply following tools blindly, let TradesViz teach you how to use tools like options flow better. Being able to provide solid reasoning for every execution you take will surely make you a consistently successful trader. After all, 90% of trading failure comes from not understanding the process which leads to breaking one's own rules.

The key to success in trading is knowledge.

With this new feature, we hope to provide all traders with another valuable resource to learn from and succeed. As always, if you have any questions or feature requests, please contact us at [email protected].

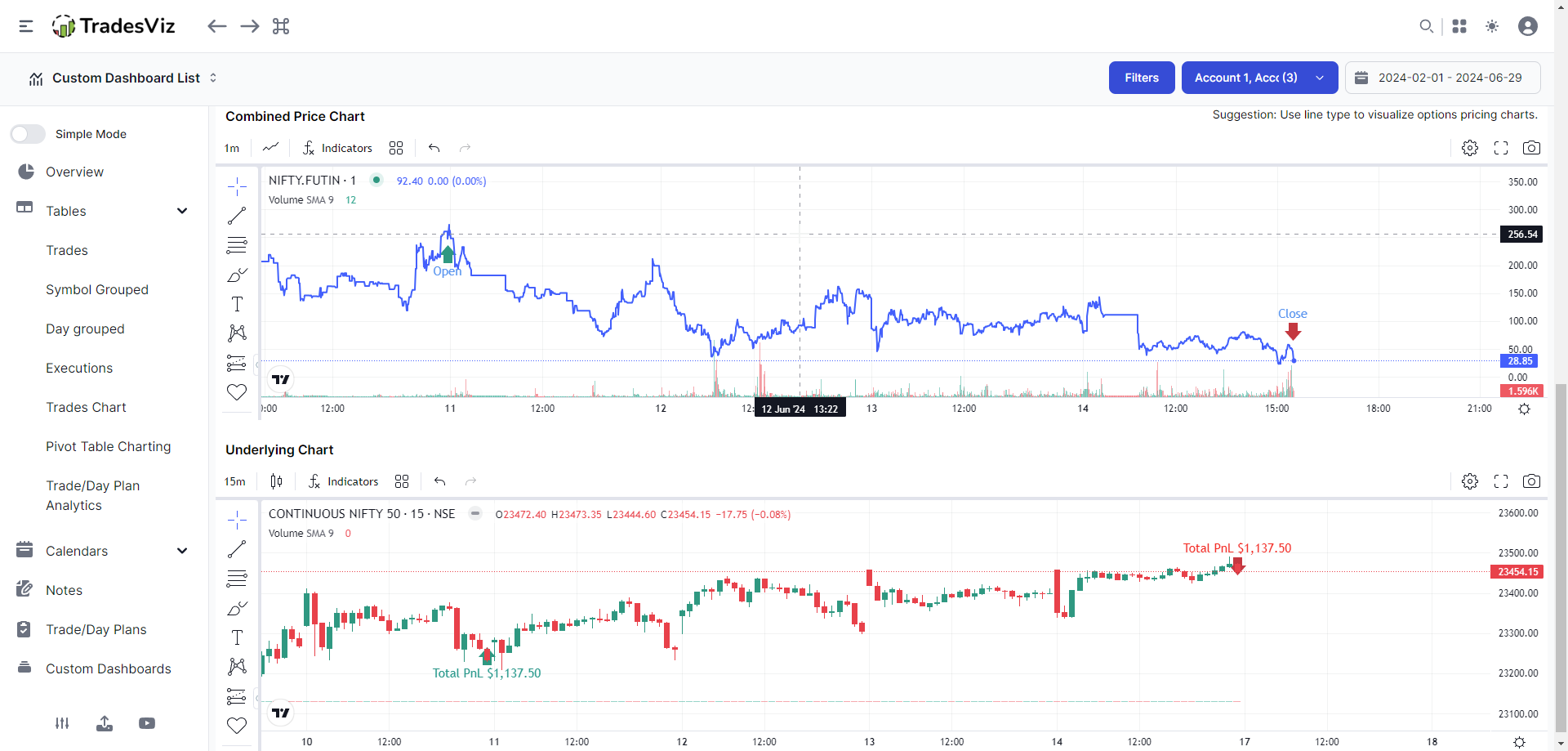

Update July 2024

All of these features are now available for NSE (India) future and stock options! This is the first time an online trading journal has both the most popular options trading exchanges data and that's TradesViz!

Explore more here: https://www.tradesviz.com/blog/nse-options-charts/