We're more than halfway into 2025, and the improvements and updates from TradesViz are getting more users every day interested in journaling and trading analysis. As you may know from our last large change log, which was ~7 months ago, we have reduced the frequency of changelogs and increased the content of each changelog post to give users and readers a better picture of our progress so far and what we plan to do next!

The most significant update we've done in the last 7 months is actually "invisible"... What do we mean by that? We just did our first large migration of the entire fleet of TradesViz servers to a better, more scalable infrastructure to serve the increasing demand of users for quality journaling analytics. While you may not immediately observe any difference, as you add more trades, the overall speed and performance of TradesViz will be maintained. Speed of calculations, broker sync, and real-time sync were also improved.

On top of this, we have released a lot of features, increased capacity and limits for a lot of existing features, and improved the overall speed of all components of TradesViz. Just like how we launched TradesViz v2 about 2 years ago, what happened in the last few months was an upgrade of a similar, if not bigger, scale in the backend of TradesViz, which included upgrading all the software, frameworks, and tools that are used to support the internals of TradesViz. In summary, these last 6-7 months were spent on refinement and setting up the stage for much bigger things to come.

With the "invisible" update out of the way, let's focus on updates that you can readily benefit from. We've split up the improvements month by month and have highlighted the important features changed/updated/launched for that month so that you can easily track our progress.

December 2024

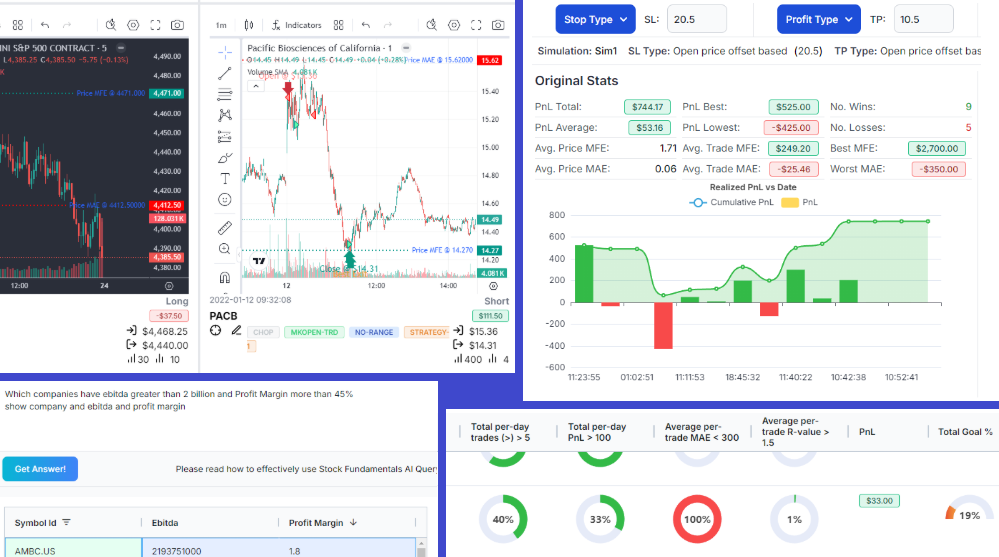

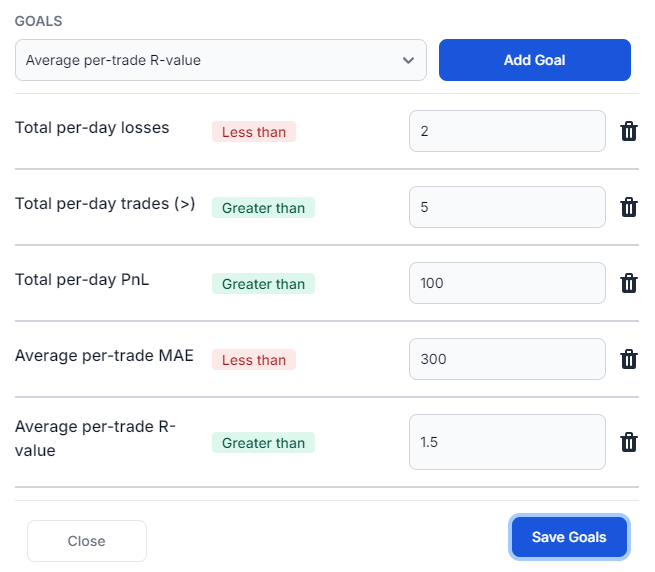

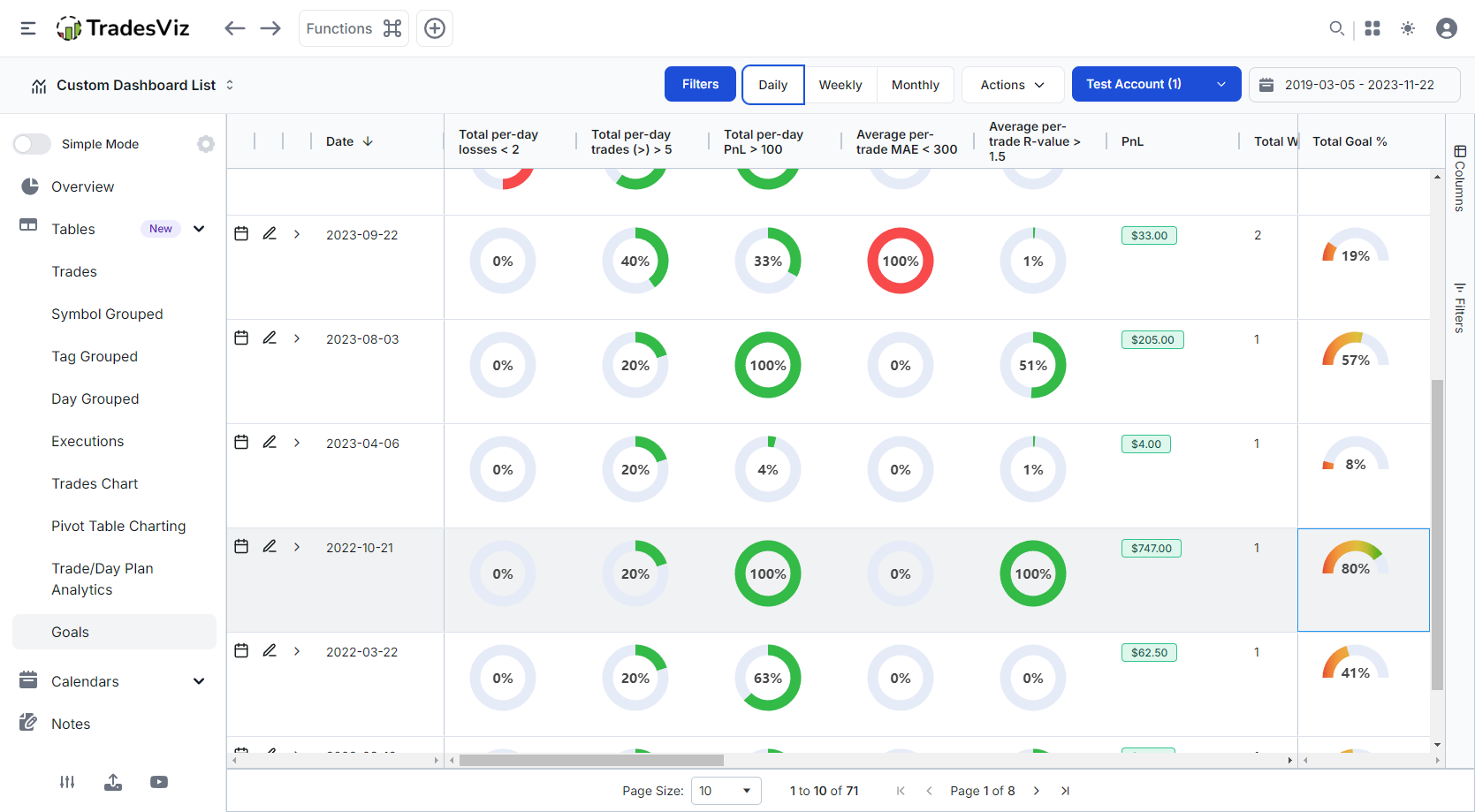

Introduction of trading goals in TradesViz: Traders wanted a way to keep track of not just plans, strategies, but also to set goals and see how much of it was achieved on a daily, weekly and monthly basis. This feataure delivered exactly that. With more than 20 pre-defined goal conditions that are fully customizable, you can clearly see if your performance matches your expectations.

|

|

Once you set the goals, you can easily visualize them using the dedicated goals table under the tables section for each period: daily, weekly, and monthly.

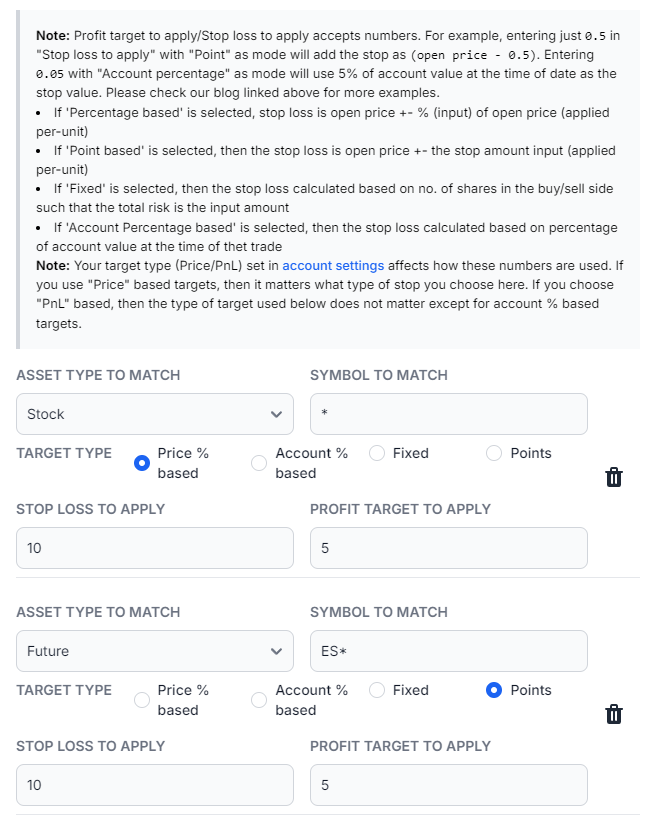

Up next: Solving a problem with brokers. Since most brokers do not report stop loss or profit target values, traders lose a lot of valuable information related to risk management. Of course, it has always been possible to manually enter them or set it based on asset type in TradesViz, but traders wanted more automation and flexibility, and we delivered: Advanced target profiles.

With this, you can not only set granular per-symbol-level target profiles, but you can also set your stops and profit targets as a function of price and quantity. For example, if your stop is going to be 10% of your entry price with a 0.5 slack, you can enter `0.10*price + 0.5`. Another nifty feature is that this, along with the advanced commission/fees profile feature (which is very similar), can be applied immediately to all trades in a trading account - no need to re-import or clear etc.,

Other updates/improvements:

- Improve Heldentrader, Webull, BingX, Saxobank, Tastyworks (OAuth sync added), IBKR, MT5, PropReports + more broker import modules

- Added support for Futures contract-level data in addition to continuous data

- Improved running pnl calculations, MFE/MAE for certain asset types, expanded best exit support

- Improve AI Q&A query processor

- Fix bugs with shared trades pagination + speedup

+ Many more improvements, fixes, and updates!

January 2025

We added new auto-sync brokers: HTX and Trading212.

Updates/improvements:

- Improve Phemex, TradeLocker, Vanguard, Dhan, Binance, Thinkmarkets, Robinhood + more broker import modules

- Fix tags coloring issues

- Added sync failure reason for select brokers

- Added more common questions to FAQ

- Added inline notes and tags editing in trade explore

- Added right click to order for single simulator

- Fix bugs with pivot grid's states

+ Many more improvements, fixes, and updates!

February 2025

More risk metrics: We introduced analysis/charts of duration to MFE/MAE. During many of our interactions with traders, we found that there seems to be a lot of interest in MFE/MAE, but a lot of it did not have any proper direction. While MFE/MAE are very important and useful stats, instead of just looking at the value of it, we started to look at the time and specifically, the duration from the start of your till the MFE or MAE occurrence. This was specifically helpful because one of the most common questions traders ask is "when to exit?". While we do have stats for best exit, multi-timeframe exit, this adds an additional *useful* and informational layer of information for traders to look at and optimize their exits.

We added new auto-sync brokers: Bitunix.

Updates/improvements:

- Improve Kucoin, Schwab, Webull (UK), cTrader, Binance, Thinkmarkets, Robinhood + more broker import modules

- Added practice mode to fundamentals page

- Fix few bugs and improved the performance of options flow

- Improve AI Q&A model

- Move to faster storage for user files/data

- Update AI summary model

- Improved grids used in day/trade explore pages

+ Many more improvements, fixes, and updates!

March 2025

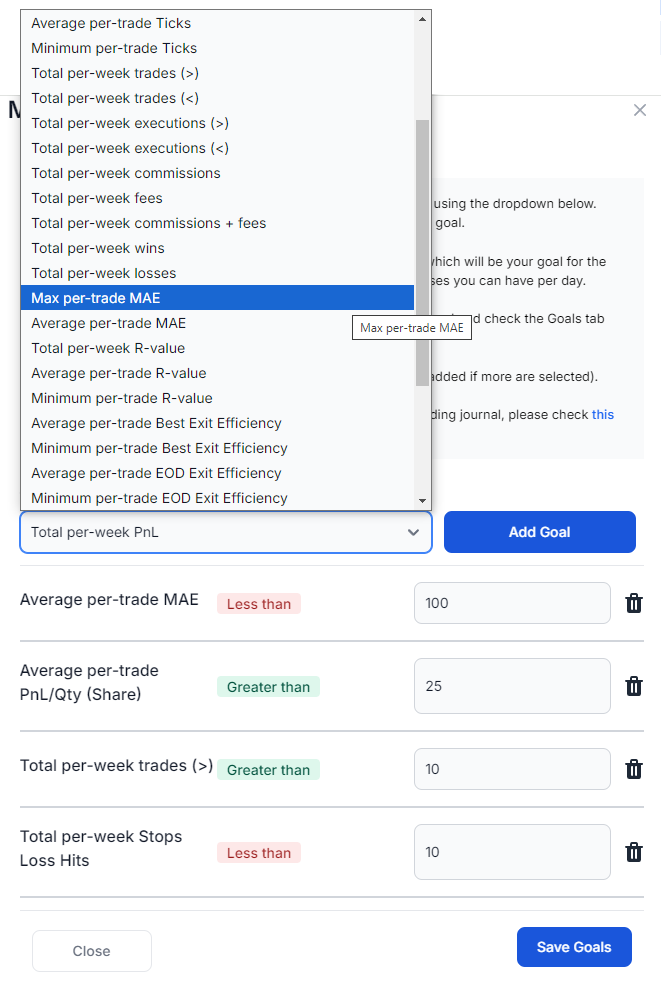

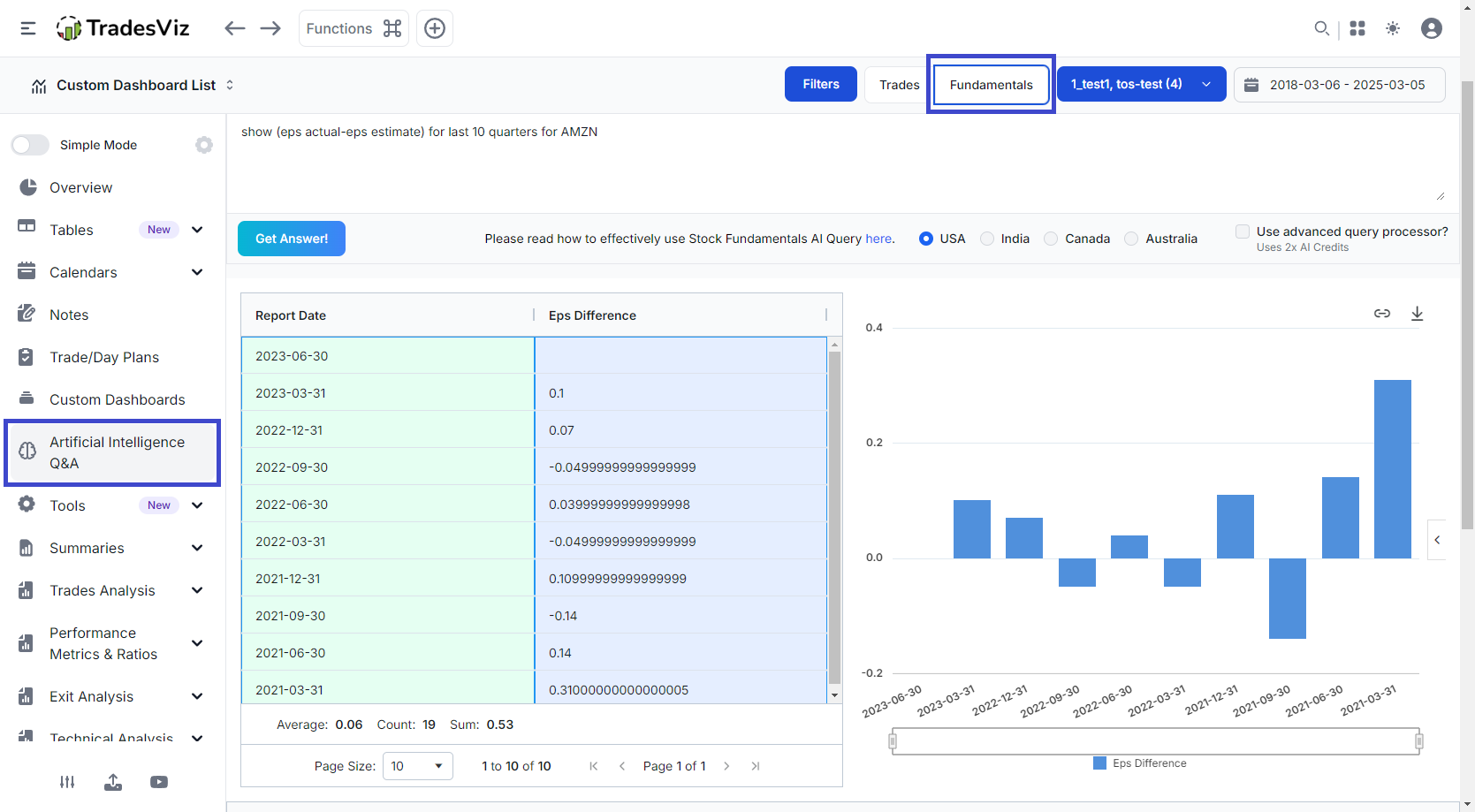

We wanted to expand how traders learn new information using the concept used in the AI Q&A. The result of this is fundamentals AI Q&A: A way to query and learn information about company fundamentals using easy to understand visualizations.

The AI Q&A system (for both trade and fundamentals) has a few core components: Ask in natural language and get results that you can visualize based on your needs (powered by the grids used in TradesViz). The combination of powerful visualization tools + AI models + a unique query processing system that keeps improving makes these systems a very reliable system despite the underlying technology (AI) being non-deterministic.

As an example, it's easy to quickly visualize core fundamentals like EBITDA, net earnings, research expenses, float etc., of any symbol using just natural language. What if you have a very specific query - like, what were the stocks that had more than x% of net earnings, but lower expenses in A category compared to B category in the technology sector? We are showing simple examples here, but we suggest reading the full blog post and experimenting with this to unlock a new venue to learn about stock fundamentals!

We added new auto-sync brokers: Woox.

Updates/improvements:

- Improve CQG, MT4, Dydx, TradeZero, Quantower, Coinbase, Optimus + more broker import modules

- Expanded support for best exit for more asset types/variations

- Added new goals for goal tracker

+ Many more improvements, fixes, and updates!

April 2025

No large features, but we did spend a lot of time creating the most comprehensive guide on how to do effective trade journaling.

From importing trades to improving your trading edge, this guide contains everything. Almost all of the content is generic and is applicable to any type of trade journaling practice. If you are new to trading or if you need proper direction, this is the first guide you need to read: https://www.tradesviz.com/blog/how-to-journal-and-analyze-trades/

We added new auto-sync brokers: Hyperliquid.

Updates/improvements:

- Improve RoboForex, TD365, 5paisa, TopStepX + more broker import modules

- Updated Ninjatrader/MetaTrader 5/SierraChart real-time sync indicator

- Finalize and complete migration of TradesViz servers to bigger hosts with larger server instances

Most of our time in April was spent on migration and monitoring new servers/instances' performance to make sure there is little to no downtime or data issues - fortunately, it went well without any issue, and we're all set for a high level of scaling for the future of TradesViz!

May 2025

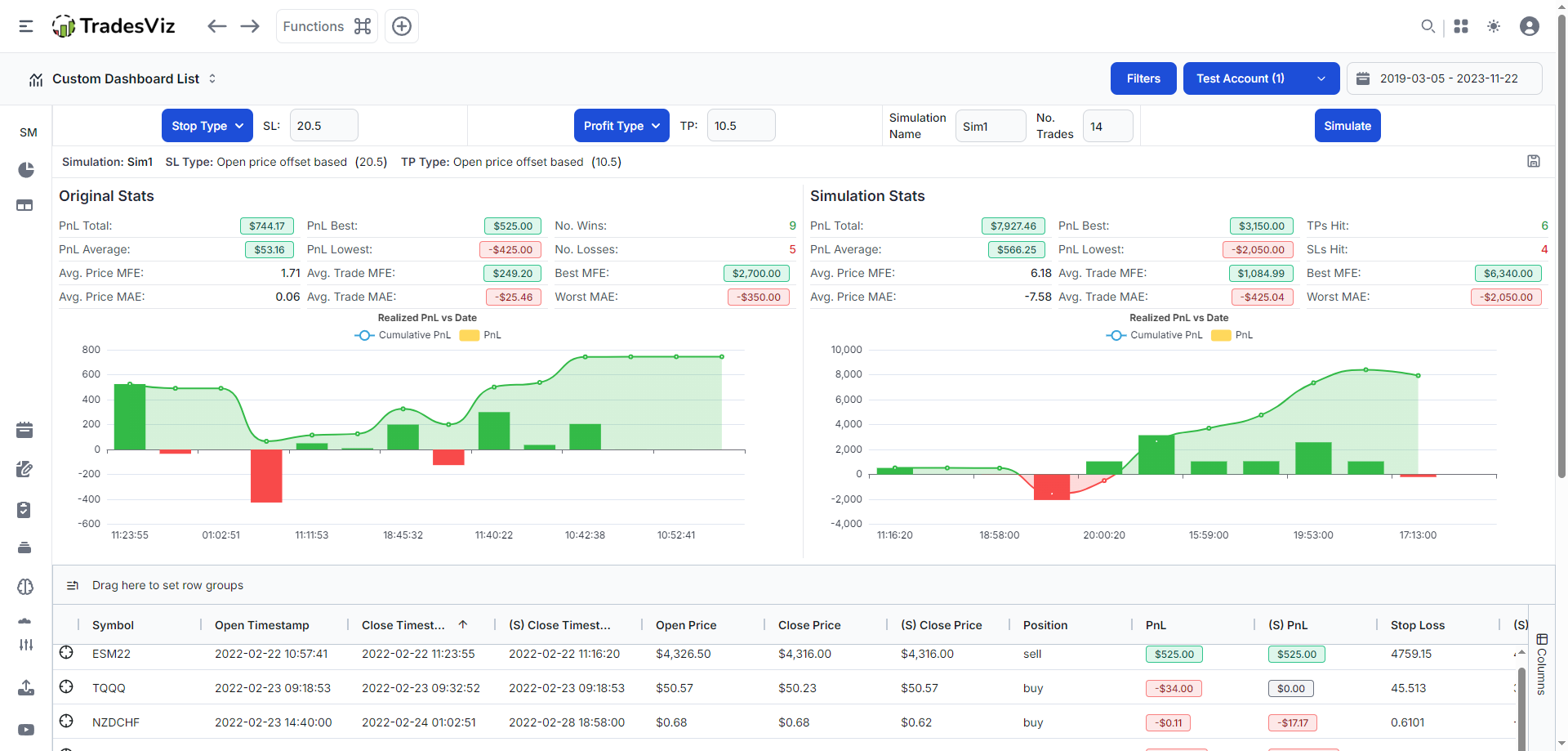

Introduction of a long-awaited feature: The stop loss and profit target simulator. A lot of traders were interested in "what-if" scenarios of what would have happened if they had moved up their stops by a certain amount or if they increased their profit target range etc., This single feature handles all of that and more.

With 7 unique target profiles for each stop and profit, along with the ability to tweak the no. of days you want to be in a trade, you can clearly simulate and compare your trades *side by side*. For each trade with the simulated parameters of stop and profit targets, you will see pnl, duration in trade, MFE/MAE, exit reason, and more generated for you automatically with a single click. All of your simulation results can also be saved to your notes once you are done with the simulation tests.

One of the key focuses this year, on top of refinement, has been the focus on tools that help traders become better traders. Journaling is just one part. Tools like the risk simulator are the stepping stones to becoming a well-rounded trader in the long term. In any sport, you can't get better at it ONLY by planning the sport alone 24/7. You need a proper workout regime, take care of your diet, work on mobility/flexibility/strength, improve endurance, and more - it's a holistic process. Trading should also be treated as a sport and approached in a well-rounded way.

Updates/improvements:

- Make TradesViz home page faster

- Improved speed of all tables in TradesViz

- Added a dedicated posts page to make sure all of our X/twitter content is visible to all users/visitors

- Launched new landing page

+ Many more improvements, fixes, and updates!

June 2025

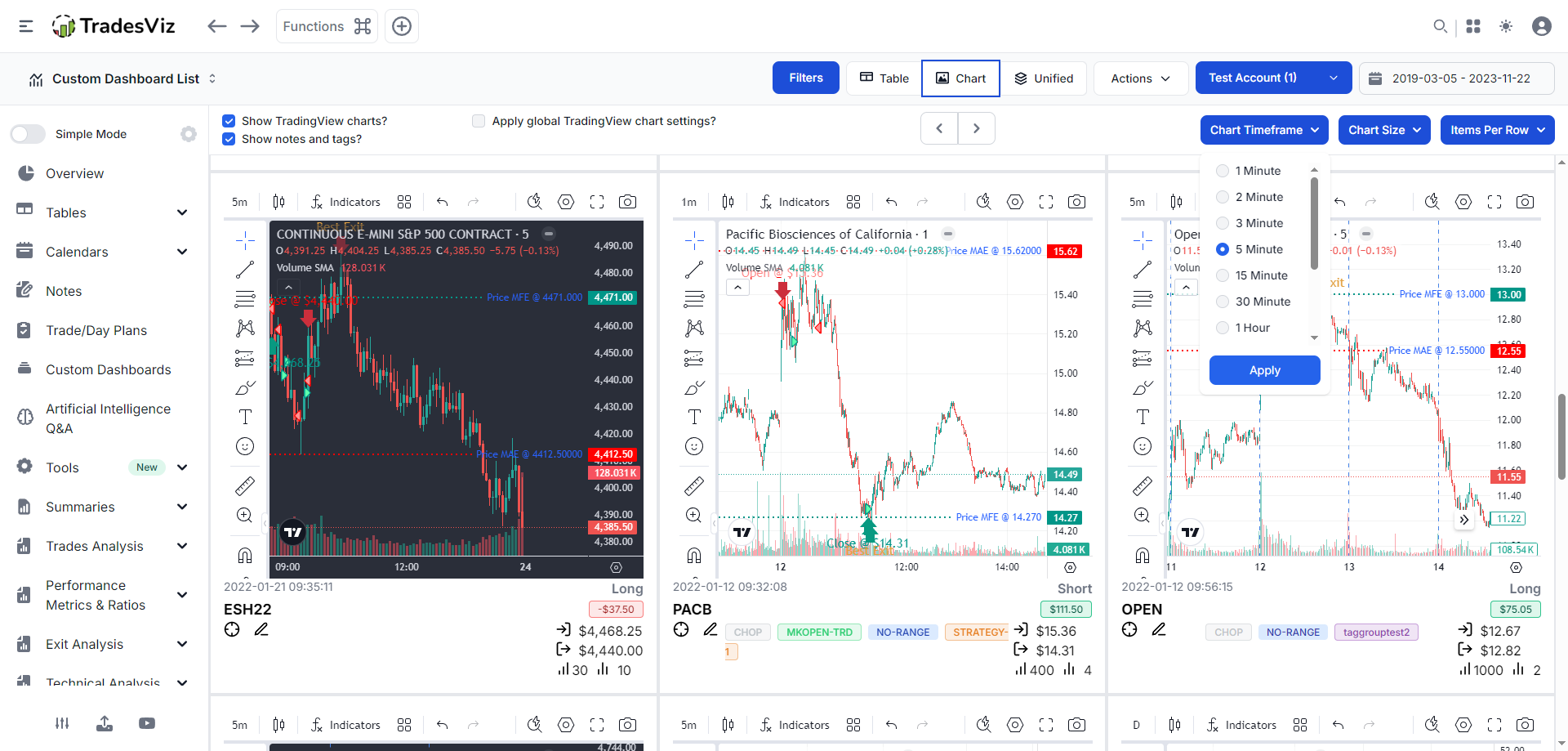

Review and all improvements in one of the most visited tabs of TradesViz: Chart View

To date, chart view in TradesViz is still the only way to view interactive or static charts for all your trades on a single page. We have made many improvements to this tab and some big ones, including bug fixes in the month of June 2025, so we wanted to update our original guide for this tab.

Along with this, we are preparing to launch some large features - some of which are not available in any online journal, nor will it ever be based on the trend we're seeing other "journals" take. Spreaking of which, the state of trade journaling has not changed by much this year either, but our focus has broadened. Stay tuned for the state of trade journaling 2025 edition, which reviews all existing journaling options and compares it with the trader's sentiments and requirements.

Updates/improvements:

- Fix bugs with risk simulator

- Improve Schwab auto-sync

- Improve dark mode

- Fix frontend UI bugs

+ Many more improvements, fixes, and updates!

What's next for TradesViz? You told us. We're working on it now.

- We're improving our UI/UX for all the important components of the dashboard.

- Much better stats and visualization for option spreads and complex strategies

- Screening features

- More flexibility for trade/day plans with new checkbox condition

- More flexibility in AI-based features

- Easier onboarding for new traders

+ More updates are already planned.

Got a new idea? Something we're missing? Something that would make your experience on TradesViz even better? Let us know! We are always open to feedback, and we openly share all of our updates in our changelog posts.

As more users look for value in an era where everything is "powered" by AI, TradesViz stands out with a balanced blend of proven analytics, useful AI features, combined with high ease of use and flexibility for traders of all experience levels.

Every update, change, and revamp is powered by the conversations and feedback we hear from YOU. We are still available via live chat where you can talk to our devs and tech. support team directly on what we can do to improve. Behind TradesViz is a team of engineers, data scientists, and traders who are working every day to make TradesViz a better platform for all traders, not just for journaling, but for ideation, education, and analysis.

The year is not over yet, and we plan to bring one of the biggest updates to TradesViz soon. We hope for your continued support as we keep expanding TradesViz to serve more trader's needs! :)