TradesViz trading journal has not only been the #1 source of technical analysis of trades for traders, but over time, it has grown to be a comprehensive documentation platform for traders interested in documenting every aspect of their trading journey. For example, TradesViz is still the only journal to have a dedicated tab for managing notes (with tags, searchable inputs, note types, etc.), 100% custom tags and tag colors/groups, and the most advanced type of documentation feature: the trade and day plans.

So the question is, what to use when? What should you look for when you organize your data? This blog dives deep into examples and use cases for each of these features.

Unpacking Notes, Tags, and Plans in TradesViz

Notes: Your trading diary

Read all about notes and related features here: https://www.tradesviz.com/blog/notes-complete-guide/

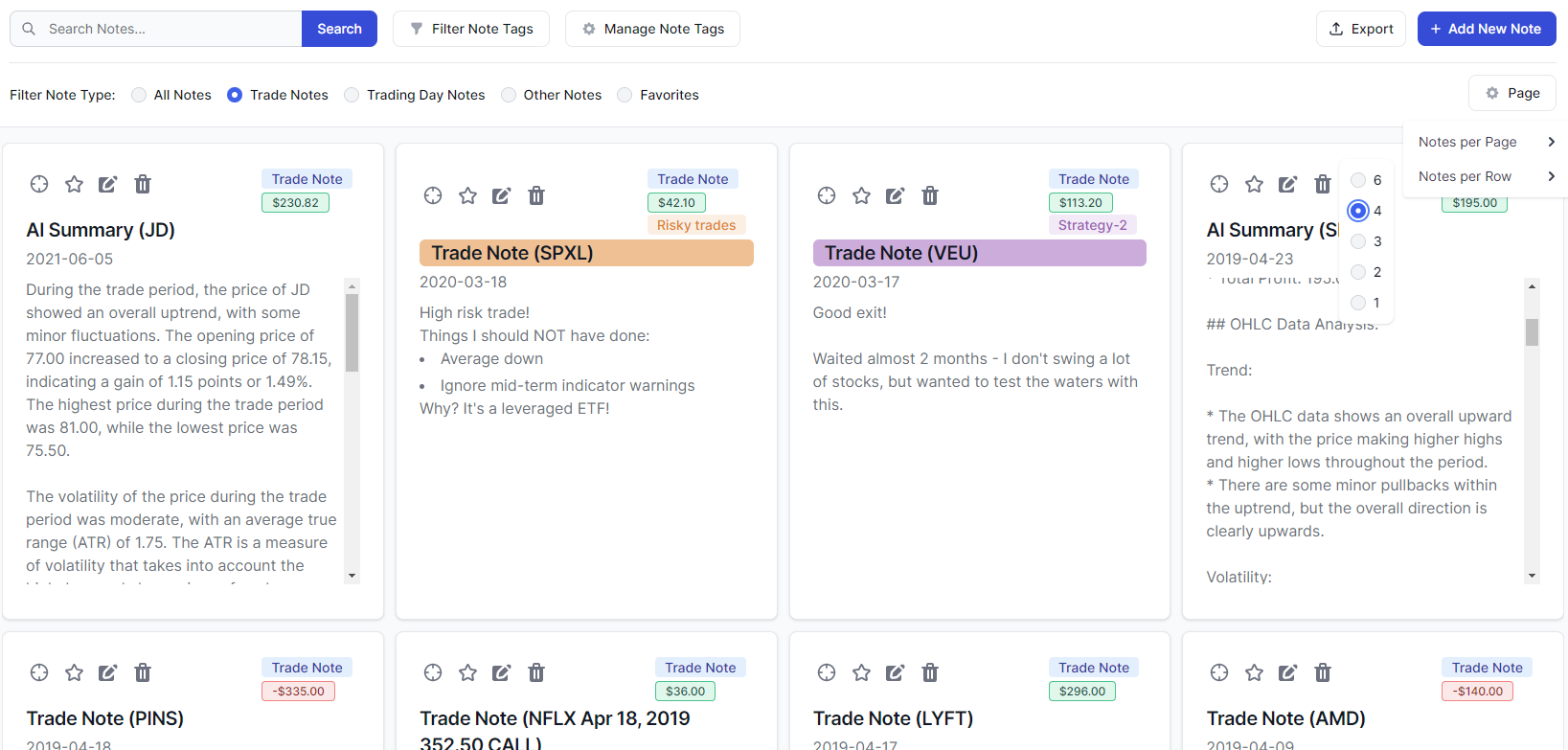

Notes in TradesViz serve as your personal diary for each trade or trading day. They are unstructured rich text fields that allow you to record a wide range of information, from the specific reasons behind your entry and exit decisions to your emotional state during the trade and any external factors that might have influenced your actions. Think of notes as the space where you can truly flesh out the narrative of your trading experience. This can include links to other pages/blogs/trades (or anything) and even images in TradesViz. Simply copy and paste an image into a note and it gets converted into a link automatically.

How to add Notes: Adding notes in TradesViz is straightforward. When you manually input a trade, you'll find a dedicated "Notes" section. Similarly, you can edit any existing trade in your journal to add or modify your notes. Finally, you can navigate to the dedicated notes tab and add notes from there and even link them to any existing trades or any days!

What can Notes be used for?

- Documenting your pre-trade analysis and the specific reasons for taking the trade.

- Recording your real-time thoughts and emotions as the trade progresses.

Note: You can write down notes DURING trading and let TradesViz automatically merge the notes with the closest trade. This feature is called real-time notes. - Reflect on your execution and identify any deviations from your planned strategy.

- Noting down any external factors (news, economic events, personal circumstances) that might have impacted your trading.

- Capturing lessons learned from each trade, both winning and losing.

- Elaborating on unique or unusual trade setups.

- Adding images/charts of your trades or strategies

- Adding info about news/events that affected your trades/trading day

Tags: Filtering & analytics + Limited qualitative context

Read all about tags and related features here: https://www.tradesviz.com/blog/tags-complete-guide/

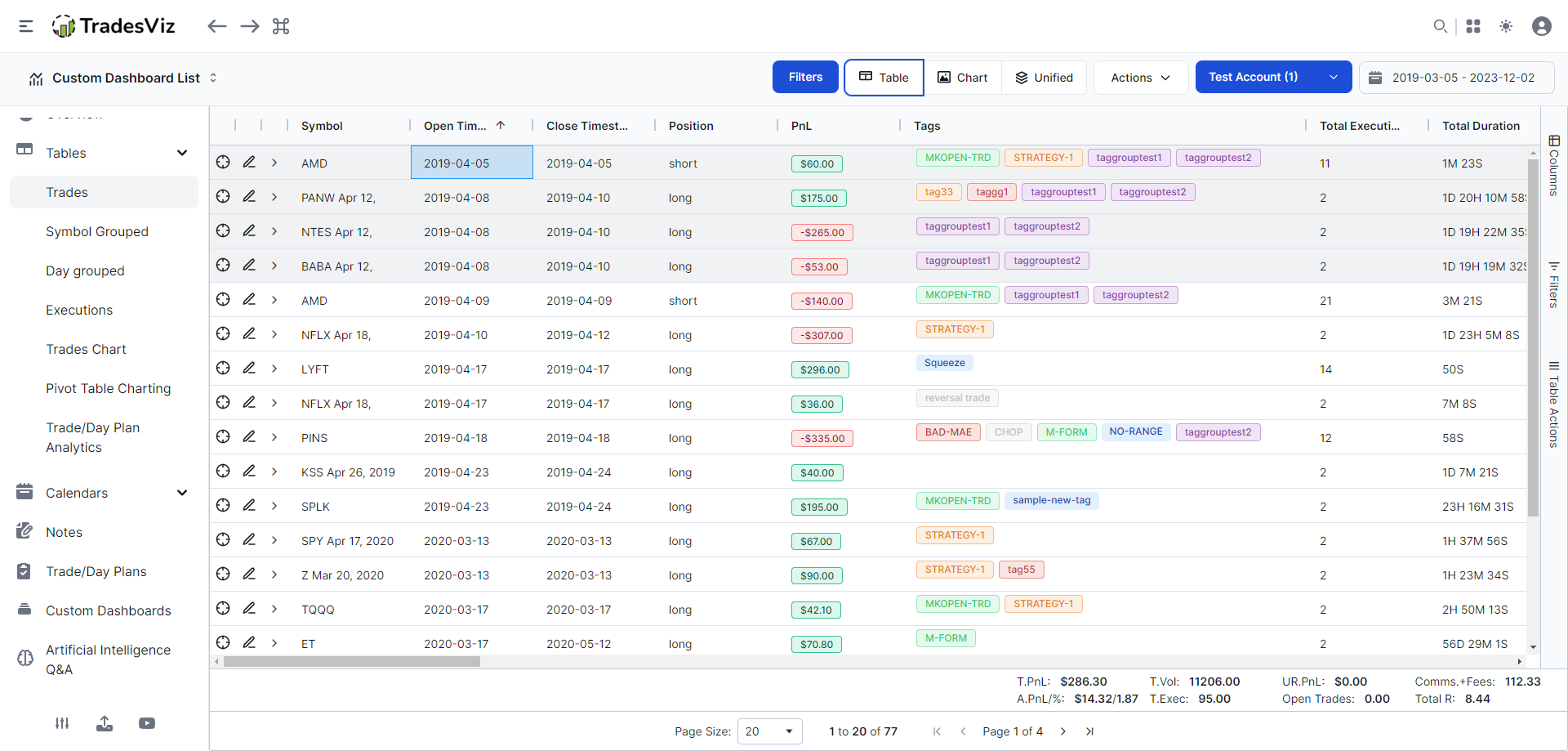

Tags in TradesViz are like "labels" you attach to your trades. Think of them as the colored tabs you see in the document drawers. Their main purpose is to make sure you can quickly and efficiently access the trades you want. In other words, they are designed for systematic organization and powerful analytical capabilities. Efficient filtering leads to useful analytics. Unlike the descriptive nature of notes, tags allow you to group similar trades based on predefined criteria, enabling you to identify patterns and evaluate the performance of specific aspects of your trading.

How to add Tags: You can add tags to your trades during manual entry or by editing existing trades by clicking on the pencil icon in any row in the trades table. On top of this, you can apply tags (and also notes) to many trades at once using the group apply function.

Categorizing: Tags can be categorized into tag groups - there are no limits here, you can create many groups and segregate tags into those groups for more analytics and easy organization.

What can Tags be used for?

- Categorizing trades by strategy (e.g., "Breakout," "Reversal," "Scalping").

- Grouping trades by setup (e.g., "Double Top," "Moving Average Crossover").

- Analyzing performance based on market conditions (e.g., "Bull Market," "Bear Market," "High Volatility").

- Identifying trades taken during specific timeframes (e.g., "Morning Session," "Afternoon").

- Flagging trades based on specific criteria (e.g., "High Confidence," "Revenge Trade").

etc., etc., - there are NO limitations here!

Notice the bolded words in the above list - that's all you need to know to get started. Here's the main point:

Get creative! TradesViz allows you to even search for tags using wildcards! This level of flexibility is unheard of in ANY other solution. So next time some says "setup" or "mistake", think - you can do a lot better with TradesViz, where you are not bound by any rules.

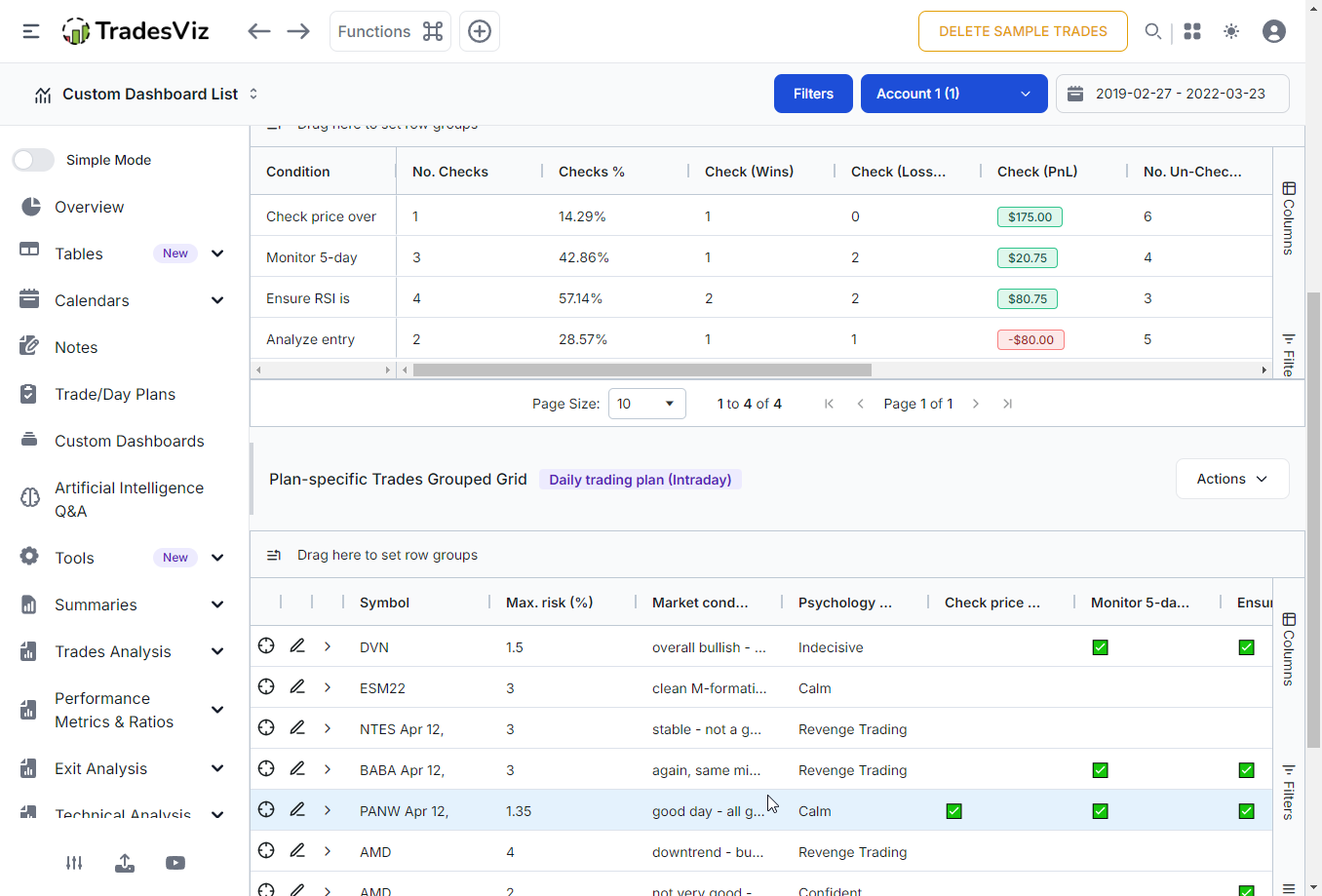

Qualitative + Quantitative data using trade/day plans: The holy grail?

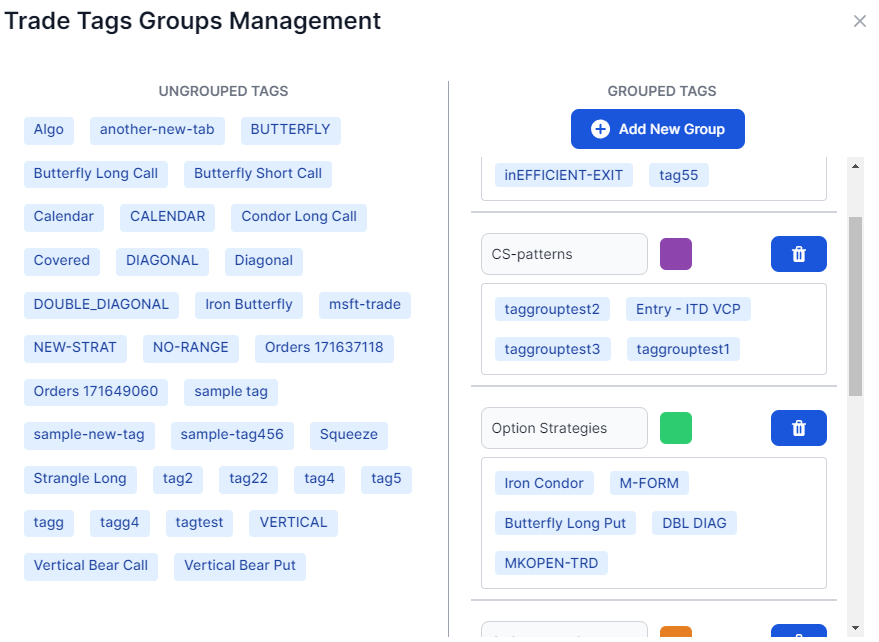

The hit feature that made tens of thousands of traders look at TradesViz in 2023. We completely shattered the boundaries between "just having notes" and not being able to analyze them, or "tagging trades" but not having enough content. Here's the tl;dr of plans: You can have content AND analytics.

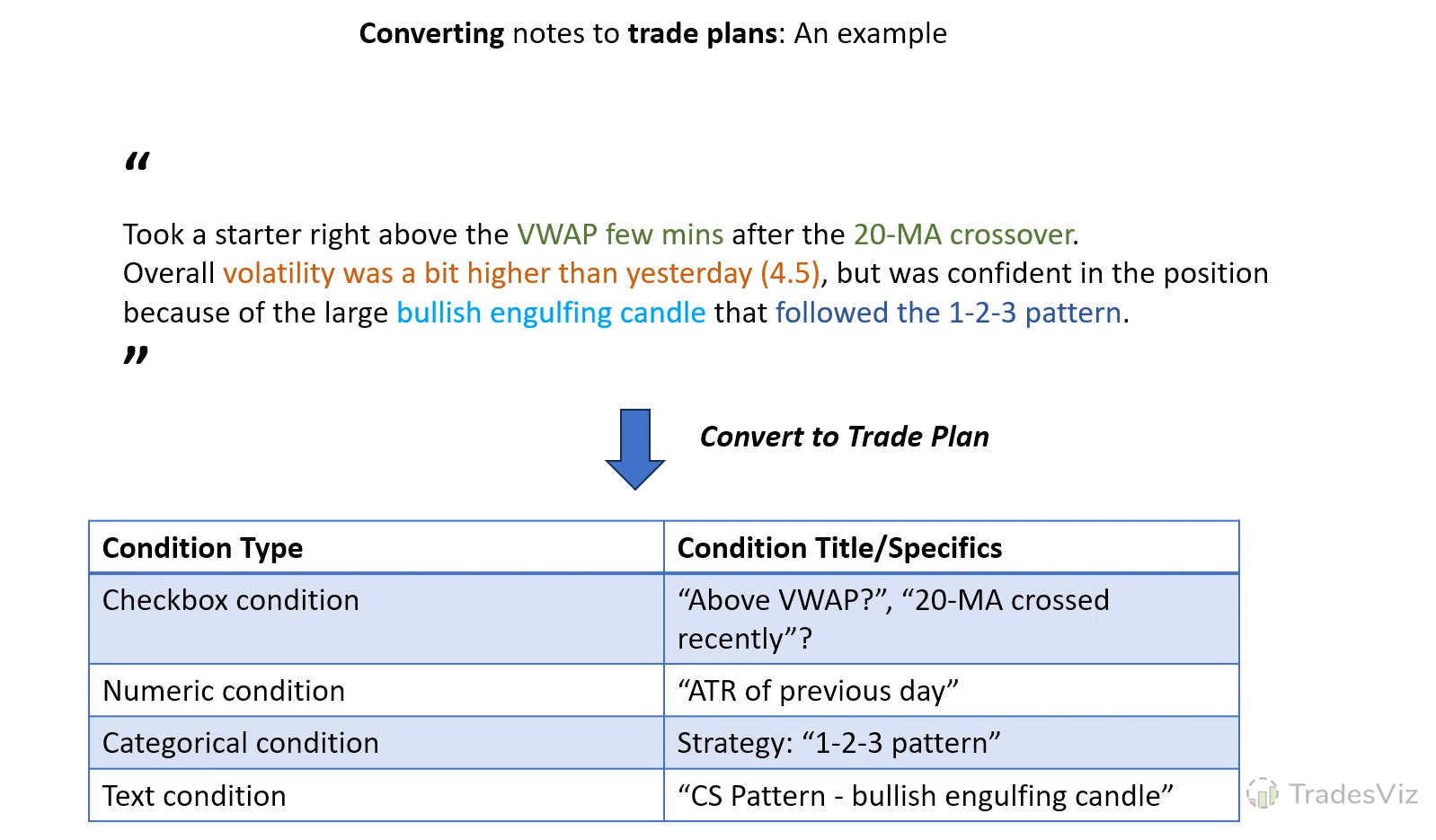

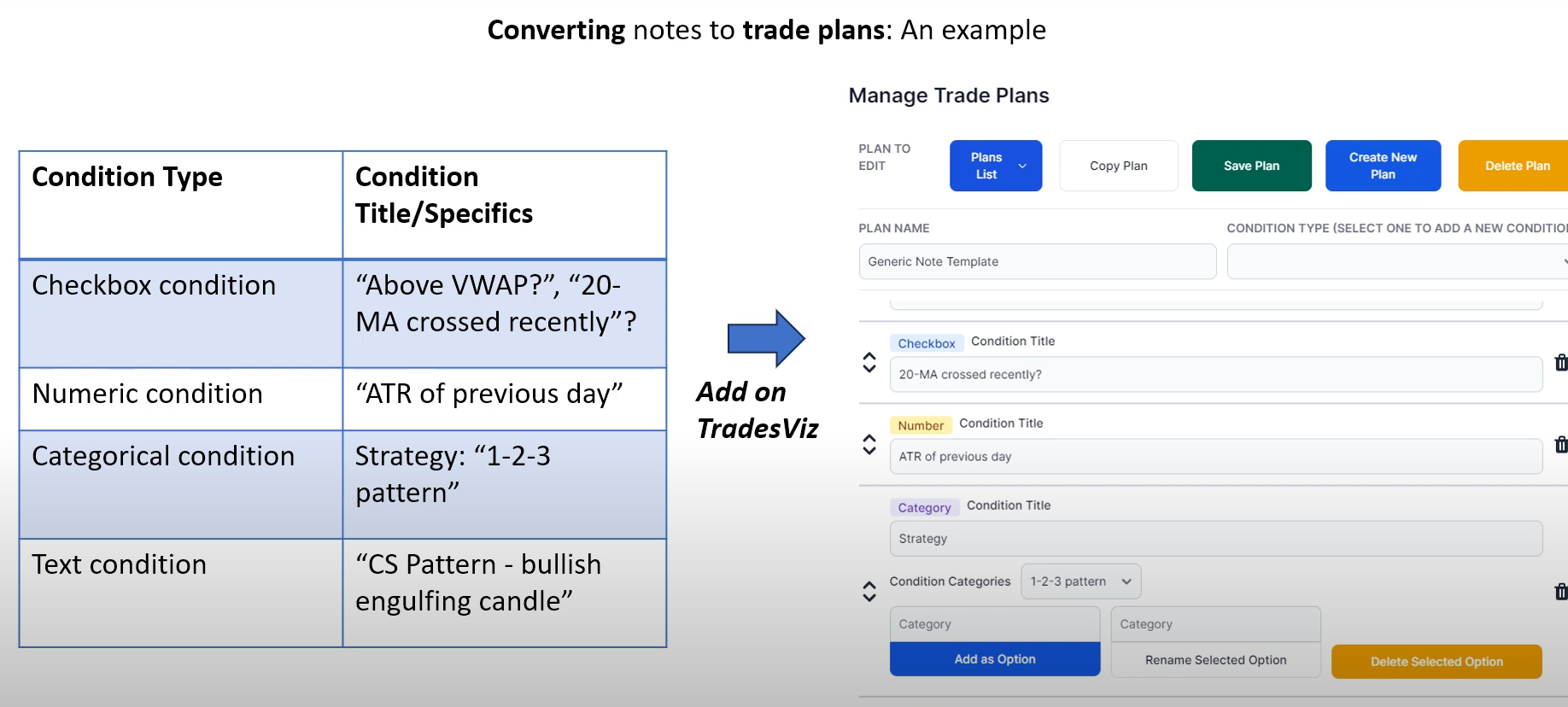

Objectives, strategies, rules, and mental state goals, market conditions, strategy conditions - pretty much ANY info you can think of, you can add to trade plans. How? A trade plan is a collection of one or many text, numeric, categorical, or checkbox fields. These 4 times allow you to express ANYTHING you want to write about or analyze about a trade or about a day.

How to create Plans: TradesViz has a dedicated section for creating and managing your trade/day plans - the plans tab (just like the notes tab). You can customize your plan with specific checklist items relevant to your trading style and goals. You can also edit/create day/trade plans from the day/trade explore pages.

What can Plans be used for?

- Setting clear objectives for the trading day (e.g., target profit, maximum loss).

- Defining the specific strategies or setups you will focus on.

- Establishing rules for entry, exit, and stop-loss levels.

- Planning your position sizing and risk management parameters.

- Defining the specific instruments you will be trading.

- Setting time limits for your trading session.

- Outlining your pre-market routine and preparation steps.

- Defining your desired mental and emotional state for trading (e.g., focused, calm, patient).

- Reviewing your performance from the previous day.

- Identifying potential distractions and how to avoid them.

+ There are countless more scenarios. Unlike notes or tags, there are truly ZERO limitations on what you can use plans for.

To be very honest, in an ideal world where you have enough time to log trades, we would suggest trade plans for most scenarios. But we don't always have that much time to organize our trades, thus, we have all of these options on TradesViz. The next section explore when to use what.

When to Use What: Practical Scenarios

Scenario 1: Documenting the Nuances of a News-Driven Trade

Use Case: Primarily Notes, Optionally Tags

Let's say you took a trade based on a significant economic news release. While the trade details capture the price action, your notes can provide the crucial context. You might describe your interpretation of the news, how it aligned with your technical analysis, your initial expectations for the trade, and any surprises that occurred. You could also use a tag like "News Event" to categorize such trades for later analysis of your performance around news releases.

Example Note: "The inflation data came in lower than expected, causing a sharp rally in the market. I entered long on the break of the previous day's high, anticipating follow-through. However, the rally stalled quickly, and I noticed some profit-taking. I exited earlier than planned due to the sudden change in momentum. Lesson learned: be cautious of initial reactions to news and look for confirmation."

Optional Tag: "Economic News", "Failed Breakout"

Scenario 2: Analyzing the Effectiveness of Different Entry Techniques

Use Case: Tags

You're experimenting with two different entry techniques for your primary trading strategy. To compare their effectiveness, you can create tags like "Entry Technique A" and "Entry Technique B." Apply the relevant tag to each trade you take using either technique. Over time, you can filter your trades by these tags in TradesViz to compare their win rates, average profit/loss, and other performance metrics, allowing you to determine which entry technique is more successful for you.

Example Tags: "Entry Technique A - Pin Bar Confirmation", "Entry Technique B - Break of Range High"

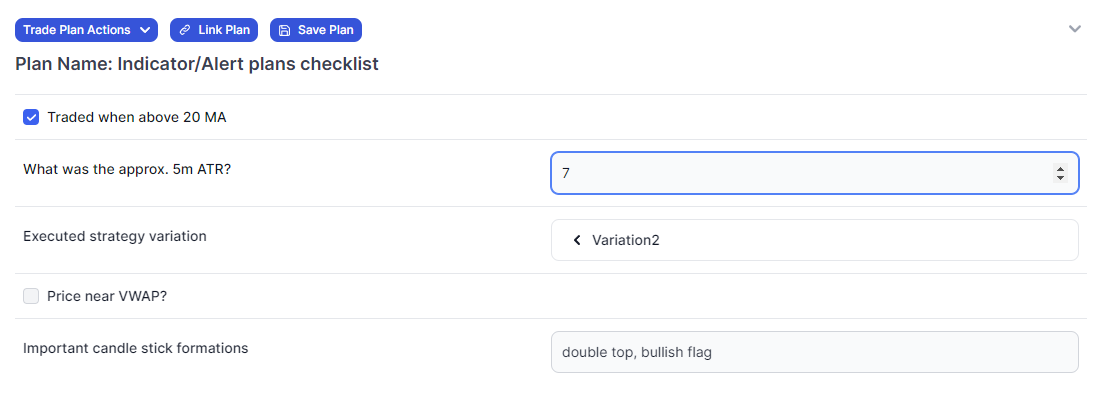

Scenario 3: Ensuring Consistent Application of Your Trading Rules

Use Case: Plans

Your trading plan for the day might include specific rules like "Only trade stocks with a daily volume of over 1 million shares," "Ensure the RSI is below 70 before considering a short entry," and "Do not risk more than 1% of capital on any single trade." Before taking any trade, you should refer to your plan and ensure all these conditions are met. After the trading day, review your plan to see if you adhered to every rule. If you took a trade on a stock with only 800,000 shares volume, you'd mark that rule as not followed, highlighting an area for improvement in your discipline.

Example Plan Items:

- [category] Only trade stocks with >1M daily volume.

- [numeric] RSI short entries.

- [category] Max 1% risk per trade.

Another example:

- [checkbox] Traded when above 20 MA

- [number] Approx. 5m ATR

- [category] Strategy variation

- [checkbox] Price near vwap

- [text] Patterns

This is a more generic and widely applicable plan template that you can take and customize to your needs.

Scenario 4: Understanding Performance Across Different Market Conditions

Use Case: Tags

You suspect your trading strategy performs differently in trending markets versus range-bound markets. You can use tags like "Trending Market" and "Range-Bound Market" to categorize your trades based on the prevailing market conditions at the time of execution. Later, you can analyze your performance for each tag to see if your hypothesis is correct and potentially adjust your strategy accordingly for different market environments.

Example Tags: "Trending Market - Bullish", "Range-Bound Market - Sideways Consolidation"

Scenario 5: Reflecting on Emotional Trading Mistakes

Use Case: Primarily Notes, Optionally Tags

You had a losing trade that triggered feelings of frustration, leading you to take an impulsive "revenge trade" that resulted in another loss. In the notes for both trades, you should detail your emotional state, the thoughts that drove your actions, and the negative consequences. You could also use a tag like "Emotional Trade" or "Revenge Trade" to easily identify and analyze all instances where emotions negatively impacted your decision-making.

Example Note (for the revenge trade): "Felt angry and frustrated after the previous loss. Immediately looked for another setup to try and make back the money. This trade was not based on my usual strategy and was purely driven by emotion. Paid the price for it."

Optional Tag: "Emotional Trading", "Revenge Trade"

Scenario 6: Proactively Planning Your Trading Day

Use Case: Plans

Before the market opens, you create a detailed trading plan. This plan includes:

- Market Analysis: Briefly note down the overall market sentiment and any key levels you are watching.

- Focus List: List the specific stocks or instruments you plan to trade and why.

- Setups to Watch For: Describe the specific chart patterns or indicators you will be looking for.

- Risk Management Rules: Reiterate your maximum risk per trade and your approach to position sizing.

- Mental State Goals: Remind yourself to stay patient, disciplined, and avoid impulsive decisions.

Throughout the day, you refer back to your plan. After trading, you review each section to see if you followed your pre-defined guidelines. This proactive use of plans helps you stay focused and disciplined during the trading session.

Example Plan Structure:

- Market Analysis: [numeric/checkbox] Overall bullish sentiment, watching key resistance at XYZ.

- Focus List: [category/text] AAPL (earnings play), [ ] TSLA (breakout potential).

- Setups to Watch For: [category/text] AAPL: Long on break above $180, [ ] TSLA: Short on failure of $250 support.

- Risk Management: [checkbox/text] Max 0.5% risk per trade, stop-loss orders in place.

- Mental State: [category] Stay patient, wait for high-probability setups, no FOMO.

[Placeholder for an image showing a detailed trading plan example in TradesViz]

Scenario 7: Tracking Progress Towards Specific Trading Goals

Use Case: Plans and Tags

Your monthly trading goal is to improve your average win rate to 55%. Your daily trading plan can include a checklist item to "Review previous day's win rate." Additionally, you can tag all trades that are part of your primary strategy with "Core Strategy." At the end of the week or month, you can filter your trades by this tag and analyze your win rate to see if you are on track to meet your goal. This combination of proactive planning and data analysis helps you stay accountable and measure your progress.

Example Plan Item: [ ] Review previous day's win rate for "Core Strategy" trades.

Example Tag: "Core Strategy"

Scenario 8: Learning from Both Successful and Unsuccessful Trades

Use Case: Notes and Tags

Whether you have a big win or a significant loss, using both notes and tags can maximize your learning. For a winning trade, your notes might detail the specific factors that aligned perfectly, the confidence you felt during the trade, and any key observations about the market behavior. You could tag it with "Excellent Execution" or "Textbook Setup." For a losing trade, your notes might focus on where you deviated from your plan, any emotional mistakes you made, or unexpected market events. Relevant tags could be "Missed Stop-Loss" or "Unexpected Volatility." Analyzing both types of trades with detailed notes and relevant tags provides a comprehensive understanding of what you are doing well and where you need to improve.

Example Note (Winning Trade): "Perfect entry on the breakout, strong follow-through, managed the trade well by trailing my stop. Felt confident and in control throughout."

Example Tag (Winning Trade): "Textbook Setup", "Excellent Execution"

Example Note (Losing Trade): "Hesitated to take profits at the initial target, got greedy, and then the market reversed sharply. Should have stuck to my original plan."

Example Tag (Losing Trade): "Greed", "Missed Target"

Key Takeaways: Strategically Using TradesViz Features

- Notes: Your go-to for detailed, unstructured information, personal reflections, and capturing the "story" behind your trades. Use them to elaborate on your thought process, emotions, and external influences.

- Tags: Essential for categorizing and grouping trades based on specific criteria. Remember: The primary use of tags is for filtering -> which translates to analysis, so leverage them for in-depth performance analysis of different strategies, setups, market conditions, and more.

- Plans: A combination of the best features of notes and tags and is ideal for setting trading objectives, defining rules and tracking and analyzing all of them. Use them before each trading session to create a roadmap and review them afterward to assess your adherence and identify areas for improvement.

Mastering the use of Notes, Tags, and Trading/Day Plans in TradesViz is crucial in understanding your data and offloading your mental load. Every day, you may make dozens of trades, have a hundred thoughts - if you can document and analyze even 10% of them, you'd be way ahead of the competition. That's why we wrote this blog post - to make sure you understand what is right for you and when to use which feature.

Create a routine - a process where you fix certain features for certain purposes - it can be 100% unique to you. That's how you develop good habits that turn you into a great trader over time. Your journal will eventually become the best trading book you've ever read and the most accurate guide for your path forward. Effective journaling = Quantitaive + Qualitataive data so don't neglect these practices! :)