The introduction of Plans (day and trade) has been the most used feature since the launch and from feedback, we are hearing from traders - it is being used for A LOT of use cases (some of which we didn't even know was possible!).

-

Create trade and trading day plans (custom checklist & more)

-

Custom analysis of trade and day Plans + Trading checklist statistics (Pivot grid)

Video guide:

The focus of this blog post going to be on exploring some use cases that you can apply with the help of the plan system in TradesViz. While the potential use cases and possibilities are endless and may vary according to your trading style, strategy, and the types of assets you trade, we will be exploring the generic ideas that you can apply regardless of the type of trading you do.

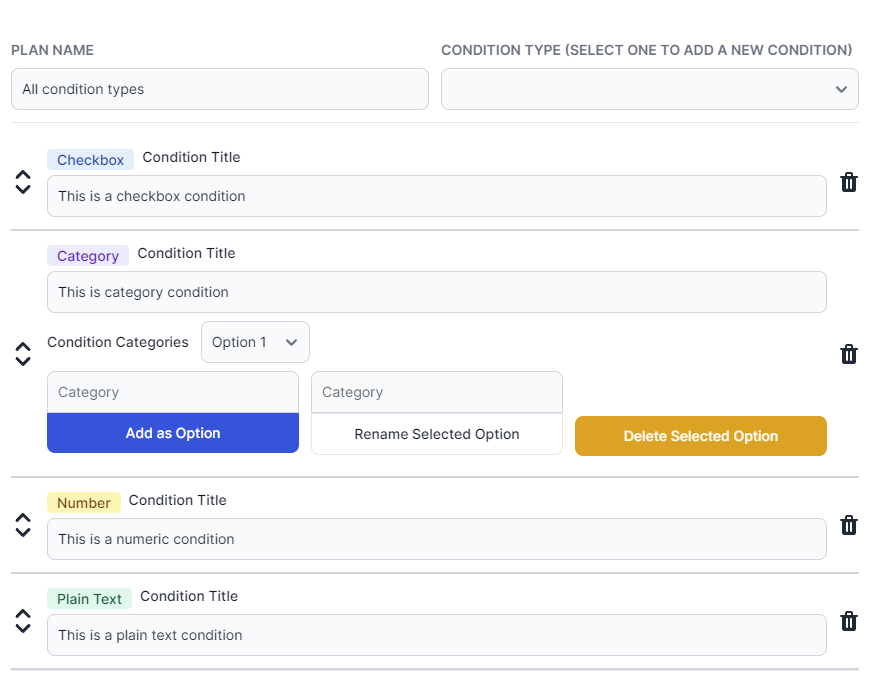

Basic input types

To give you a quick refresher, each plan can have multiple "conditions" and each of these "conditions" can be any of the following types:

- Checkbox

- Text input

- Category input

- Numeric input

Here's how they look when you construct the plan via the account setting:

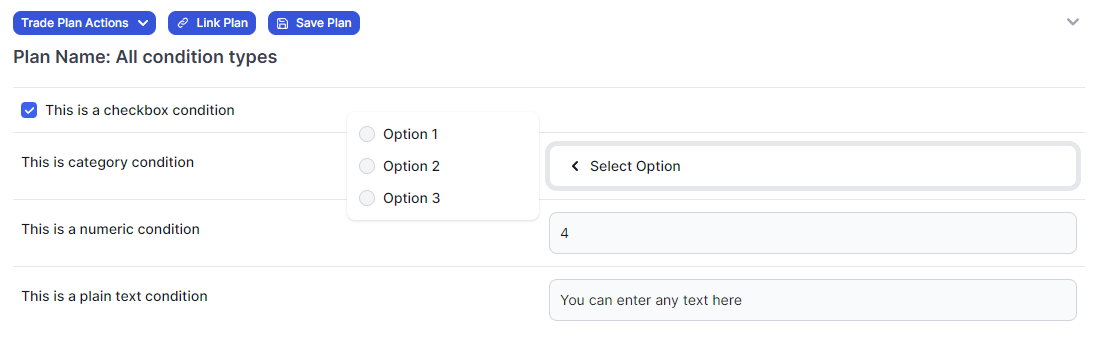

and this is how they look when you add this plan to a trade/day:

When to use what input type?

Building a plan requires you to understand the types of input and to which conditions you should use them. We will explore this by the use of examples.

Example 1: You want to add a condition to track an indicator's value

Correct input type: numeric condition

You may be tempted to use plain text condition, but beware that if you use a non-numeric value, it will lose its analytical capabilities when it comes to analyzing your plans via the pivot grid. If there are multiple indicator inputs or if the input contains text, consider splitting it into multiple conditions.

Example 2: You want to add a condition to add your mental state before trading.

Correct input type: category condition

For simplicity's sake, you may want to use the text condition or a simple checkbox condition with a check for "feeling good" or not or something similar. But remember: the goal of the plans is not just to provide you with context on what happened with that trade/trading day, but also to be able to analyze the conditions. This is the most valuable part of the adding plans. Because of this, you need to make a decision here: categorize your moods/health/mental conditions beforehand (it's a little bit of work, but it's worth it) and add it as options to the category condition.

Example 3: You want to add a condition to record your market bias.

Correct input type: ... Any!

Why?

Because this is such an open-ended question, the condition would largely depend on how much information you want to enter.

For example, if you want the simplest way, a checkbox condition would suffice: check for bullish or uncheck for bearish.

For example, if you want to add multiple biases: slightly bullish, very bearish, neutral, etc., then you can use a category condition.

For example, if you want to give a rating of 1 to 10 - 1 being very bullish and 10 being very bearish then you can use a numeric condition

etc.,

The conditions you enter would, of course, be very different from the simple examples given above. But for every condition you add, ask yourself this:

How can this be used from an analytical perspective?

While not every condition needs to be used for analytics, if you are going to add a condition to add context to your trade, why not design it in such a way that it also acts as a useful indicator for you to analyze?

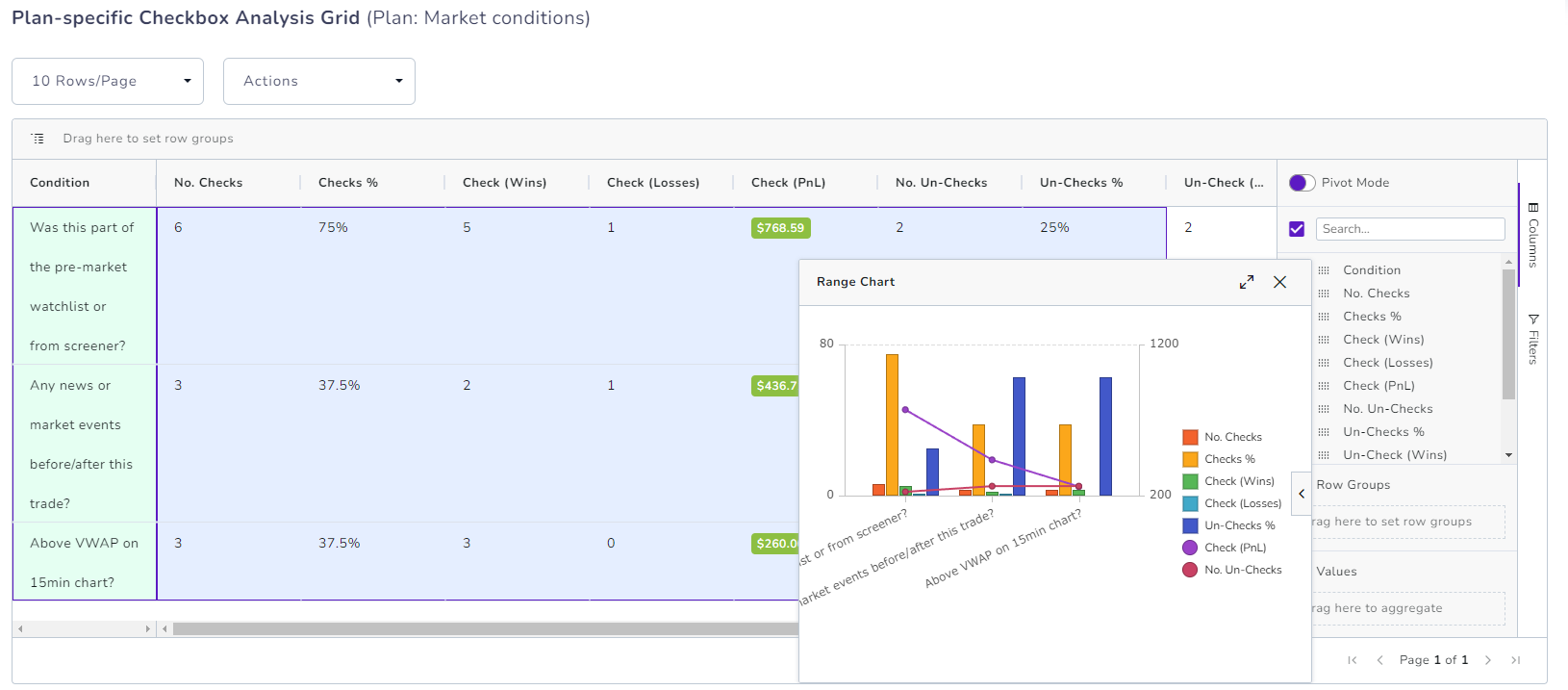

Special consideration to the checkbox: Since it is the easiest condition to operate (just a single click), there is a dedicated table in the plan anlaysis tab for checkboxes that shows the statistics of conditions w.r.t no. of checks, un-checks, win-rate and other metrics.

Remember that these tables in the plan anlaysis tabs share most of the features from the pivot grid (except the pivot part). This means you have extremely flexible ways to interact with and visualize your data.

Don't be afraid to experiment!

Analysis might be daunting to you at first, but we're trying to make this as easy as possible and if you leverage it correctly, you will have a far greater rate of success

Trade plan examples

Trade plans typically contain information regarding a trade. For example, it might not be ideal to add a condition that talks about market conditions in a particular trade unless you have a specific requirement for it as adding it to the trading day as a day plan would be a better fit. What would be a good fit are trade-related questions like:

- If the risk management was good or bad? (category or checkbox)

- How many times did we make an execution without having a plan? (numeric)

- Did we move the stop loss or profit target? (checkbox)

- How can the price action be described? (text or category)

etc.,

Note here that the questions are very specific to the trade. They are not common/generic. This is so that when we view the trade's details via the trade explore view, which goes into great detail about 20+ individual statistics about each trade - all of which are fixed and cannot be changed, the attached trade plan gives you full flexibility on what data YOU want to view alongside each trade.

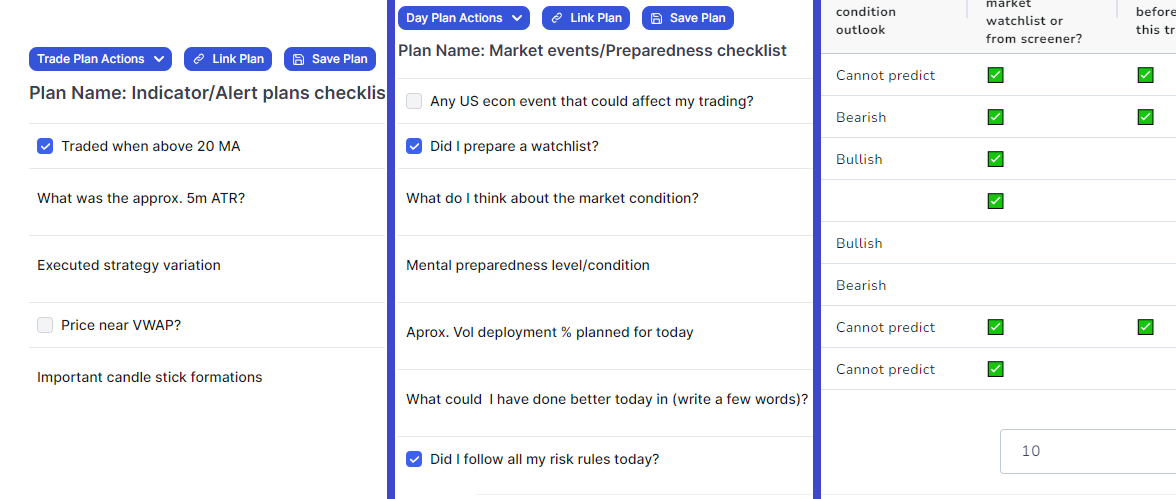

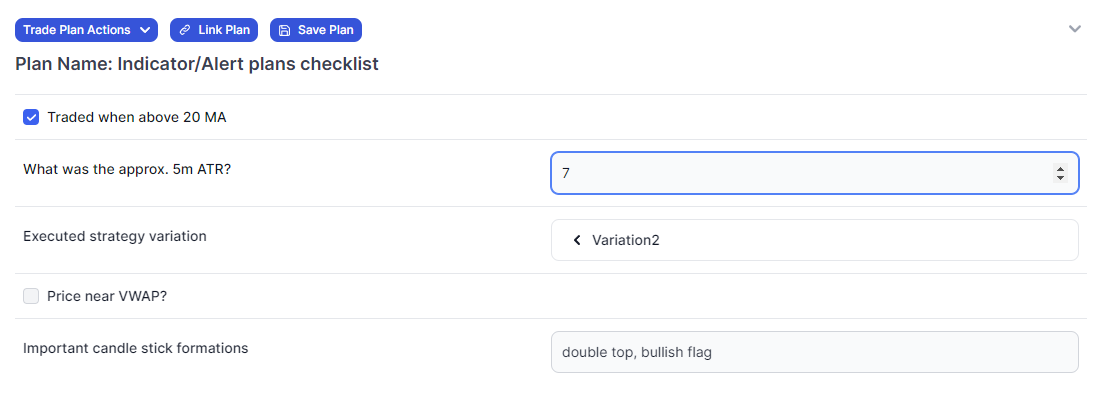

Example: Indicator/Alert plans checklist

- Condition 1 [Checkbox]: Traded when above 20 MA?

- Condition 2 [Numeric]: What was the approx. 5m ATR?

- Condition 3 [Category]: Executed strategy variation: [Options: Variation1, Variation2, Variation3, Custom]

- Condition 4 [Text]: Important candle stick formations [Flag, Double top, etc.,]

- Condition 5 [Checkbox]: Price near VWAP?

Applied example to a trade:

Day plan examples

As we discussed at the beginning of the trade plan example section, general, more commonly applicable statistics are a good fit for day plans. Some such conditions include:

- What was the previous day's ATR? (numeric)

- What is the overall market outlook today? (categorical or text)

- Any market events today? (checkbox)

- How is our mindset/psychology today? (category)

- Am I still thinking about yesterday's losses? (checkbox)

etc.,

Note here that we are including more personal questions about our mentality, preparedness, etc., If you were to add these conditions to each trade, that would be a bit tedious - BUT, it's not impossible to do and it's completely left up to you - the trader, to decide what is best for YOU.

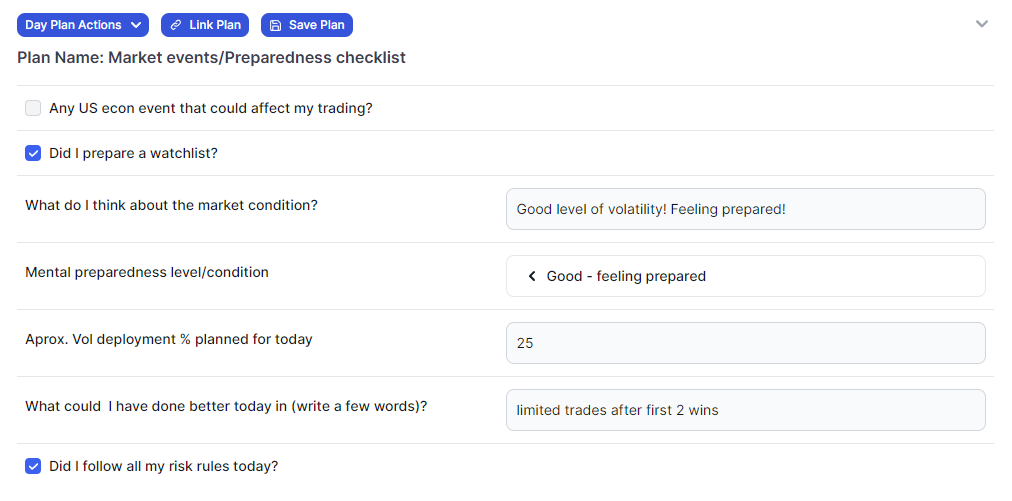

Example: Market events/Preparedness checklist

- Condition 1 [Checkbox]: Any US econ event that could affect my trading?

- Condition 2 [Checkbox]: Did I prepare a watchlist?

- Condition 3 [Text]: What do I think about the market condition?

- Condition 4 [Category/Numeric]: Mental preparedness level/condition [Options: Bad...Ready to go!] or [Numbers: 1 (Bad) to 5 (Ready to go!]

- Condition 5 [Numeric]: Aprox. Vol deployment % planned for today

- Condition 6 [Text]: What could I have done better today in (write a few words)? [Note: this can be left to be filled at the end of the trading day]

- Condition 7 [Checkbox]: Did I follow all my risk rules today? [Note: this can be left to be filled at the end of the trading day]

Applied example to a trading day:

Note above that we have included conditions that we will leave as empty at the start of the day (condition 1 and condition 2), but will fill in after the trading session. This is a unique advantage of having day plans attached to a trading day since a trading day exists irrespective of whether you trade on that day.

In fact, you can even add day plans as a way to plan for the future! This is especially useful for options traders who need to keep a keen eye on the calendar and manage positions accordingly.

That's why we keep saying - the possibilities are endless. There are no limitations to no. of plans you can create. No limitation to the types of questions/conditions you can create.

This is one of the reasons why advanced and professional traders choose TradesViz as their preferred journaling solution - there is nothing that even comes near the level of flexibility and features TradesViz offers.

We hope this guide has been a useful waypoint for you to design effective trade and trading day plans to augment your trading analysis.

Please note that these are simple examples.

Always keep in mind that the guidelines and suggestions present here are to help you get started with writing your own plans that suit your trading style/strategy.

We would consider this one of the most powerful features we have because it effectively allows you to create ANY statistic you want and add it to your trades. Meaning, you are not confined to the 80 to so stats we have per trade, rather... it's just your requirement and your trading knowledge that are the limits here.

If you need any assistance with creating trading plans, we can definitely help. Let us know your feedback, ideas, and questions to [email protected].