Another six months. Another wave of features you won't find anywhere else.

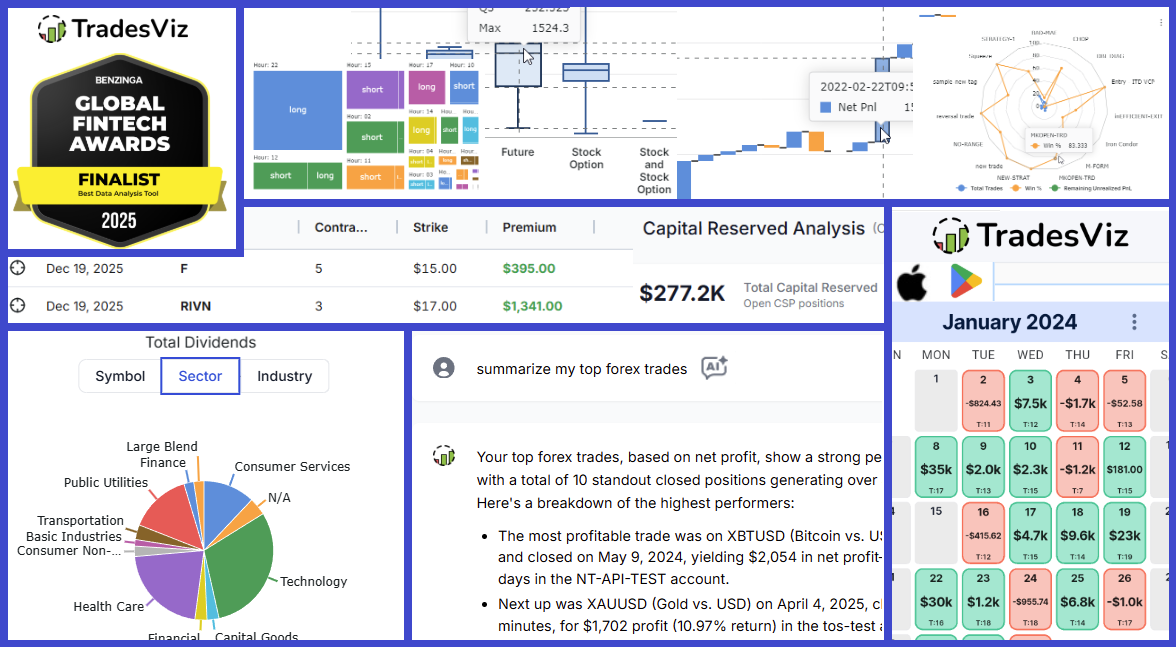

We kicked off July by adding support for running PnL on spreads. We ended December as a finalist in Benzinga's Global FinTech 2025 Awards for Best Trading Analysis Platform. In between? AI Trade Chat launched. The Options Command Center shipped. Mobile got a complete v2 overhaul. And we fixed, refined, and enhanced imports across dozens of brokers.

This changelog covers it all - month by month. Let's get into it.

July 2025: MT5 full auto-sync Goes Live

The Gist: July was about refinement. We shipped the Metatrader 5 auto-sync feature out of beta and continued crushing broker import bugs.

Key Upgrades:

- MT5FA Auto-Sync Released from Beta: No indicators. No third-party APIs. Just pure, automated MetaTrader 5 syncing for any MT5 platform. If you use a prop firm or any broker running MT5, your trades now flow into TradesViz without lifting a finger. Check the MT5 auto-sync blog post for setup details.

- New Broker: Blofin: Crypto traders using Blofin can now import directly.

- New Broker: Yahoo Finance: Manual import support added for basic portfolio tracking.

- Futures Chart Improvements: Continuous contract charts now work correctly for futures journaling.

- Days-to-Expiry (DTE) Column Added: Your trades table and day explore now show DTE for options. Track expiries without mental math.

Broker & API Updates:

Coinbase, Hyperliquid, Plus500, cTrader, Tradier, IIFL, OKX, Definedge, and E-Trade - all received import fixes this month.

August 2025: Pivot Grid Custom Stats

The Gist: This was AI month. We launched AI Trade Chat - an unstructured, conversational interface to interrogate your trade data. We also introduced custom stat calculations in pivot grids and added multi-select conditions to trade plans.

Key Upgrades:

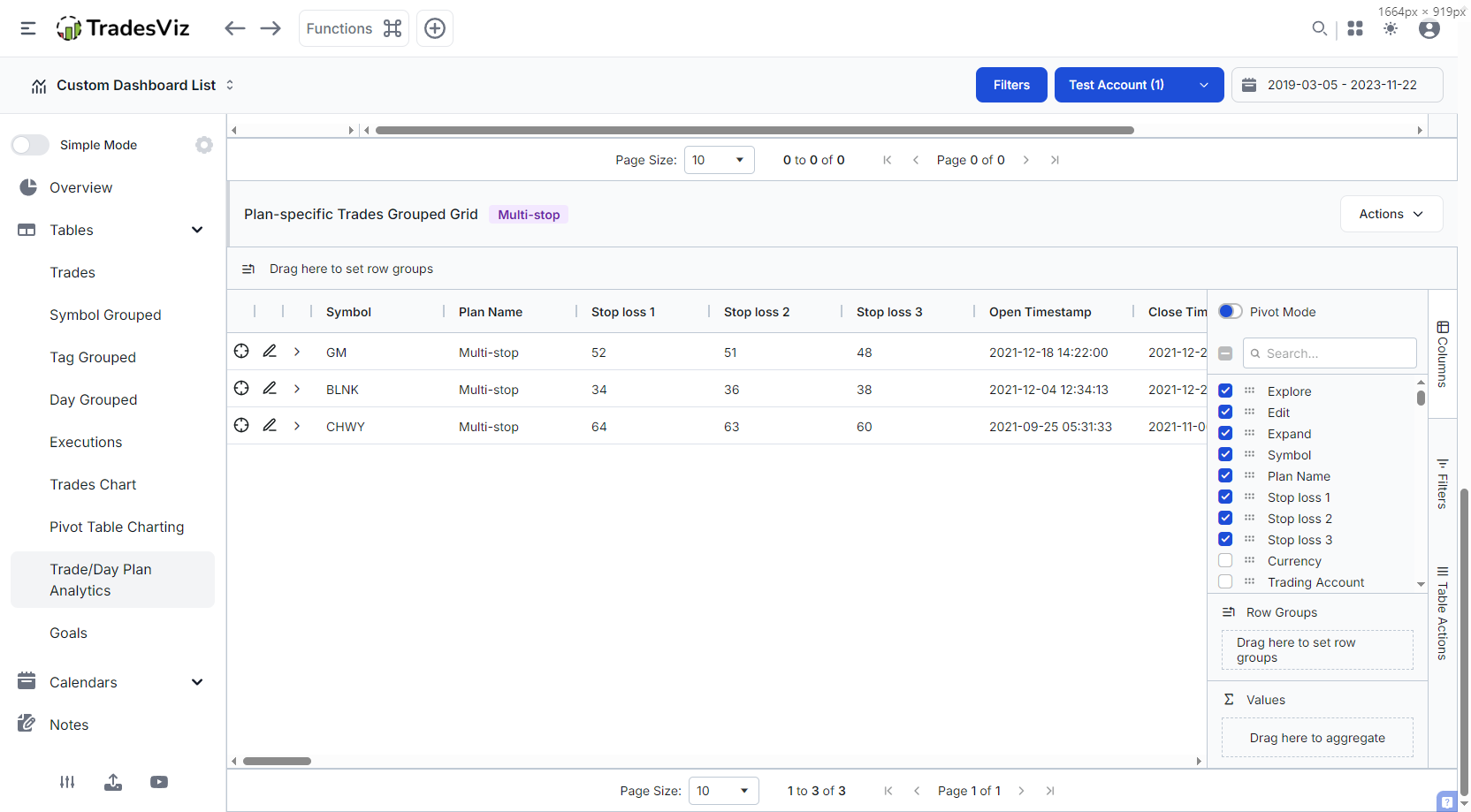

- Custom Stat Calculations in Pivot Grids: Define your own formulas using numeric columns. Calculate custom profit factors, adjusted R-values, or any metric you can dream up. This is the first time any online trading journal allows fully custom-calculated stats inside pivot grids. Read the guide.

- Multi-Select Conditions in Trade Plans: Plan conditions now support multiple selections. Track complex setups without creating duplicate fields.

- New Broker: DXTrade XT: Expanding support for prop firms traders.

- Grid updates: Faster rendering. Better click events. Smoother spark lines. Tables just got snappier.

- Alt Cost Basis Calculation for Options: More uniform cost basis display across different options strategies.

Broker & API Updates:

Saxo, Merrill Edge, Zerodha, Tiger, Bybit (demo mode added), IG, Bitget, TD365 - all updated and improved.

September 2025: AI Trade Chat + Mobile App v2 & New Chart Types

The Gist: Mobile got a ground-up rebuild. We also dropped new visualization options: treemaps, waterfall charts, and box plots, and published the R-Value explainer that options traders have been requesting. We've started to write comprehensive blog posts on various topics that traders have difficulty with. With the experience we have in trading, developing trading tools, and talking to 10000s of traders, we feel our authority and knowledge in how to effectively analyze these topics can help newer traders on the market.

Key Upgrades:

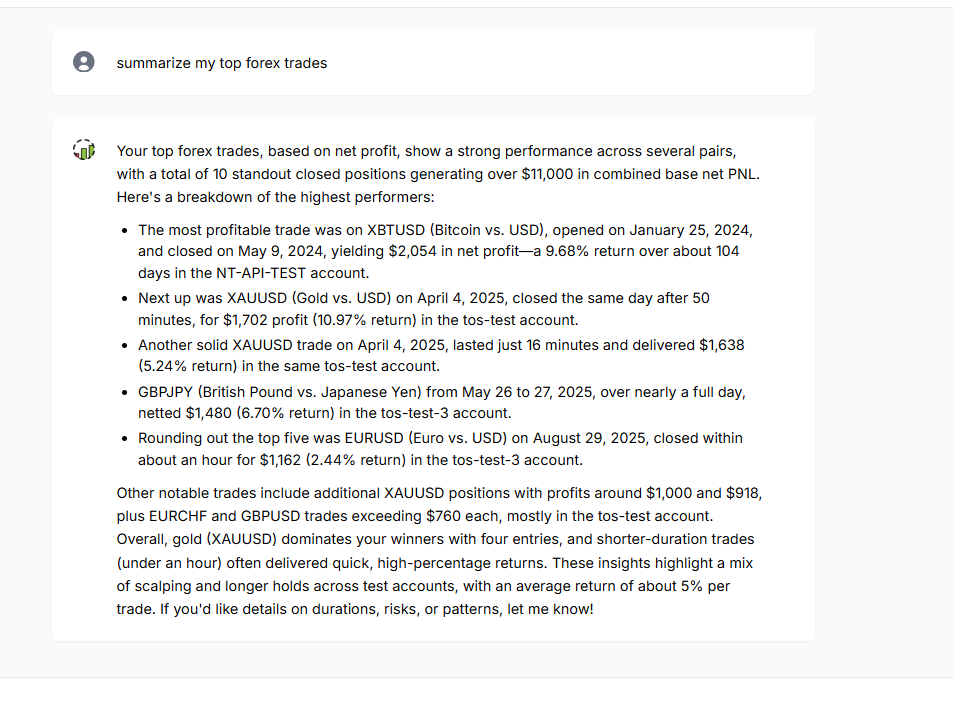

- AI Trade Chat Launched: Ask subjective questions. Get real answers. Unlike our structured AI Q&A (which is still unmatched), AI Trade Chat uses chain-of-thought reasoning to tackle questions like "Why do I lose on Wednesdays?" or "Summarize my worst month." Full breakdown in the AI Trade Chat blog post.

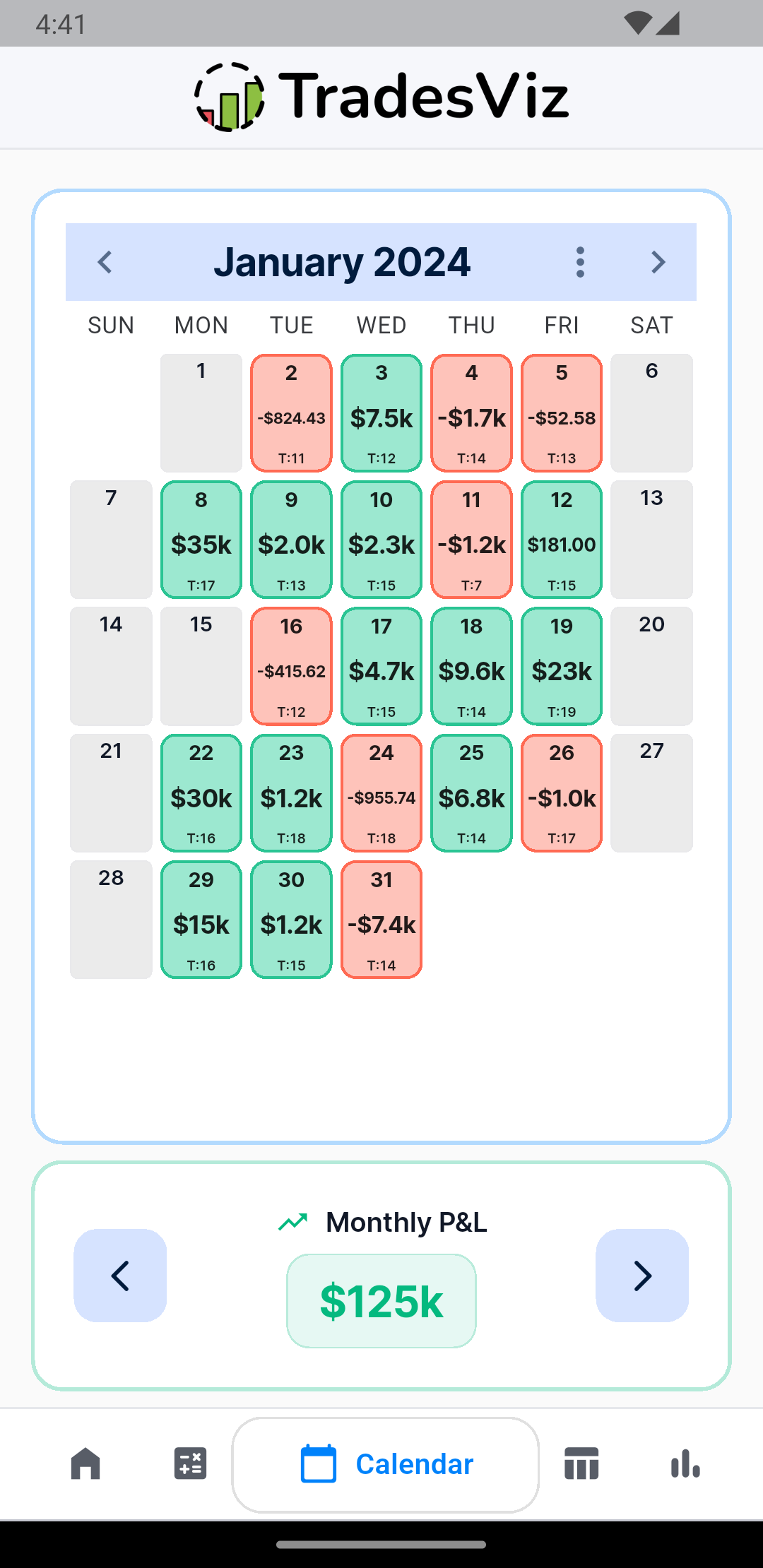

- Mobile App v2 Released (Android + iOS): Completely redesigned UI. Faster load times. Notes tab on mobile. Sync triggers from the app. Dark/light mode. This isn't a reskin - it's a rebuild. Full details in the mobile v2 blog.

- New Chart Types for Grids & AI Widgets: Box plots, treemaps, waterfall charts, range bars, and more. Your pivot grids and AI widgets now support these visualizations. See examples.

- R-Value & Profit Factor Blog Published: Still confused about R-value vs. profit factor? We wrote the definitive guide. Read it here.

- Group Apply for Trade Plans: Select multiple trades, apply plan tags in bulk. Save minutes per session.

- Discord Bot Tags Filtering: Filter trade alerts by tags directly in Discord.

- New Brokers: AJ Bell, Revolut, Lighter, Spreadex: UK and EU traders rejoice.

- MFE/MAE for Options Trades: Now calculated using actual options OHLC data. Your drawdown and favorable excursion metrics just got accurate.

- Wealthsimple Options Support: Canadian options traders can now import.

- Greeks Added to Pivot Grids: Delta, theta, gamma - pivot on them, chart them, filter by them.

Broker & API Updates:

Robinhood (options sync now working!), Trading212, Fyers, Bitget, Nordnet, BingX, ThinkMarket - all improved.

|

|

October 2025: Running PnL for Spreads & Expiry Calendar

The Gist: Options traders - this one's for you. We shipped running PnL calculations for multi-leg spreads and added expiry tracking to the calendar. Robinhood options sync went live. AI features got upgraded to the latest models.

Key Upgrades:

- Running PnL for Multi-Leg Spreads: Iron condors. Straddles. Calendar spreads. Your running PnL now calculates correctly for complex options positions. We've built out 1-minute OPRA data infrastructure internally specifically for this. No other journal can show you minute-by-minute PnL on your spreads.

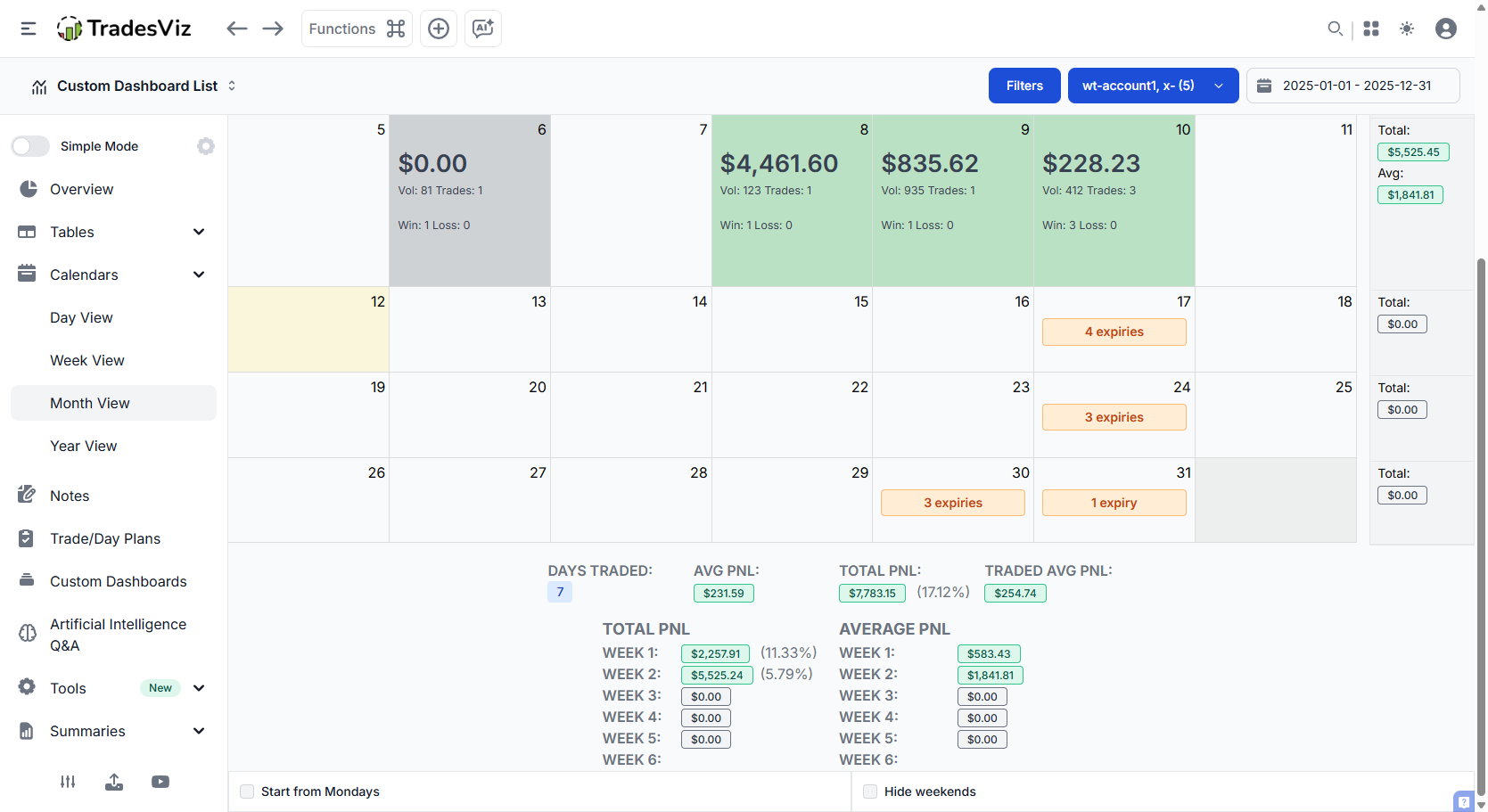

- Options Expiry on Calendar: See expiring positions directly on your PnL calendar. A small checkbox enables it. Never get blindsided by expiration again.

- Day Explore Expiry Filter: Filter the day explore tab to show only trades expiring on specific dates.

- Robinhood Options Auto-Sync: Fully working. Finally.

- AI Model Upgrades: More combinations of AI models explored and deployed. Response quality improved across the board.

- New Brokers: WazirX, PrimeXTB: Crypto and CFD coverage expanded.

- Entry/Exit Mode in Backtester: Define exact entry and exit logic for strategy testing.

- Coinbase Contract Support: Futures contracts from Coinbase now import correctly.

Broker & API Updates:

Tastytrade, Saxo (additional commission handling), Schwab, TradingView, TradeLocker, Fidelity (new format support), MEXC - all enhanced.

November 2025: Options Command Center & Benzinga Finalist

The Gist: The Options Command Center launched! A dedicated dashboard for tracking your entire options portfolio with payoff charts, capital at risk treemaps, and EOD pricing. Oh, and Benzinga named us a finalist for Best Trading Analysis Platform at their Global FinTech 2025 Awards - 3rd time in a row!

Key Upgrades:

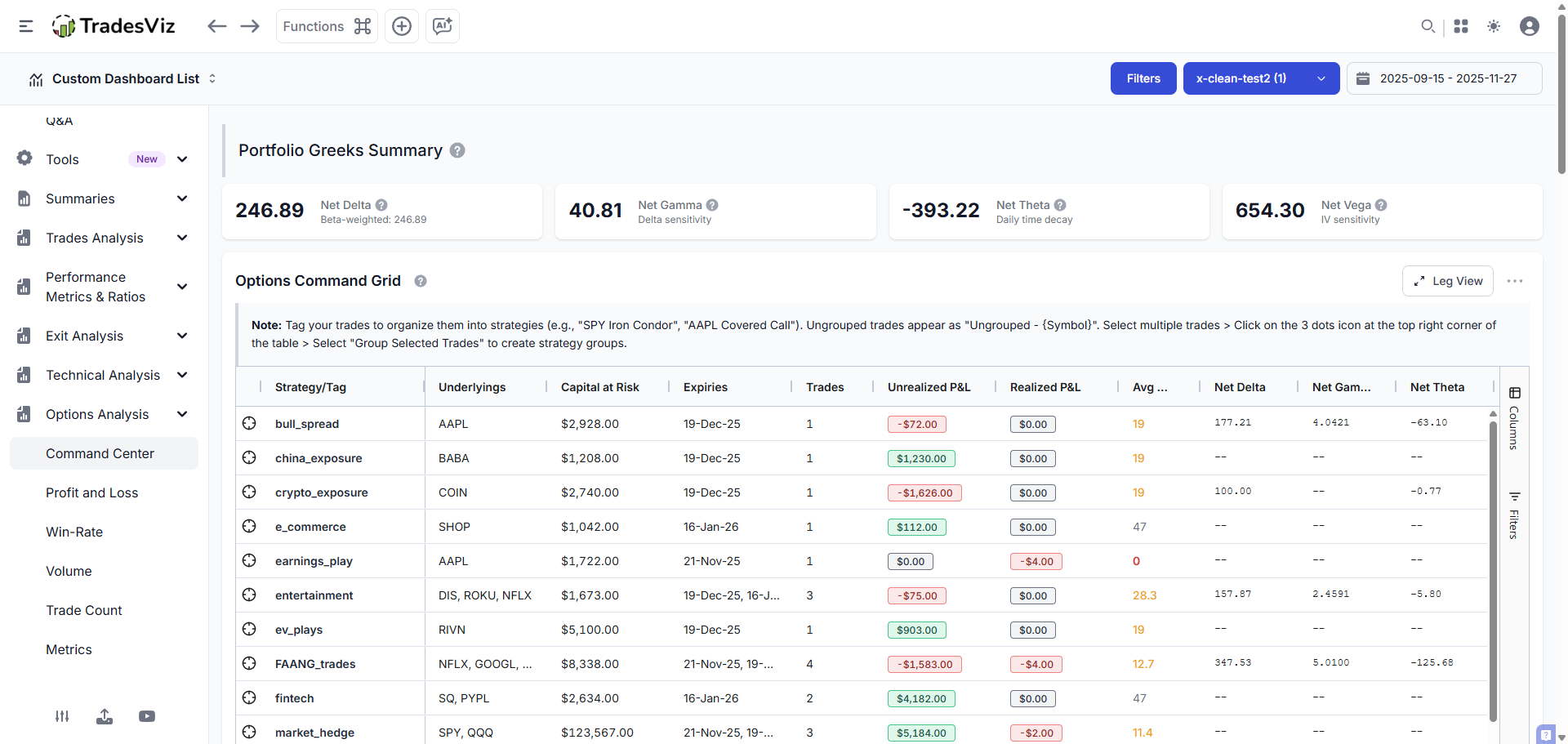

- Options Command Center (Options Portfolio Dashboard): Your options positions. One page. Payoff charts update with EOD prices. Capital-at-risk treemaps show exposure by symbol. Greeks summary at a glance. This is the control room options traders have been asking for. Full walkthrough here.

- Benzinga Global FinTech Awards 2025 Finalist: We were selected as a finalist in the Best Trading Analysis Platform category. Recognition from the industry that TradesViz isn't just keeping pace - we're setting it. This changelog should prove it.

- Candlestick Pattern Backtesting Blog Published: Want to know if engulfing candles actually work on ES? We ran the numbers. Read the analysis.

- Multi-Sim Vertical Resizer: Resize charts in multi-symbol simulation by dragging borders.

- Seamless Timeframe Switching in Multi-Sim: Change timeframes without layout disruption.

- Cost Basis for Multi-Asset Types: Dividend and stock positions now display cost basis correctly across asset types.

- Indian Commodities Support: MCX symbols now handled properly for certain brokers

- New Broker: Bitmart: Crypto exchange import added.

- PPro8 Broker Support: Prop firm traders using PPro8 - you can now import your files!

Broker & API Updates:

Tastytrade (OAuth only now), Fyers, Fidelity, CMC, OKX, Deribit, HDFC, CQG, TD Direct, Groww - all fixed or improved.

December 2025: Trading Psychology Blog, Dividend Tracking Upgrades & Award Badge

The Gist: We closed the year by publishing the trading psychology tracking guide, adding sector/industry filters to dividends, and proudly displaying our Benzinga 2025 Finalist badge. Plus the usual broker fix marathon - over 25 import modules touched this month alone. Why do we share this? Because it's important for users to know what brokers keep changing their formats, have issues with formatting, etc., it's important to understand that if your file suddenly stops working, it's because something in your file changed - either column names, the way numbers are represented, or something that's not as usual. Don't expect this to be resolved automatically. Please reach out to us. Broker updates are done and deployed within 24 hrs. But we really hope more brokers bring support for read-only APIs... It's going to be 2026 soon... It's HIGH time this happened. The no. of times we've been asked, "Do you support auto-sync for < a broker that does not have any semblance of a proper API >" is TOO HIGH and it's only increasing. Brokers with seamless auto-sync are winning in customer retention.

Key Upgrades:

- Trading Psychology Tracking Blog Published: Your mindset affects your PnL. We wrote a comprehensive guide on tracking psychological factors in your journal using tags, notes, and the AI systems we've built. Read it here.

- Per-Sector & Per-Industry Dividend Filters: Track dividend income by sector (Technology, Healthcare, etc.) or industry. Visualize where your passive income actually comes from.

- New Broker Support: ForTraderX (via Freestoxx), Vantage Pro Trader

- Multi-Currency Recalculation Fix (Sierra Chart): Non-USD accounts now calculate correctly across Sierra real-time sync trades.

- R-Value Auto-Clear: Clearing stop loss now properly clears R-value calculations. No more stale data.

Broker & API Updates:

TradeLocker, Oanda, Freestoxx, Exante, TradingView, Hyperliquid, Rithmic, CQG, E-Trade, Bybit, IG, Webull, Wealthsimple, NinjaTrader, ProRealTime, Merrill, Bitget, Binance - all received fixes in December. It was a busy month!

![]()

Looking Forward: 2026 and Beyond

2025 saw TradesViz recognized by Benzinga as a top trading analysis platform. Not because we hyped ourselves—because traders and industry experts saw the work. AI Trade Chat. Options Command Center. Running PnL for multi-leg spreads. A mobile app that doesn't feel like an afterthought. These aren't incremental updates. They're capabilities that don't exist elsewhere.

Here's what 2026 holds:

- Deeper AI Integration: Market data + your trade data + AI reasoning. We're building toward a future where your journal proactively surfaces insights you didn't think to ask for.

- Enhanced Simulator Modes: More realistic fills. Options chain improvements. Spread execution practice.

- Unified Portfolio View: Multi-account aggregation with cross-broker analytics.

- Psychology & Discipline Tracking: Structured frameworks for tracking emotional states, rule adherence, and behavioral patterns alongside your PnL.

- More Broker Connections: We're in talks with several major platforms for direct API integration.

Why TradesViz remains #1 in value, features, utility, and advancements:

Every "trading journal" claims to be the best. Here's what separates us:

- Feature Depth: 600+ stats. Pivot grids. AI Q&A. Options flow. Running PnL on spreads. Simulators for stocks, futures, forex, options, and crypto. No one else comes close.

- Real AI, Not Marketing AI: We shipped AI Q&A in 2023. AI Trade Chat in 2025. Over 30,000 unique queries from users. Other journals slap "AI" on a (poor) GPT wrapper and call it innovation (which doesn't even work...).

- Broker Coverage: 40+ auto-sync integrations. 300+ manual import formats. If your broker exists, we probably support it.

- Price-to-Value: The free tier is more powerful than paid plans elsewhere. Pro and Platinum unlock features that don't exist on any competitor at any price.

- Speed of Iteration: This changelog covers six months. Look at how much was shipped. We don't do roadmap theater. We build and release. All year long.

The traders who take journaling seriously end up here. The ones who don't stay serious don't last in the markets anyway.

See you in 2026.

Got questions? Feedback? Feature requests? Hit us up via live chat or email [email protected]. We read everything.