Last updated: February 17, 2026

Trading Psychology: The Complete Guide to Mastering Your Mind

Transform emotional patterns into quantifiable edges with data-driven psychology tracking

Why Trading Psychology Is the Real Edge

You know the technicals. You've studied your setups. Your analysis is solid. But somehow, your P&L doesn't match what you know you're capable of.

Here's what most traders eventually figure out: trading psychology isn't some soft skill you can ignore. It's the gap between your theoretical edge and your actual returns.

Research by Barber and Odean (2000) found that overconfident traders who trade excessively underperform by 6.5% annually. Odean's earlier work (1998) showed traders are 1.5x more likely to sell a winning position than a losing one. These aren't soft problems. They're measurable, repeated mistakes with real dollar costs.

Why Most Psychology Advice Falls Flat

Most trading psychology advice boils down to one of two things:

- Motivational platitudes: "Just stick to your plan" or "Control your emotions." Sounds great. But how? Nobody ever explains the mechanism.

- Basic mood tracking: Check a box that says "Anxious" or slide a "tilt meter" before each trade. OK, then what? That data just sits there, disconnected from your actual results.

Neither of these gives you the feedback loop you actually need. What you need is correlation with outcomes, pattern recognition over time, and concrete triggers you can spot before they wreck your next trade.

A Data-Driven Alternative

What if you could see that your win rate drops significantly when you trade within 30 minutes of a loss? Or that your average loss size doubles on trades taken when you're frustrated? Or that trades you planned in advance consistently outperform reactive ones by a full R-multiple?

This isn't hypothetical. These patterns are hiding in your trading data right now. They only become visible when you track emotional states alongside trade metrics.

What Is Trading Psychology?

Trading psychology covers the emotional and mental factors behind every trading decision you make. It sits at the intersection of behavioral economics, cognitive psychology, and practical market experience. Understanding how cognitive biases, emotional states, and behavioral habits shape your market participation is the first half of the problem. Measuring and changing them is what separates consistently profitable traders from the rest.

Why Psychology Matters More Than Strategy

Most trading education focuses on entries, exits, and setups. But consider this: two traders can follow the exact same system and produce drastically different results. Same signals, same rules, same markets. The difference is almost always psychological. One trader follows the plan. The other panics out of winners, chases losers, sizes up after a hot streak, and revenge trades after getting stopped out.

Barber and Odean's landmark study (2000) demonstrated this at scale. They analyzed 66,465 household brokerage accounts over six years and found that the most actively trading households earned an annual return of 11.4% versus the market return of 17.9%. The cause? Overconfidence leading to excessive trading. These investors had access to the same information and opportunities as everyone else. Psychology was the only differentiator.

The Science Behind Trading Emotions

The field of behavioral finance, pioneered by Daniel Kahneman and Amos Tversky, has identified dozens of cognitive biases that affect financial decision-making. Their prospect theory (1979) is foundational: it proved that people feel losses roughly twice as intensely as equivalent gains. A $1,000 loss doesn't just cancel out a $1,000 win emotionally. It hits much harder.

This asymmetry creates predictable errors. Traders hold losing positions too long (hoping to avoid realizing the pain) and sell winning positions too early (to lock in the pleasure before it vanishes). Terrance Odean measured this directly in his 1998 study of 10,000 brokerage accounts: investors were 1.5 times more likely to sell a winning stock than a losing one. He called it the disposition effect, and it reduced their annual returns by 3-5%.

Understanding these biases isn't enough to fix them. Knowledge alone doesn't change behavior. That's why most "trading psychology" books produce temporary motivation but no lasting change. What does work is measurement: tracking your psychological states alongside your trade outcomes, so the patterns become undeniable.

The Four Pillars of Trading Psychology

1. Emotional Awareness

Catching fear, greed, hope, and frustration as they show up, not after they've already influenced your decisions. This takes honest self-monitoring and consistent journaling. The goal isn't to eliminate emotions (that's impossible), but to notice them early enough that they inform your decisions rather than drive them.

2. Cognitive Bias Recognition

Learning the mental shortcuts that cause repeatable mistakes: confirmation bias (seeking information that confirms your existing position), recency bias (overweighting recent events), loss aversion (the Kahneman-Tversky 2x asymmetry), and the disposition effect (Odean's finding that traders sell winners 1.5x more often than losers). Every trader has them. Profitable traders learn to spot them and design systems around them.

3. Behavioral Pattern Analysis

Tracking how your actions stray from your plan under certain conditions. When do you over-size? When do you exit too early? When do you chase? At what time of day do your worst decisions happen? These patterns are consistent and personal. Everyone's psychological fingerprint is different, which is why generic advice rarely helps. You need your own data.

4. Performance Correlation

Linking psychological states to actual trade outcomes. A feeling by itself isn't useful until you know its P&L impact. Data turns gut feeling into strategy. When you can say "trades I take when frustrated have a 30% lower win rate than trades I take when calm," you have something you can act on.

Key Cognitive Biases Every Trader Should Know

Beyond the major patterns covered in our topic guides, several cognitive biases affect traders on a daily basis:

- Confirmation Bias: Once you have a position, you unconsciously seek information that supports it and discount information that contradicts it. This makes it harder to recognize when a trade is going wrong.

- Anchoring: Your entry price becomes a mental reference point that distorts your exit decisions. A stock dropping from $50 to $40 feels different than a stock rising from $30 to $40, even though both are at $40 right now.

- Recency Bias: Recent events get disproportionate weight. After three winning trades, you feel invincible. After three losers, you feel like your strategy is broken. Neither conclusion is justified by the sample size.

- Sunk Cost Fallacy: "I've already lost $2,000 on this trade, I can't sell now." The money is gone regardless of whether you hold or sell. But the emotional pull to "get your money back" from the same trade is powerful.

- Gambler's Fallacy: Believing that a string of losses makes a win more likely (or vice versa). Each trade is independent. Markets don't owe you a correction.

- Endowment Effect: You overvalue things you own. Your current positions feel more valuable than they are, making you reluctant to close them even when the thesis no longer holds.

Common Trading Psychology Challenges

Click any topic for an in-depth guide on identifying, measuring, and overcoming each psychological pattern

Fear of Missing Out (FOMO)

Chasing trades after moves have already started, abandoning entry criteria

Impact: TradesViz users report significantly worse outcomes on unplanned vs. planned entries

Revenge Trading

Increasing size or frequency after losses to 'get back' at the market

Impact: Trades taken immediately after a loss consistently underperform planned entries

Loss Aversion

Holding losers too long, cutting winners too short

Impact: The disposition effect reduces returns by 3-5% annually (Odean, 1998)

Overconfidence

Oversizing after winning streaks, underestimating risk

Impact: Overconfident traders who trade most actively underperform by 6.5% annually (Barber & Odean, 2000)

Analysis Paralysis

Over-analyzing to the point of missing valid setups

Impact: Missed opportunities have compounding costs. Track your 'watched but not traded' list

Tilt & Emotional Flooding

Complete loss of rational decision-making after emotional triggers

Impact: Tilt sessions can concentrate the majority of monthly losses into just 1-2 trading days

How to Track Trading Psychology: A Simple Framework

Tracking your psychology doesn't have to be complicated. It just has to be consistent. The key insight from behavioral finance is that awareness alone doesn't change behavior. Shefrin and Statman (1985) found that even traders who understood the disposition effect continued to sell winners early and hold losers. What breaks the cycle is structured feedback: making your psychological patterns visible and measurable so the cost becomes impossible to ignore.

Here's a four-stage framework that works:

Pre-Trade: Capture Your State

- Emotional baseline: Rate yourself (1-5) on key emotions: anxiety, confidence, frustration, excitement. This takes 10 seconds and creates a record you can correlate with results later

- Physical state: Note sleep quality, caffeine intake, and time since last meal. Research on cognitive performance consistently shows that sleep deprivation and low blood sugar impair decision-making, especially under uncertainty

- Market context: Is this a planned setup from your pre-market analysis, or something reactive? Are you following your rules, or making exceptions?

- Intent check: Write one sentence about why you're taking this trade. If you can't articulate a clear reason, that's a red flag worth noting

During Trade: Note Deviations

- Did you move your stop? Why? Was it based on new information, or on fear?

- Did you add to the position? Was that part of your original plan, or a reaction to paper profits?

- Did you exit early? What prompted it? Was price action threatening your thesis, or were you just uncomfortable with volatility?

- Did you feel the urge to check the trade obsessively? Over-monitoring is a sign of position sizing beyond your emotional tolerance

Post-Trade: Connect Outcomes to States

- How did your emotional state line up with this outcome? Were calm, planned trades better than anxious, reactive ones?

- What would you do differently? Be specific. "I should have waited" isn't useful. "I should have waited for the 5-minute candle to close" is

- Tag the trade with relevant psychology labels for later analysis (FOMO, Planned, Revenge, Impulsive, etc.)

- Note whether your pre-trade checklist was fully followed, partially followed, or ignored

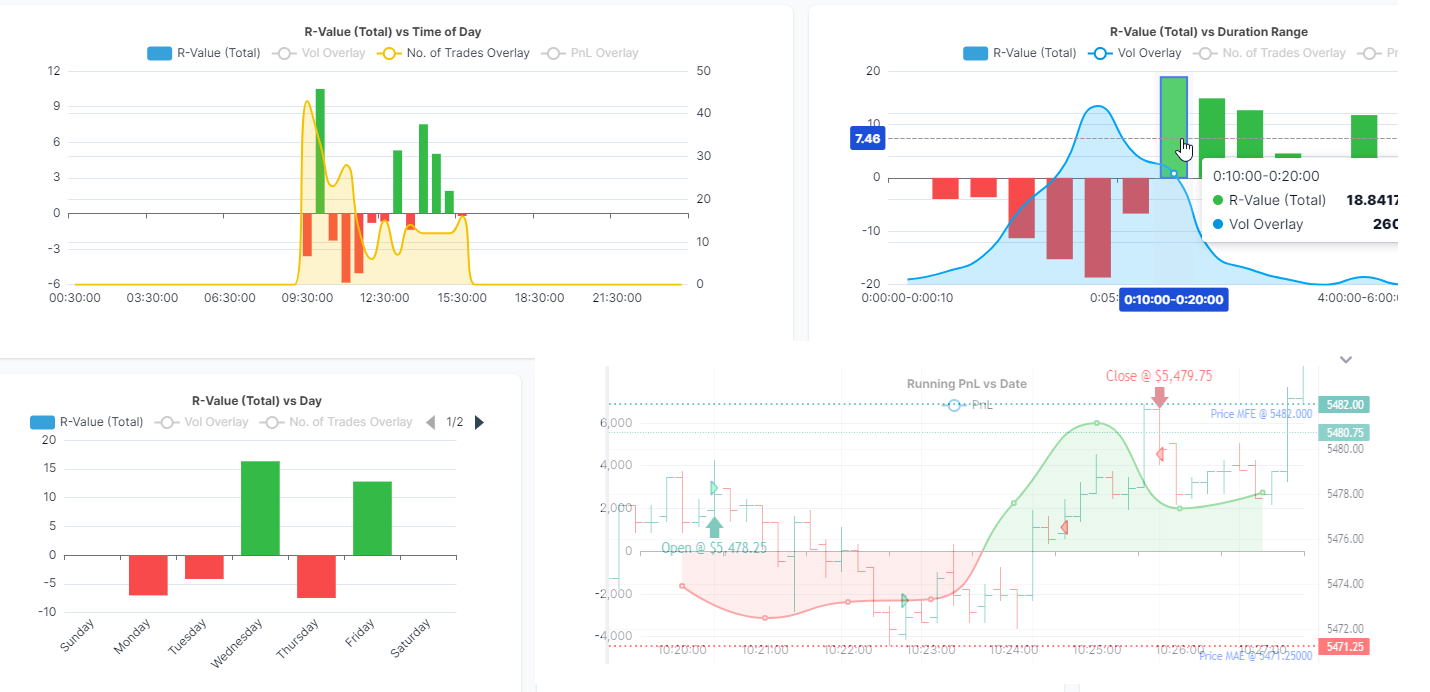

Weekly Review: Pattern Recognition

- Filter trades by psychology tags. Which emotional states produce profits? Losses? Are there states where you should simply stop trading?

- Look for time-based patterns. When are you at your best? When are you at your worst? Many traders find their worst decisions cluster at specific times

- Identify the specific triggers that come right before your worst trades. Consecutive losses? News events? Seeing someone else's gains on social media?

- Compare your plan-compliance rate to your P&L. This single metric often tells you more about your performance than any technical analysis

- Look at position size variance. Are you sizing up during winning streaks or after losses? Barber and Odean's research (2000, 2001) shows that overconfident traders consistently overtrade, and the effect is measurable

Monthly Assessment: Quantify Your Psychology

- Calculate the total P&L impact of each psychology tag. Put a dollar sign on your emotional trading

- Track your "psychology cost" over time. Is it shrinking? That's the most important metric of improvement

- Identify your top 3 psychological weaknesses by dollar impact. Focus your improvement efforts there

- Review your MFE (Maximum Favorable Excursion) data. How much money did you leave on the table by exiting winners early? This directly measures the disposition effect in your own trading

Put this framework into practice

For step-by-step implementation with screenshots and real data examples, read our complete guide: How to Track Trading Psychology: Beyond Basic Mood Meters. It covers 5 proven workflows including the "Cost of Emotion" audit, boolean discipline checklists, contextual performance analysis with day plans, AI-powered queries, and the MFE/MAE fear-and-greed check.

Recommended Reading: The Complete Psychology Tracking Playbook

Our most popular blog post breaks down 5 actionable workflows with real examples, screenshots, and data. Learn how to run a "Cost of Emotion" audit, build boolean discipline checklists, use Day Plans for contextual analysis, leverage AI for pattern discovery, and quantify the fear-and-greed effect with MFE/MAE.

Read: How to Track Trading Psychology: Beyond Basic Mood MetersTradesViz Features for Psychology Tracking

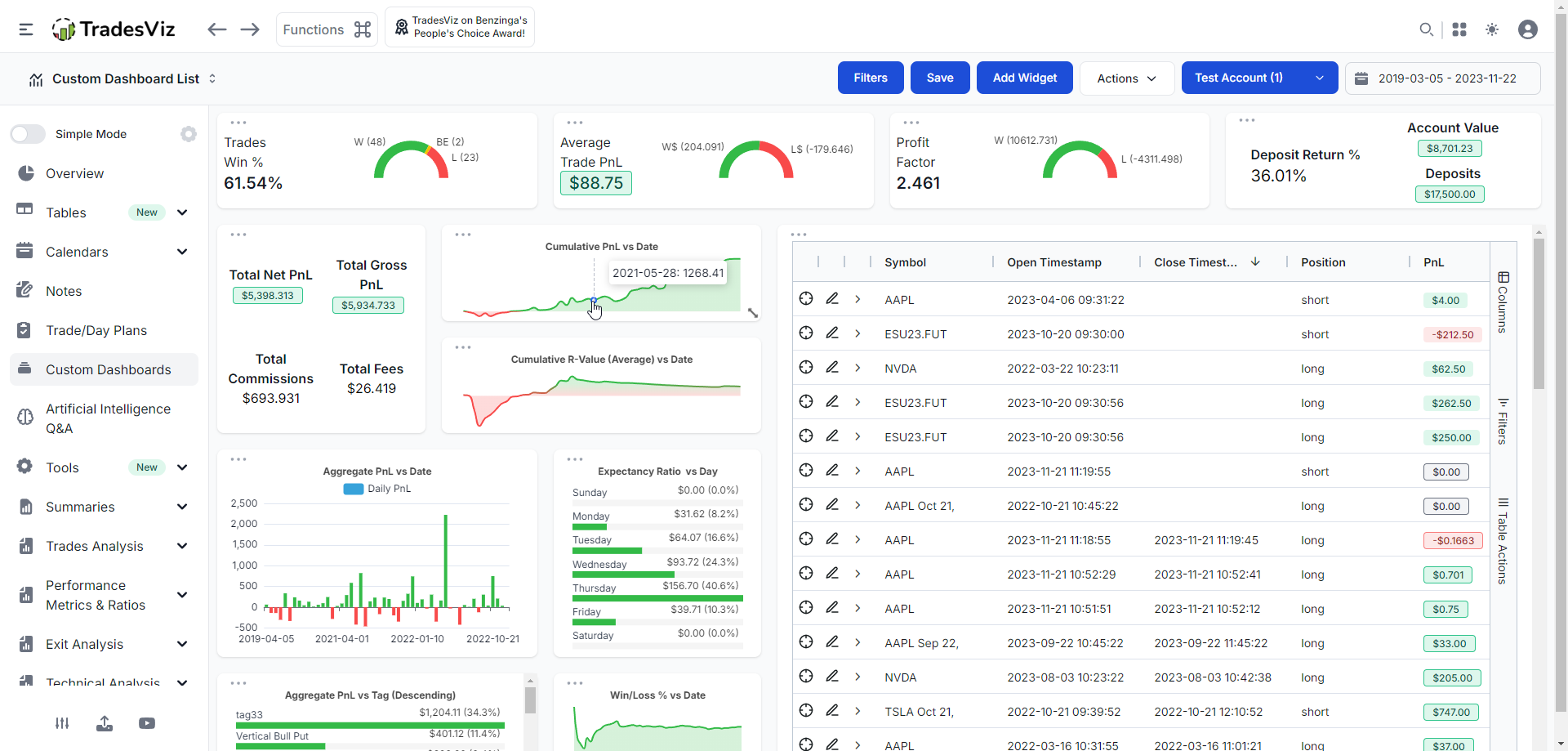

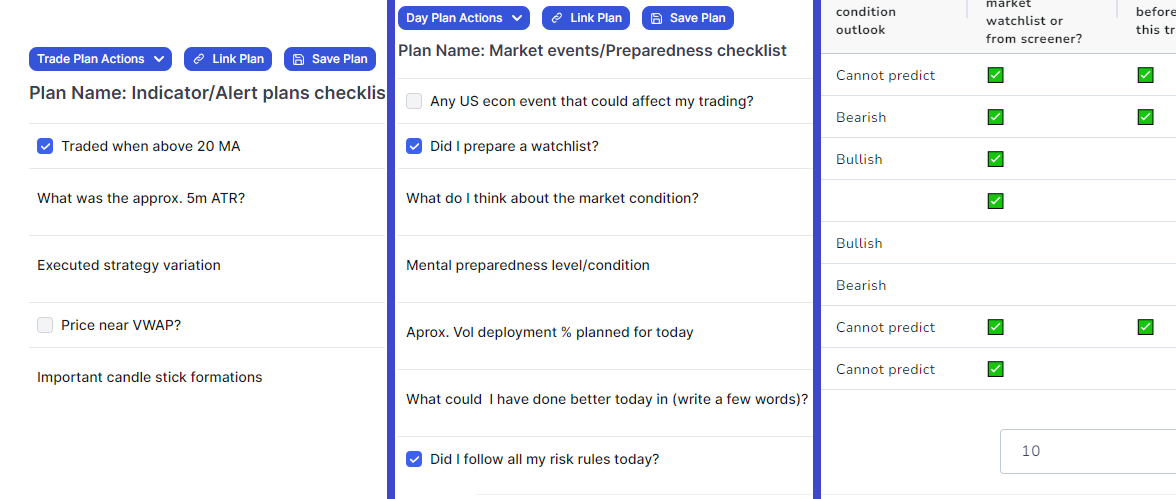

Purpose-built tools to turn emotional patterns into quantifiable, actionable data

Custom Tags & Tag Groups

Create psychology-specific tags (FOMO, Revenge, Planned, Impulsive) and color-code them. Filter your entire trade history by psychological state.

Learn more

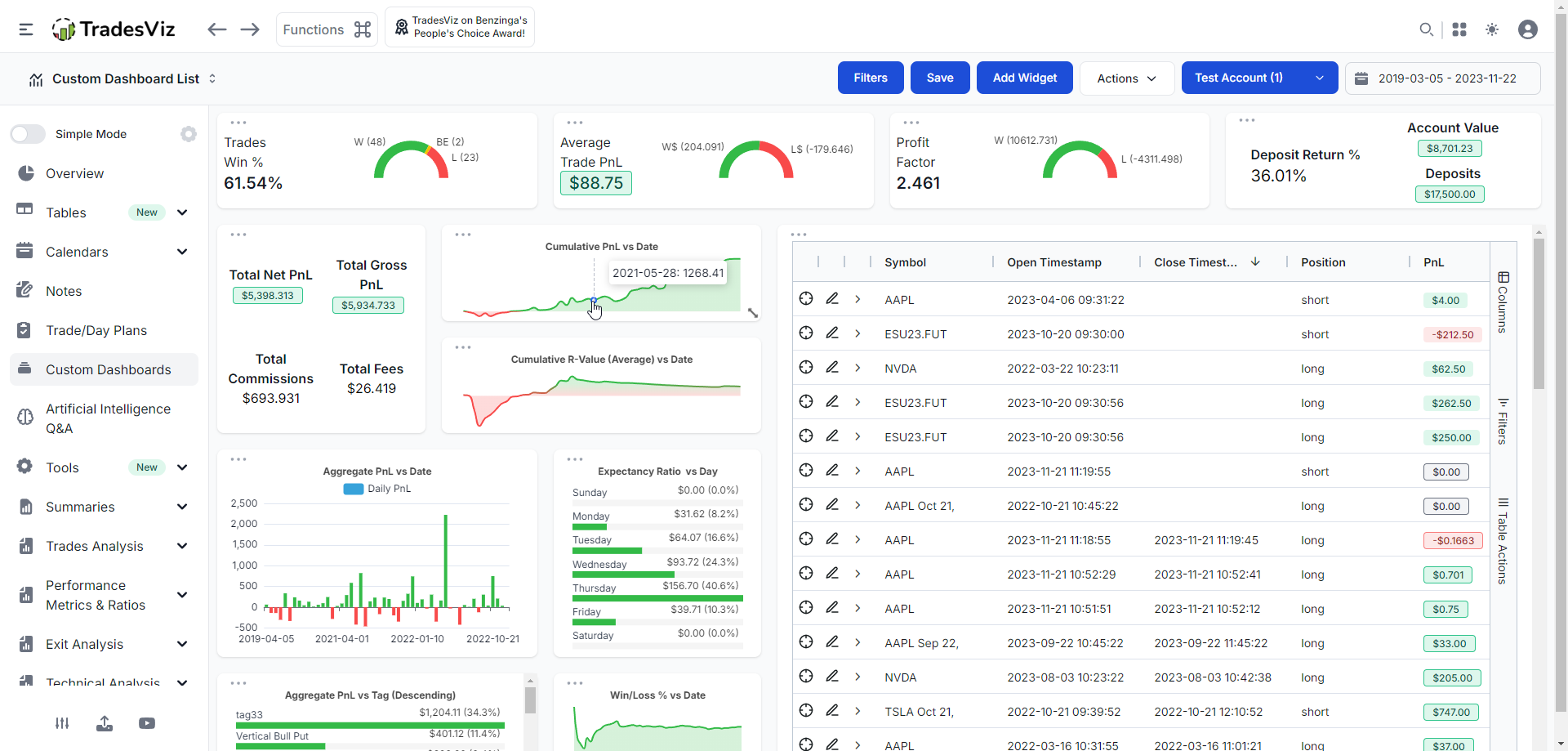

Notes & Executions Journal

Attach detailed notes to any trade. Document your emotional state, reasoning, and lessons learned. Everything is searchable and filterable.

Learn more

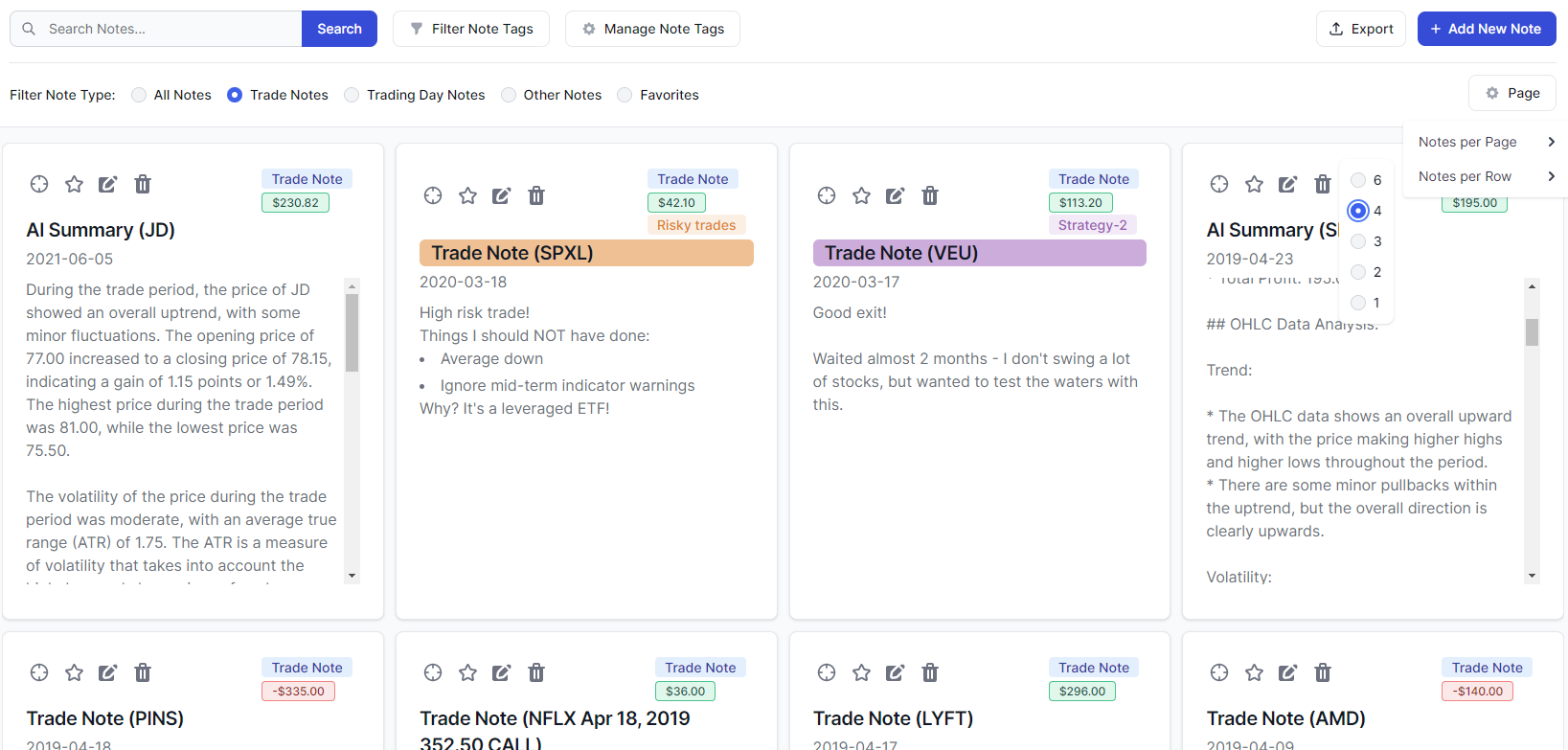

Trade Plan Analysis

Track and analyze the trading rules you break and follow everyday/every trade. Identify when psychology helps or hurts.

Learn more

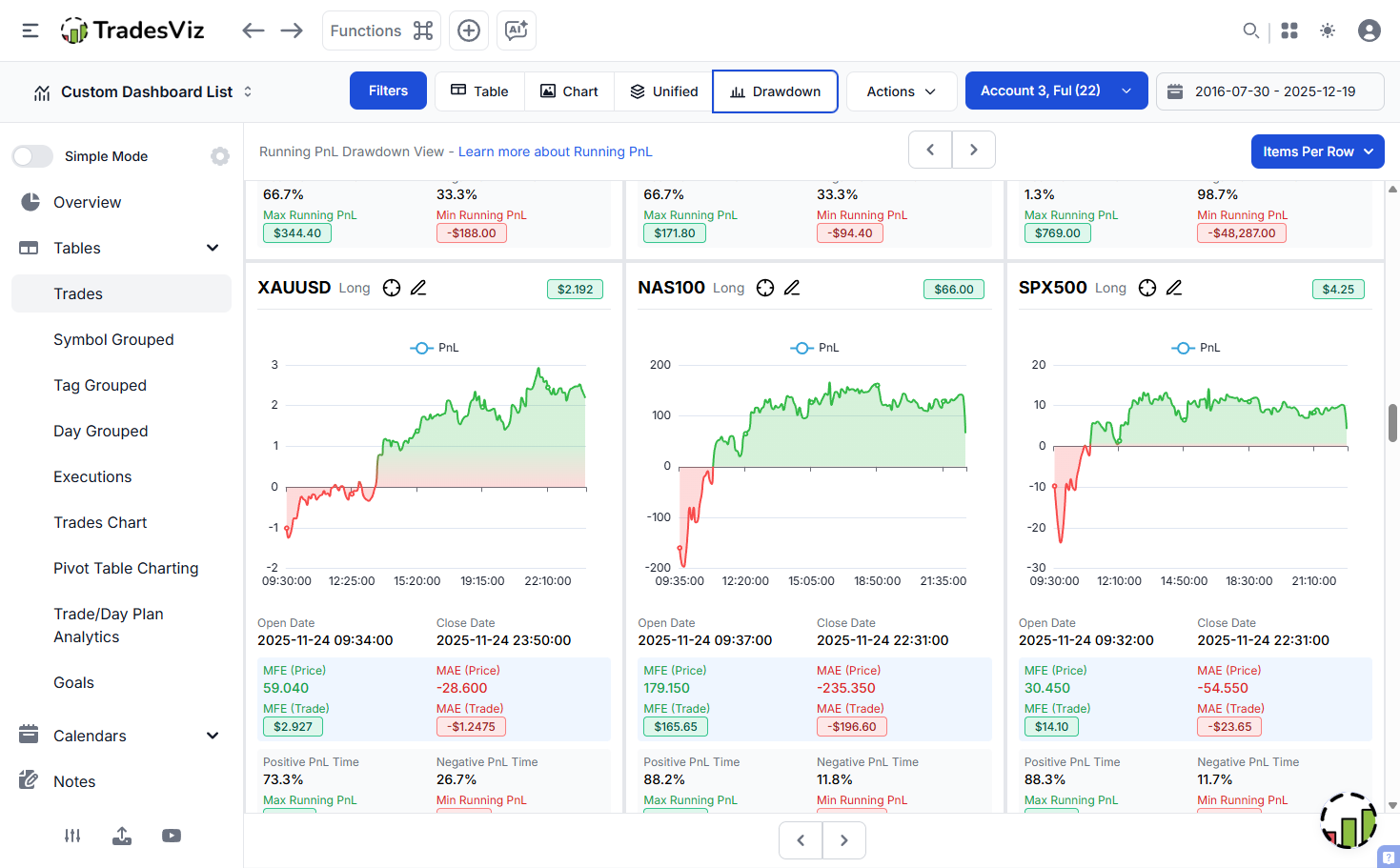

Drawdown Tracking

See how long you spent in profit vs loss across your positions. Perfect for identifying risk management patterns and exit timing issues without clicking into each trade individually.

Learn more

MFE/MAE Analysis

Maximum Favorable and Adverse Excursion shows if you're cutting winners short or letting losers run. It's the disposition effect, quantified.

Learn more

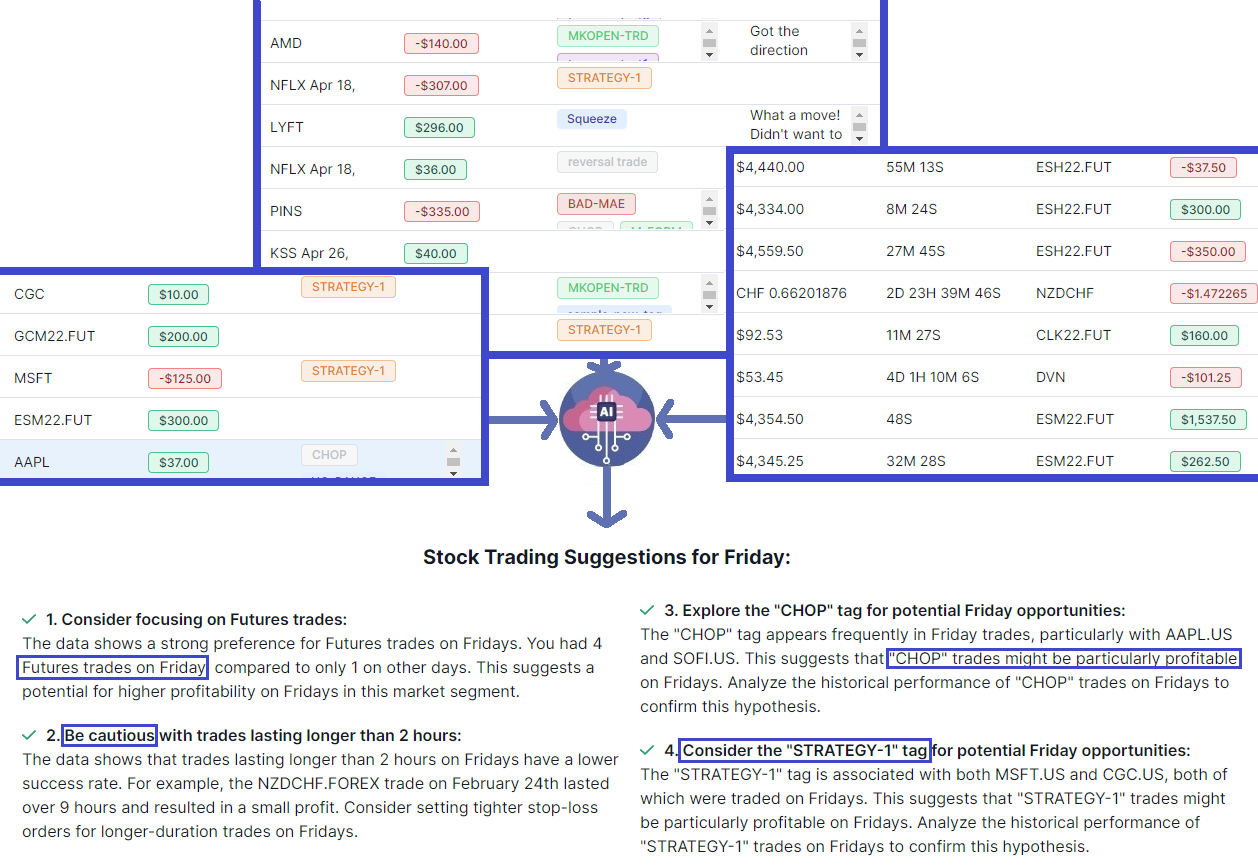

AI Trade Analysis

Our AI analyzes your trading patterns and identifies psychological tendencies you might not notice. Get personalized insights on your behavioral patterns.

Learn more

The Data Behind Trading Psychology

Research-backed statistics on how psychology affects trading performance

Losses are felt roughly twice as strongly as equivalent gains, driving irrational hold/sell decisions

Kahneman & Tversky, Prospect Theory (1979)

Annual return reduction caused by the disposition effect (selling winners early, holding losers)

Odean, Are Investors Reluctant to Realize Their Losses? (1998)

Excessive trading driven by overconfidence reduces net annual returns by this much on average

Barber & Odean, Trading Is Hazardous to Your Wealth (2000)

Traders are 1.5x more likely to sell a winning position than a losing one

Odean, Disposition Effect Study (1998)

Research References

The data and insights on this page draw from foundational behavioral finance research:

-

Kahneman, D. & Tversky, A. (1979). "Prospect Theory: An Analysis of Decision under Risk." Econometrica, 47(2), 263-291.

Established that losses are felt roughly 2x as strongly as equivalent gains, explaining loss aversion and risk-seeking behavior after losses. -

Odean, T. (1998). "Are Investors Reluctant to Realize Their Losses?" The Journal of Finance, 53(5), 1775-1798.

Demonstrated the disposition effect: traders are 1.5x more likely to sell winning positions than losing ones, reducing annual returns by 3-5%. -

Barber, B.M. & Odean, T. (2000). "Trading Is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors." The Journal of Finance, 55(2), 773-806.

Found that the most active traders (driven by overconfidence) underperformed the market by 6.5% annually. Higher trading frequency correlated with worse returns. -

Barber, B.M. & Odean, T. (2001). "Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment." The Quarterly Journal of Economics, 116(1), 261-292.

Showed that overconfident investors trade 45% more and earn annual risk-adjusted returns 2.65% less than less active investors. -

Shefrin, H. & Statman, M. (1985). "The Disposition to Sell Winners Too Early and Ride Losers Too Long: Theory and Evidence." The Journal of Finance, 40(3), 777-790.

First formal identification of the disposition effect in financial markets, building on Kahneman and Tversky's prospect theory framework.

Trading Psychology FAQ

Commonly asked questions about trading psychology and emotional management

What is trading psychology and why does it matter?

Trading psychology covers the emotional and mental factors behind your trading decisions. It matters because even a solid strategy will fall apart if emotions cause you to deviate from your plan. Academic research consistently shows this: Odean (1998) found traders are 1.5x more likely to sell winners than losers, and Barber & Odean (2000) showed overconfident traders underperform by 6.5% annually. These biases are measurable, and they directly eat into returns.

How can I improve my trading psychology?

The best approach is consistent tracking and review. Record your emotional state before each trade, tag trades with labels like FOMO, Planned, or Revenge, and regularly check how those states line up with your results. Over time, vague feelings turn into clear patterns you can actually work on.

What are the most common trading psychology mistakes?

The big ones are: 1) FOMO, chasing trades after they've already moved, 2) Revenge trading, sizing up after losses trying to get back to even, 3) Loss aversion, holding losers too long while cutting winners short, 4) Overconfidence after winning streaks, sizing up at exactly the wrong time, and 5) Analysis paralysis, overthinking until you miss the setup entirely.

How does TradesViz help with trading psychology?

TradesViz gives you the tools to track and analyze your psychological patterns: custom tags for emotional states, detailed trade notes, time-based analysis to find when you trade best, consecutive win/loss tracking to catch overconfidence or revenge trading, MFE/MAE analysis to measure the disposition effect, and AI-powered pattern recognition that flags behavioral tendencies in your trading.

What is the best way to track trading emotions?

Use a three-stage approach: 1) Before the trade, rate your emotional state and note whether it's a planned or reactive trade, 2) During the trade, write down any deviations from your plan (moved stops, early exits, added to position), 3) After the trade, tag it with relevant psychology labels and note what you'd change. Reviewing this weekly is where the real insights show up.

How long does it take to improve trading psychology?

Most traders see real improvement within 2-3 months of consistent tracking. You need enough data to spot patterns (usually 50+ trades with psychology tags) and the discipline to review it weekly. A lot of TradesViz users say that just seeing their FOMO or revenge trading stats laid out in front of them was enough to change their behavior.

Can trading psychology be measured objectively?

Absolutely. While the emotions themselves are subjective, their impact on your P&L is very measurable. Odean's 1998 research demonstrated this rigorously: traders consistently sell winners too early and hold losers too long (the disposition effect), costing 3-5% annually. In TradesViz, you can compare win rates and R-multiples for trades tagged with different emotional states, look at time-from-last-trade correlations, and track how position sizes change during winning or losing streaks. These numbers turn psychology from a fuzzy concept into something you can actually work with.

What is the disposition effect in trading?

The disposition effect is the tendency to sell winners too early (to lock in gains) while holding losers too long (to avoid making the loss real). It's one of the most well-studied biases in trading. You can measure it by comparing your MFE (Maximum Favorable Excursion) to your actual exit points. If there's a big gap, you're consistently leaving money on the table.

Turn Your Psychology Into a Real Edge

Over 150,000 traders use TradesViz to spot emotional patterns and turn them into better results. Free plan available.