This has been another long-requested feature from many of our users! We already had MFE/MFE values that are auto-calculated for all trades, but today, we are launching charts for MAE/MFE in the same TradesViz style - full explorability!

You will find that we have made some minor rearrangements of tabs on the left side of your TradesViz dashboard. MFE/MAE stats can now be found under "Performance metrics charts".

What is MFE/MAE?

MFE stands for Maximum Favorable Excursion and it tells you what is the max amount of price movement in your favor in the duration of your trade.

MAE stands for Maximum Adverse Excursion and it tells you what is the max amount of price movement against your favor in the duration of your trade.

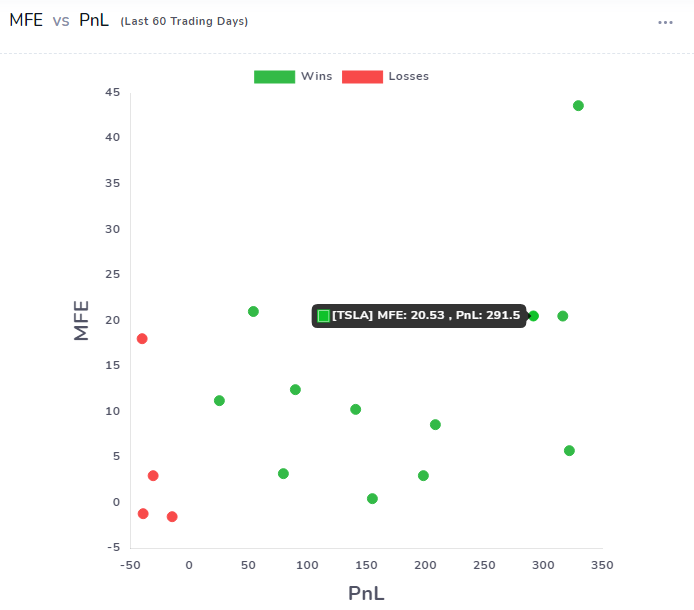

Here is a chart example:

Analyzing MAE and MFE statistics can help you optimize your exit strategies/stop or target placement.

In simple terms, if the distance between your MFE and trade price is too high, then that means you are not capturing the full profitable move you could have had - many traders call this as "let your winners run" - but it's not as simple as that. You might have to adjust your Risk/reward ratio based on the MFE/MAE analysis metrics to have an optimal profit placement for scenarios like this.

On the other hand, if MAE distance is too high, then it means you are exposing yourself to too much risk - i.e, the potential drawdown in the trade could have been much worse and even if you ended the trade with the profit, exposing yourself to such drawdowns is not healthy. This calls for optimal stop placement - now again, a popular saying is "cut your losers short" - once again, it's not as simple as it sounds and requires one to take more effort and analyze the right places to keep their stops. Tight stops can take out of trades and if your risk-reward is not high enough, without a higher win rate, you will simply lose more money in the long run.

Therefore, it is required to not just look at MFE/MAE but combine it with charts such as R-value and Risk: reward vs PnL charts (Performance metrics charts > General metrics) to find the best combination of stop placement and risk management for your strategies.

Here's an example of MFE vs PnL of trade. For every data point, when you hover your mouse over it, you can clearly see what the symbol of the trade was, MFE, and the stat it is being compared to (PnL, Volume, Open time, Close time).

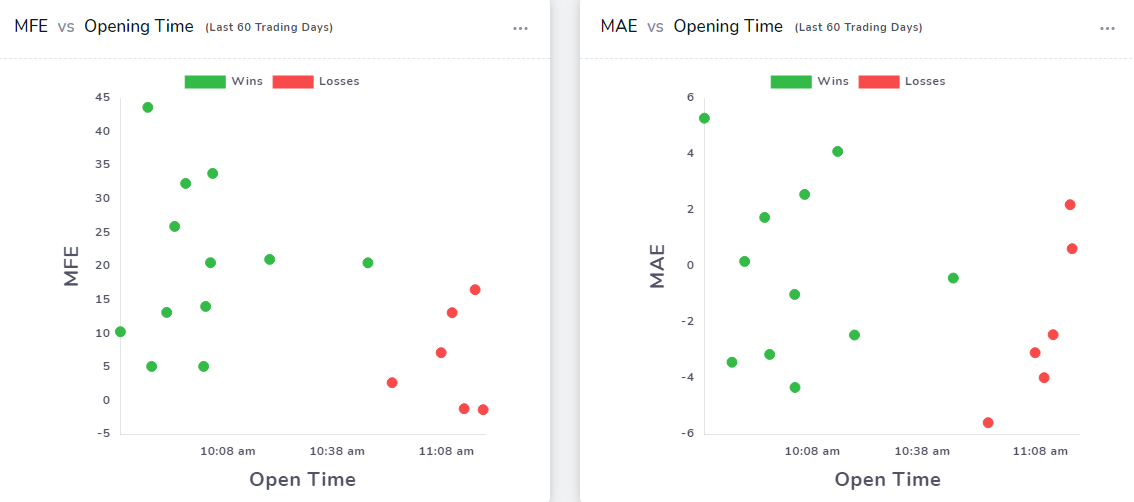

Here are all the charts you will find in this tab:

- MFE vs PnL

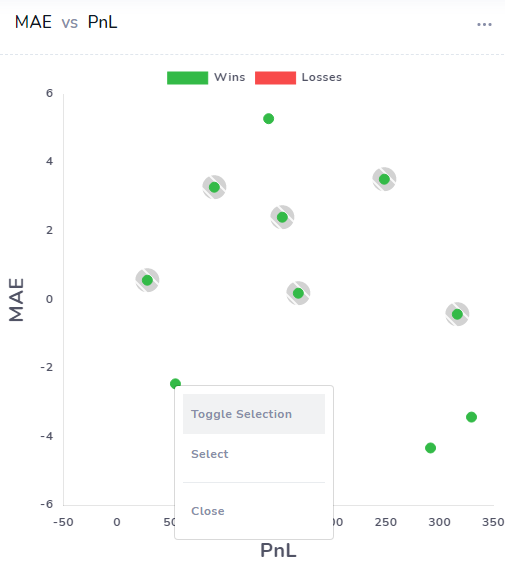

- MAE vs PnL

- MFE vs Volume

- MAE vs Volume

- MFE vs Open time

- MAE vs Open time

- MFE vs Close time

- MAE vs Close time

You will notice that, unlike most journals where only MFE, MAE/PnL relationship is visualized, we are including 2 more additional comparisons - volume and open/close time. From our analysis, we believe that these 2 comparisons can yield lots of new insights that you would have missed if you only had access to the MFE, MAE/PnL chart.

As with all other types of analysis we have on TradesViz, you can click on each individual data point in any of these charts and explore them to view exactly what trade was behind the particular data point. This is extremely useful in finding outliers and learning more about potentially profitable setups!

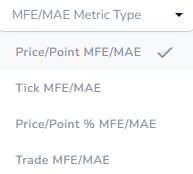

In addition to the above features, you can also switch between ticks, pnl, and more using the dropdown at the top (this modifies the Y-axis values).

We hope this makes your journaling experience more fruitful and helps you easily optimize your trading strategies! Please let us know if you are interested in seeing more MFE/MAE-related stats or any other statistics in TradesViz - we try our best to accommodate all feature requests!