Why should I journal my trades?

What's the point of looking back at my trades?

Two very common questions that all traders ask when they discover the process of journaling. Either they are recommended to journal their trades from a course they are taking or by a friend etc., Most of the time, new traders ignore this.

Why?

Try recommending a 'trading system' to a new trader or perhaps a new indicator - they will almost immediately start using it. Why? because they think it could potentially be a holy grail that can make them money. This type of behavior/psychology is not only present in trading, we see it everywhere in our lives. During our studies, maybe when following a diet, or exercising? We are geared towards seeing out rewards that are near our grasp.

It is hard to comprehend the rewards of following a process over the long term even if it has been proven because habits are hard to form. Journaling is one of the time-tested methods that are recommended by legends of the trading world has been a practice in existence since the dawn of trading itself.

The only way you get a real education in the market is to invest cash, track your trade, and study your mistakes…. The examination of a losing trade is tortuous but necessary to ensure that it will not happen again.

Jesse Livermore

(Legendary trader)

Yet, we see so little interest in it. When you take look at professional traders or long-time traders, almost everyone rigorously follows some type of bookkeeping process.

You can forget about finding an edge, analyzing your strategies, finding the best assets to trade for you, etc., The first step is to understand what you are doing and journaling is the ONLY process that can help you with that.

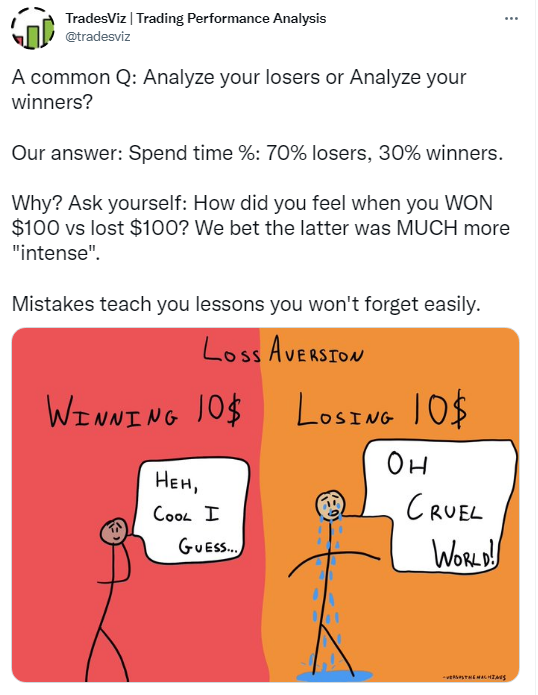

A while back, we tweeted about an important psychology topic: Loss aversion

(Source: https://twitter.com/tradesviz/status/1470017299570577414.

Article: https://thedecisionlab.com/biases/loss-aversion)

This is an important topic because every trader has experienced this. Why are we bringing up this topic now? because your trading journal pretty much reflects what your trading psychology/mentality is. Trading is largely a mental game - a very hard one and there are very few ways to "qualitatively" measure where you are and how you can improve. Once again, no mentor, no course, no book, no video is going to know about *YOU* more than your own trading journal filled with your notes, tags, trades, and analysis.

We always say the following:

So far we have covered why a journal is necessary for the qualitative side of trading, but that's not all there is to journaling. From a "quantitative" side, if you are not treating every win and loss as a potential data point to learn from, you are losing out on a lot of very valuable information.

We will get straight to the point here. Here are some questions a good trading journal can answer for you without any effort from your side at all:

- What are your strong suits in terms of asset classes/sectors/price range etc.,?

- When should you focus on trading - calendar-wise/time-wise?

- How do your strategies compare against each other? How do they vary in different market conditions?

- How much risk are you taking per trade?

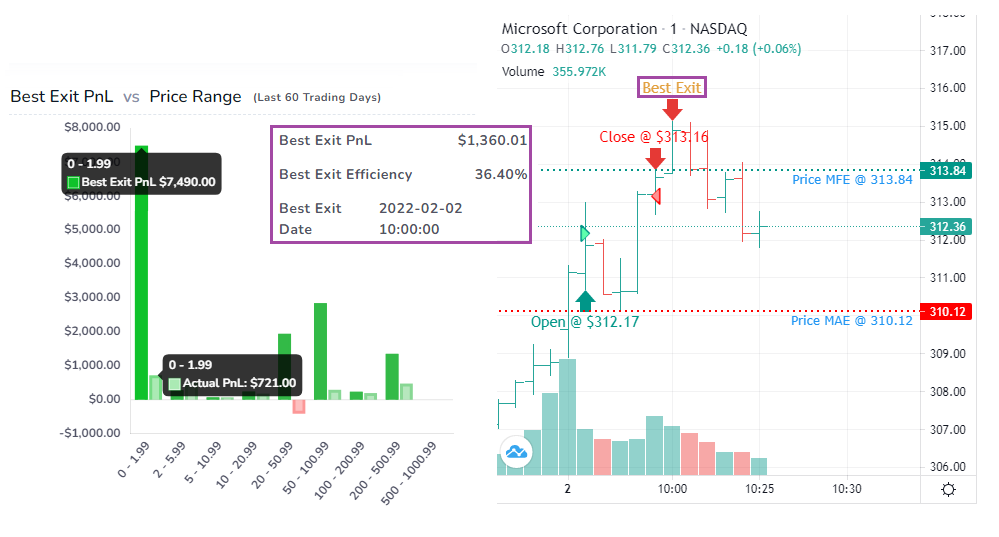

- Are you leaving too much money on the table based on the risk you take?

- How skewed are your risk-reward ratios?

- Are you trading against the market/flow?

and many more...

(Source: https://tradesviz.com/blog/exit-analysis-charts)

If you can figure out the answers to even some of the above questions, you are already several steps ahead of the average trader and all of these answers are given to you as long as you have a journal and use it. That's it. That is all the effort that is required from your side - simply use your journal.

- Excel? Sure no problem.

- A note pad (digital/physical)? Definitely doable!

- An advanced online journal? The easiest option for most traders.

Now, does simply using a journal automatically make you a better trader?

No.

But it does set you up for success by providing valuable insights that can definitely help improve your trading. In a field where the odds are stacked against you, you would ideally want as many conditions in your favor as possible - or as traders would call it, you need a "trading edge".

Having and maintaining journaling is the most *objective* way of measuring yourself. Before you improve yourself, you need to measure yourself and how you are performing (this also touches on the fact that having a journal means you are indeed accountable for everything you do since it's an automatic bookkeeper).

There is also a gross underestimation of the sheer amount of insights and analysis one can generate with just information from simple trade executions. We will prove that with the example below.

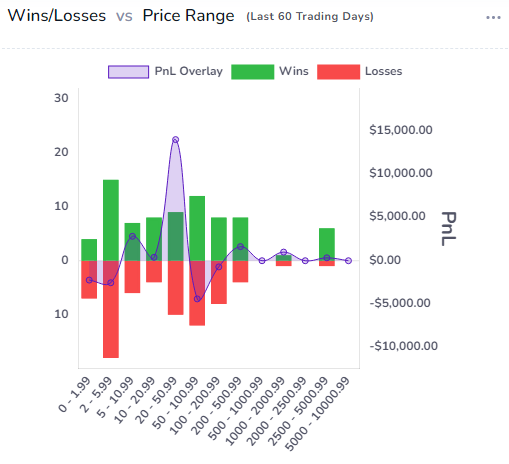

Above, we see a single win-rate vs price range chart with a PnL overlay.

- What do you see in this chart?

- What type of insights can you gather?

- If a trader were to show this to you and ask you for advice, what would you say?

- Do you see any improvements that can be done?

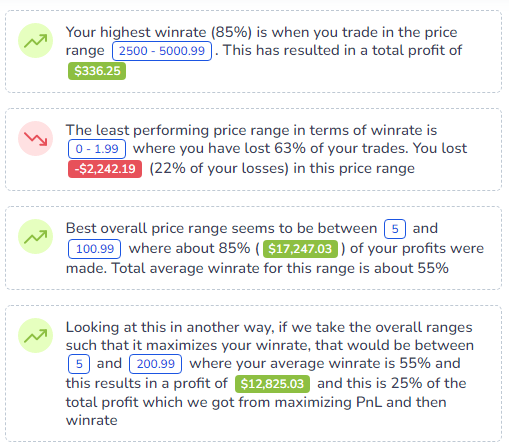

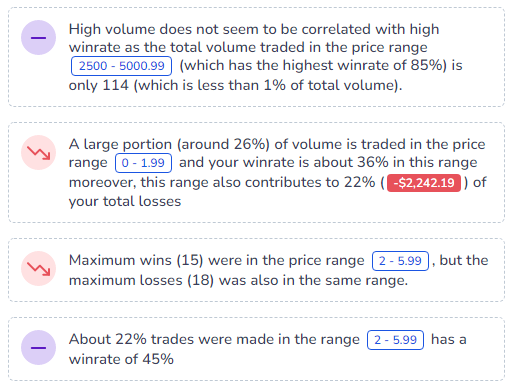

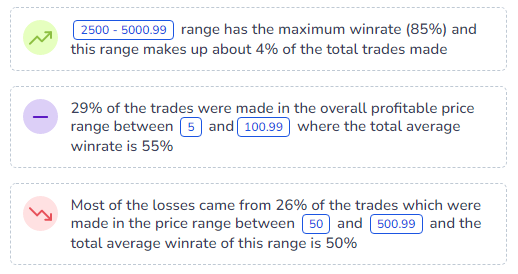

Here's what you can see if you had a journal:

Do keep in mind that this is one chart.

While not every journal is created equally, this is what we provide our users. We strongly believe that 100% data-driven analysis of your trades is pivotal no matter what type of trader you are.

Do you *lose* anything by having a journal? We can't think of a reason. Whereas, this whole article has plenty of benefits if you have one. Perhaps there is free lunch for a trader if you use a journal?... ;)

If you don't yet have a journal, we suggest spending just 10 mins on TradesViz. Talk to us. We are always available. Tell us what you are looking for - we will help you or we will build it for you.

As always, we wish you the best and we hope this article has served as a useful resource on why you should use a journal if you don't have one yet.