Trade journaling is a practice that has existed for decades and has evolved from physical template sheets/note pads to advanced online logging systems that take care of automatically filling in and analyzing information regarding your trades.

What is the use of a trading journal? There are many, but here are the 2 most important purposes in our opinion:

- Gauging your trading performance: Quite simply, your report card for how much money you have made. Do you see a lot of red? Not good. Lots of green? Good!

- Information offloading: If you are trading 3 different markets (not rare at all amongst the current generation of traders), how are you going to remember every single execution/trade you made and how much you gained/lost from it? Journals can help organize your information into digestible chunks that can be referred to whenever you want.

So far, most journaling methods provide very simple solutions for both the purpose we have mentioned above. Total PnL/No. of trades/Volume per day/month/year and maybe some way to organize trades symbol-wise. Note that traditional paper-based approaches or simple excel-sheet based approaches make the 2nd use of information offloading not so easy to achieve due to the complexity and the amount of data available.

The benefits are clear. Yet, why do we see very little adoption amongst traders (especially new) in taking up trade journaling? Through surveys and feedback, here are some answers we found:

- Journaling is hard: Writing down every trade or searching through websites to download executions export files, tagging them, commenting on them, manually correcting them - all of this takes a considerable amount of time for a beginner.

- No immediate benefits: Ok, you now have all your data in your journal - now what? Your recent PnL performance has been going down and what are you going to do about it?

- Expensive/limited features: Paper journaling is extremely rare these days. Since most users have migrated to online journaling services, one of the main complaints has been that charges of these services are too much for beginner traders and most free versions offer very limited features.

We launched TradesViz about a year ago to solve a lot of these pain points and improve the adoption of trade journaling among traders of all experience levels.

One of our biggest hurdles? point [1] ("Journaling is hard")

Our approach to solving this problem:

- With our most recent features which include automatic imports of trades/executions from brokerage platforms safely, we are slowly but steadily heading towards widespread adoption of journaling where no action from the user is required to get the data into their journals.

- Other features such as bulk functions commenting, tagging, splitting, and merging of trades with just 2 clicks all make journal editing extremely easy even for the very first-time user.

- Automatic chart generation for each trade in your journal makes it very easy to grasp the context of the trade. No need to manually screenshot or annotate your execution. All of this is done automatically.

The next problem we have to solve is to provide useful insights to users in their trading journal itself - i.e, point [2] ("No immediate benefits").

Our approach to solving this problem:

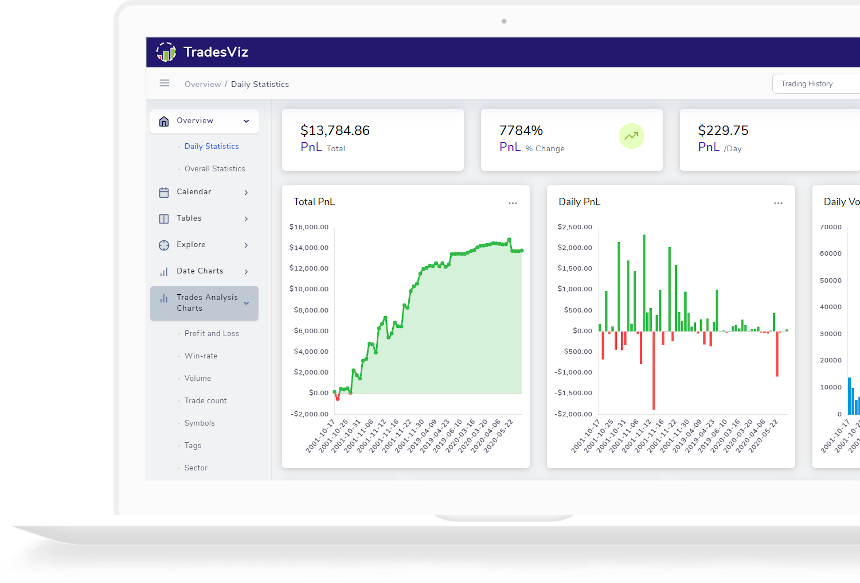

- 100+ unique visualizations each serving a particular purpose.

- We leave no data unused. Correlations between PnL, volume, trade count, day of the week, duration, etc., and more are all visualized and insights are automatically generated for each main comparison automatically.

- Risk analysis and statistics for each trade give you a new perspective on how you can or should trade similar trades in the future w.r.t stop loss and profit target placement.

- We are the first online journal to incorporate options greeks analysis and dedicated risk: reward analysis.

The final problem: Cost - point [3] ("Expensive/Limited features"). We fully understand that new traders cannot afford to spend $20, 30, or 40 every month on a trading journal when they barely have any trades and when their portfolio value itself is very small.

Our approach to solving this problem:

- Upload 3000 executions per month on the free tier. This is unmatched by any other paid online journal. Based on our research, most trading journals only offer 100 free trades per month which is barely enough for many trades of the current generation.

- More than 60% of visualizations and analyses available for free. Most trading journals don't even show stats other than just basic PnL vs price/duration charts.

- Free fundamental research tool. We not only focus on logging and performance analysis but on being a holistic tool for traders to do both their research and performance analysis all under one roof.

- Same fast and responsive customer service via chat and email for all users of TradesViz. We respond to all queries within 24 hrs (typically much quicker) and highly appreciate feature requests (many user-requested features have been implemented before).

Our primary goal since day 1 has been to make trade journaling as easy as possible and to improve its adoption among traders of all experience levels. With absolutely no downside, trade journaling can only be beneficial to new and experienced traders in discovering new traits/strategies and helping them hone their trading edge.

With the reasons and our approaches explained above, we truly believe TradesViz is the best trading journal for all traders and especially traders of the current generation who are just looking to find their edge in the markets.

We are continually improving our services and features and we would very much like to talk to you if you have any feedback or opinions on TradesViz. Our contact email is [email protected].