TradesViz

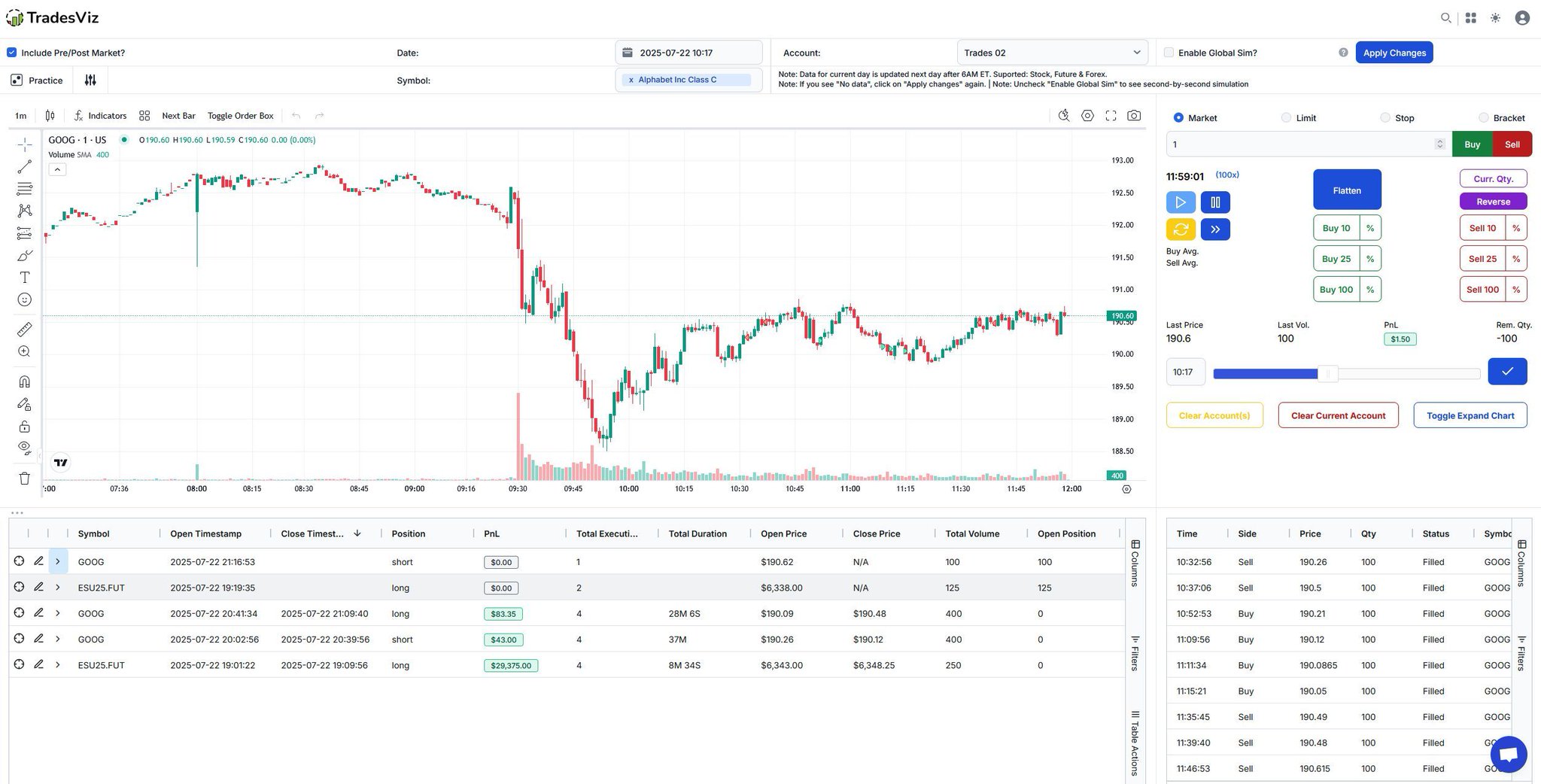

Practice like it’s real — without the risk. The Trading Simulator in TradesViz lets you replay market days, test entries, and refine your strategy. Speed up, pause, reverse — full control to build confidence and precision. Perfect for weekend practice or tightening up before live trades. Every pro sharpens their edge — this is where it starts.