TradesViz

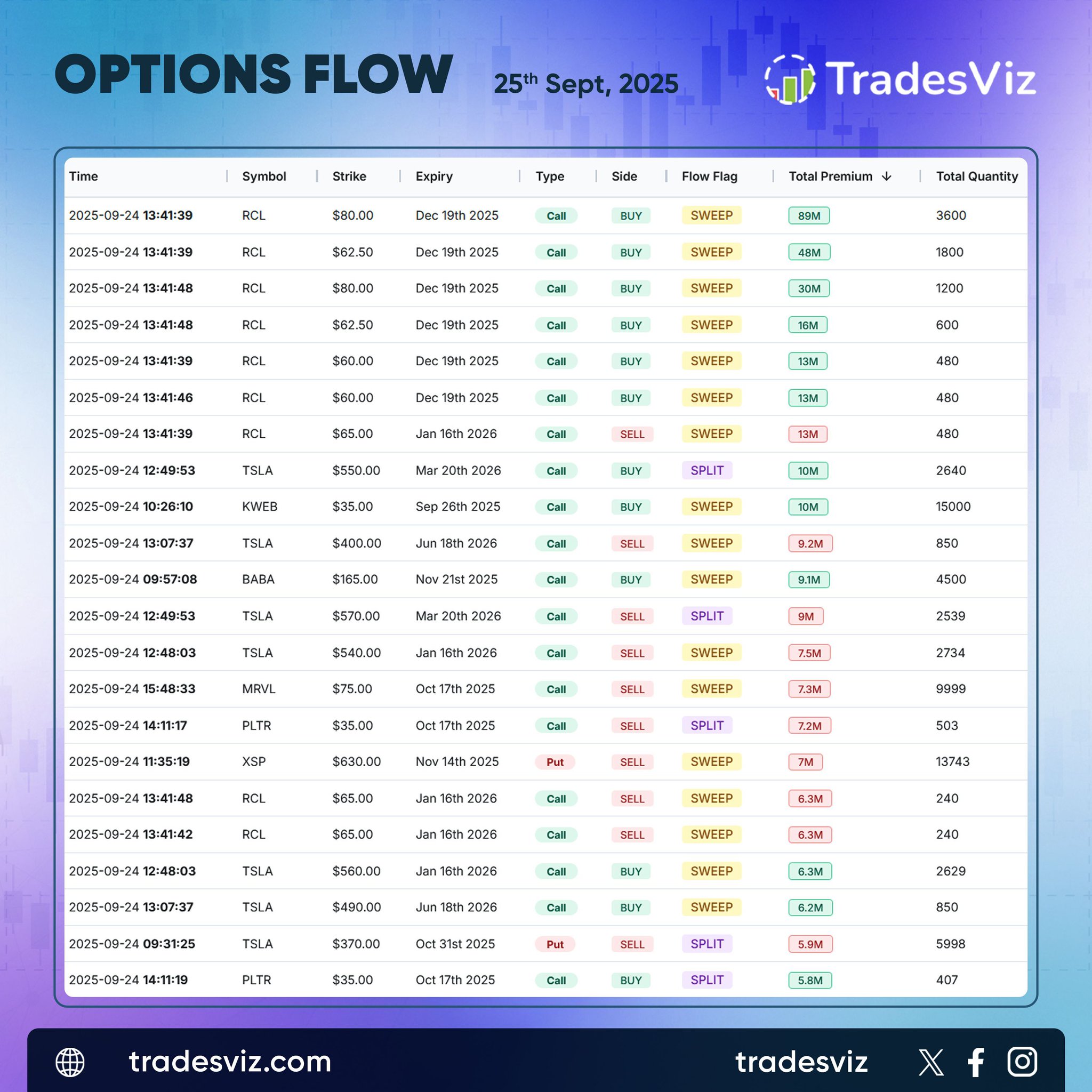

Big flow moves on Sept 25 — $RCL steals the spotlight with a cluster of high-premium sweeps across multiple strikes. $TSLA once again shows up with both split and sweep activity — volume piling in from all sides. Names like $KWEB, $BABA, and $MRVL also catching strong call flow attention. Sweep tags = urgency. Multiple hits = conviction. Stay alert — this flow is setting up something big.