TradesViz has been the leader when it comes to providing simulation as part of journaling. We've introduced the world's first platform to have stocks (US), ETFs(US), futures(US), and forex second-level simulation integrated as part of our journaling solution. Soon after this, we also released the ability to replay all stocks, ETFs, futures for the US, and all forex pairs which allows you to replay your trades second-by-second giving you ample opportunities to learn.

In addition to this, we've also introduced the world's first and only (to our knowledge) options chain simulation for all optionable stocks/ETFs and indices in the US.

All of this may have a common theme: US exchanges only. Since the inception of TradesViz, most of our users have been from the US (still the US dominates our trader demographic) but TradesViz has also been rapidly growing in other countries. To start supporting simulation for non-US exchanges, we are introducing a new type of simulation that we are calling the Universal trading simulation system.

What is this? How does this work?

This is a way to simulate not just the supported US exchanges, but the entire universe of symbols on TradesViz.

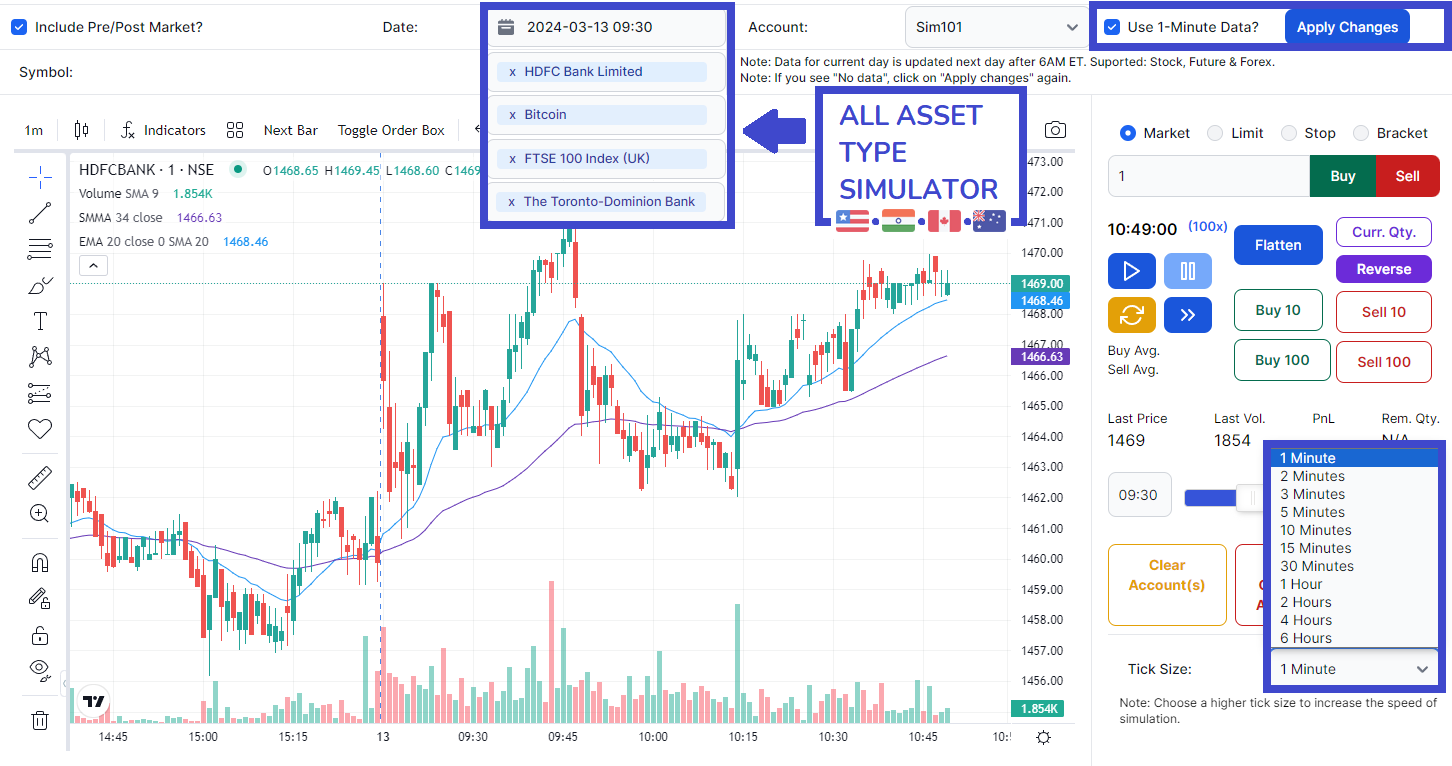

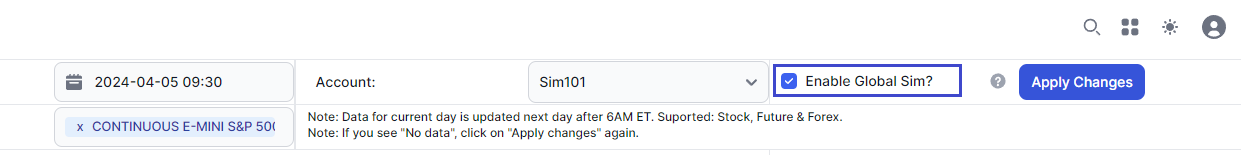

All you have to do is click on a single checkbox - "Enable Global Sim?" that unlocks all of this:

We have our own simulation engine that works very well given any data. However, so far we have limited this to only highly granular data such as 1-sec which we can get for US assets and forex. This is not yet possible or feasible to get for tens of thousands of tickers outside of the US due to a lack of data availability and data usage rules in other exchanges.

We instead use the next most granular data which is the 1-minute data to simulate pretty much any ticker on any timeframe greater than or same as 1 minute. 1 minute data is fairly easy to get and aggregate on our side so we are able to leverage our existing simulation engine to utilize this data to provide simulation services not only to US traders but also to traders from all over the world. This is the universal simulator.

Why not just use the normal simulator? What are the advantages/disadvantages?

Advantages of the normal simulator:

- Second-by-second simulation: The most granular simulation available so your executions made when simulating emulate the exchanges as much as possible.

- Up to 5-sec timeframe: Faster scalper in the west? No problem. TradesViz simulators can show up to 5-second bars so you can see every detail of your execution.

Disadvantages of the normal simulator:

- Only intraday simulation (to load the next day, you need to select the next day in the calendar and reset the simulator).

- Speed even up to 100x may not be sufficient for assets like forex.

- There are computational limitations on how fast simulation can be so if you are a longer-term intraday trader, second-by-second data will be too slow.

- Only US asset types and forex pairs are available.

If you are an existing user of TradesViz, you already know about these limitations and are well aware that the biggest limitation is that only US asset types + forex are supported.

Advantages of Universal simulation system:

- Every ticker on TradesViz can be simulated: We have data for tens of thousands of tickers for the US, IN, AU, and CA exchanges along with thousands of crypto coins and indices. All of these can be simulated bar-by-bar in at least 5-minute or 1-minute intervals all the way to 1-day intervals!

- Crazy fast: Since we are using 1-minute data as the base, the base speed up or efficiency of computation and data processing is at least more than 60x. On top of this, you are able to simulate different timeframes in different simulation-tick sizes which we will discuss below.

- More Value for International Traders: There are many traders who do not trade US stocks or only trade indices or their own countries' exchanges. So far, the simulation solutions have not been of value to them. Until now. A total of ~50,000 stocks, ETFs, cryptocurrencies, indices, and forex can now be simulated and all new exchanges we add from now on will be added to this list!

- All trading features from normal simulators are available: Buy/sell, interactive order placement, and real-time journaling - they are all there and still available. Remember: Only the scope of simulation has increased so all the non-data-related features still carry over as an added advantage to the universal simulation mode.

Sure, the only downside is that it's NOT a second-by-second simulation, but not everyone always requires that + it's near impossible to get that data for literally every symbol we support.

Here are examples of what you can do with the universal simulator:

Simulate all your favorite cryptocurrencies: We have more than 500+ coins for 1m intraday simulation and more than 5000 symbols for 5m intraday simulation.

Simulate ANY index: Yes, /ES is the most liquid index in the world. But it's certainly not the only popular one. Indices like NIFTY50 and other popular indices from major countries can be simulated at 1-minute intervals!

Simulate 50,000+ stocks: US, India, Canada, Australia - all put together have a LOT of tickers. With a growing interest in simulation and advanced journaling in India, we're happy to announce that all major Indian stock tickers will also be available for simulation in mostly 1-minute and if not, 5-minute intervals.

More about usage and simulation speed at different timeframes

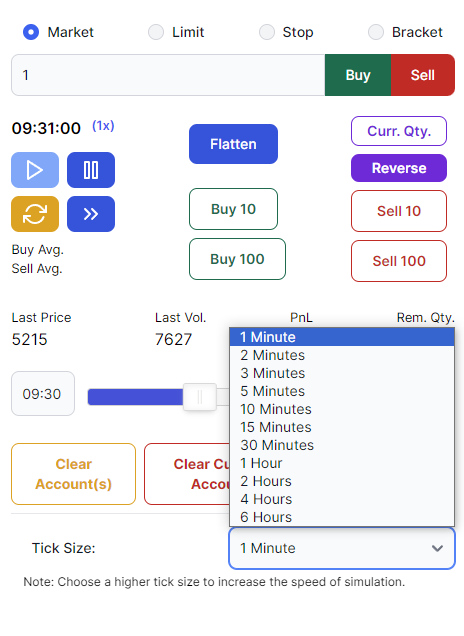

Here's a use case: You are an intraday trader, but you trade mostly on 1hr or 2hr timeframes. Simulating by second-by-second is pretty much useful for you and it's slow. In our normal simulator, you can switch to a 1-hour timeframe, but the base data being used for simulation is still in the level of seconds so even at 100x speed it's going to be slow.

This is not the case with the universal simulation which is its second-biggest strength. Simply put, you can:

- Simulate a 1-hour timeframe with increments of 5-minute, 10-minute bars, etc.,

- Simulate a 10-minute timeframe with increments of 1-minute 5-minute or even 3-minute bars etc.,

- Simulate a 1-day timeframe with increments of 1 hour or 1 minute or 10 mins bars etc.,

You can do this by selecting the "Tick size" option when the one-minute checkbox at the top is enabled.

To re-iterate, you CAN simulate daily bars with any increments ONLY using the universal simulator (yet another highly requested feature by swing traders).

Below are 4 examples of GIFs that show you exactly this capability (click on each GIF to expand):

| HDFCBANK.NSE 1-minute timeframe with 1-minute bars | HDFCBANK.NSE 1-hour timeframe with 1-minute bars |

|

|

HDFCBANK.NSE 1 hour timeframe with 5-minute bars |

HDFCBANK.NSE 1 DAY timeframe with 1-hour bars |

|

|

Interesting?

Soon, this capability will come to the multi-trading simulator. Imagine the possibilities!

With this feature update, TradesViz now can help with the simulation of trading data for not just intraday traders or scalpers, but longer-timeframe intraday traders, swing traders, and more types of traders on a global level.

Once again, we are the first trading journal to make such advances in terms of inclusivity. Trading volume is increasing globally among all exchanges and so are retail traders in proportion. To support these traders, they need a way to practice trading and that's what TradesViz now provides.

Features in development and future of simulation on TradesViz?

- Replay mode for all asset types and all tickers (not just US)

- Advanced backtesting modes

- More exchanges (EU, UK, etc., based on demand)

- Brinign the same set of features to multi-simulator so you can now trade across exchanges and maybe learn from arbitrage strategies ( :) ?)

... and more!

Let us know if you have any questions or feature requests by emailing us at [email protected]! This feature was due to combined feature requests from MANY non-US traders who also wanted to start practicing due to the lack of such tools in the market. We hope this solution provides these traders with a good starting step into trading practice via simulation.