TradesViz

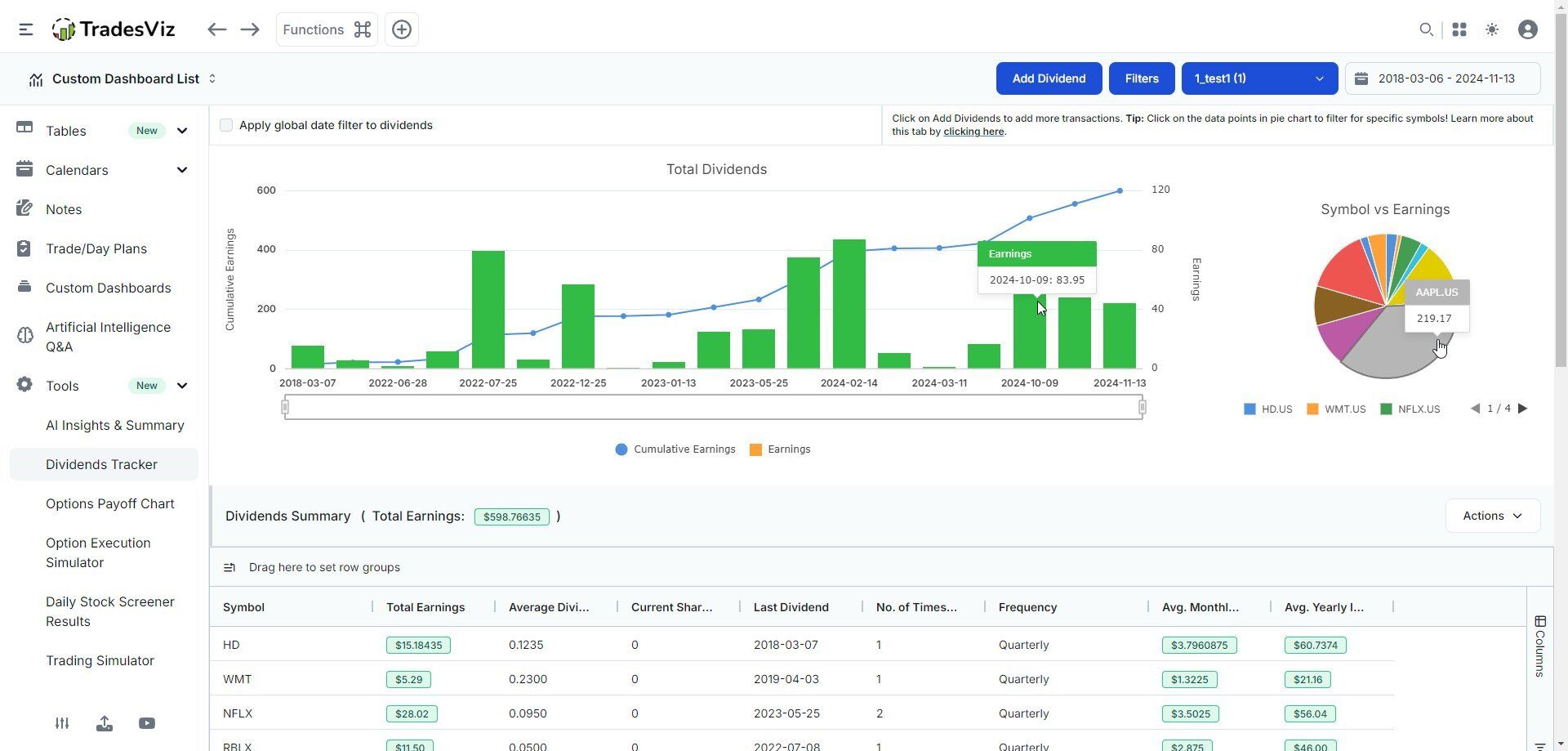

See your trading performance — week by week. The Week View in TradesViz’s calendar gives you a clear breakdown of PnL, volume, and execution trends over time. Spot when you were in rhythm and when things slipped. Track consistency, zoom into strong periods, and refine your weekly trading game. One glance tells you everything you need to adjust and improve.