TradesViz

🎉 New auto sync: Blofin accounts can now be auto-synced on TradesViz, along with a few other crypto exchanges. More auto-sync coming soon, along with cool new features 😎

TradesViz

🎉 New auto sync: Blofin accounts can now be auto-synced on TradesViz, along with a few other crypto exchanges. More auto-sync coming soon, along with cool new features 😎

TradesViz

Stop digging through spreadsheets. Just ask. 🗣️ Imagine having a quantitative analyst sitting next to you, ready to answer any question about your performance. With AI Trade Chat, you can simply type "list out my weakest account" and get an instant, data-driven audit. In this example, the AI identifies that "Trades 02" is underperforming with a Win Rate of 48.33% and a Profit Factor of 0.79. It doesn't just show the chart; it interprets the story behind the numbers. Turn your data into a conversation.

TradesViz

The Feb 10 technical screen highlighted strong, sustained participation across multiple sectors, confirming broad market momentum. In the **five‑day continuous volume expansion group**, $KELYB led with a 58.9% price gain and a massive 2.34 million‑percent volume surge, signaling aggressive reentry into thinly traded small caps. $XPO and $ARMU followed with 37%‑plus gains, supported by triple‑digit volume jumps, while $ARMG (+35.3%) and $CING (+34.1%) showed consistent liquidity expansion tied to biotech and growth themes. $PSNY and $FORM advanced about 28%, both backed by significant volume inflows, reinforcing institutional participation. Among the **14‑day uptrend names**, momentum remained firm across speculative and large‑cap names alike. $BTF (+267%) and $BNAI (+265%) led price performance, while $LITX (+117%) printed a 2,492% volume surge, confirming durable strength in EV and battery plays. $AZN, $ETHD, and $ETQ held steady 70–80% gains with sustained interest, while $CONI and $MOD extended their multi‑week climbs on expanding turnover. The alignment of persistent price increases with multi‑session volume confirmation demonstrates steady accumulation rather than short‑term speculation — a constructive signal of underlying market breadth heading deeper into February.

TradesViz

The Feb 10 options flow screen showed consistent strength in put‑side premium selling across major sectors, signaling steady institutional risk rotation rather than panic moves. $TSM led the activity with a 103% increase in put premium sold, totaling 7.5 million in flow. The accompanying trend chart showed price stability through the session, confirming controlled selling pressure rather than directional weakness. Behind it, $KD surged 14,966%, and $MAGS rose 12,268%, both reflecting sharp multi‑day expansions in put flow from minimal prior levels. $EEM and $NVDL recorded 5,244% and 2,443% jumps, showing broader engagement across international and derivative ETFs. Mid‑range increases came from $HIMS (+625%), $BRKB (+797%), $BE (+460%), $GEV (+928%), and $NFLX (+60%), confirming the flow was market‑wide rather than sector‑specific. The pattern — continuous two‑day rise in sold puts paired with price stability — indicates accumulation of short‑volatility exposure. Such coordinated selling generally reflects confidence in near‑term market resilience and institutional positioning for premium capture heading into mid‑February.

TradesViz

The Feb 10 options tape showed concentrated institutional rotations in metals, semiconductors, and megacap tech. $SCCO dominated the session with a cluster of large sweeps on the $120C line expiring Feb 20 2026, totaling over $85 million in premium across multiple prints. Combined flow across $115C and $120C strikes suggests aggressive premium selling and repositioning around copper exposure, aligning with a broader materials unwind. $TSLA followed with mixed two‑way activity on December 2028 $600P contracts, alternating buy and sell splits of $22 million, $14 million, and $12 million each. The sequence reflected delta and volatility adjustment rather than new directional bets. Smaller but notable trades hit the $340C line at $5.9 million and June 2027 $120P at similar sizing. $SHOP printed heavy sell‑side sweeps on the $135P and $140P expiries (April and May 2026), totaling roughly $22 million, signaling institutional profit‑taking or structured premium capture after strong downside runs. $LMT logged a $6.8 million split‑side call buy on the March 2026 $570C, maintaining steady defense‑sector participation. $SLV and $XOM each added mid‑sized trades—around $6 million per print—keeping metals and energy active in hedge rotation.

TradesViz

The Feb 10 earnings lineup features a heavyweight mix of healthcare, consumer, energy, and industrial leaders. AstraZeneca ($AZN) opens the pre‑market slate with a $595 billion market cap and $2.18 EPS estimate, setting the tone for global pharma. Coca‑Cola ($KO) follows at $339 billion and $0.56 EPS, providing a read on global consumer demand. S&P Global ($SPGI) adds a key financial data component with a $133 billion valuation and $4.32 EPS forecast, while BP ($BP) brings energy exposure at $101 billion and $0.57 EPS. CVS Health ($CVS) contributes healthcare‑retail visibility with $0.99 EPS on a $99 billion market cap, and Duke Energy ($DUK) rounds out the utility side with $1.51 EPS expected. After hours, Gilead ($GILD) reports with $1.83 EPS on $189 billion, and Welltower ($WELL) at $1.44 EPS on $134 billion, both providing clarity on biotech and healthcare real‑estate trends. Marriott ($MAR) at $89 billion and Spotify ($SPOT) at $86 billion finish the pre‑market roster, offering insights into travel recovery and digital streaming margins.

TradesViz

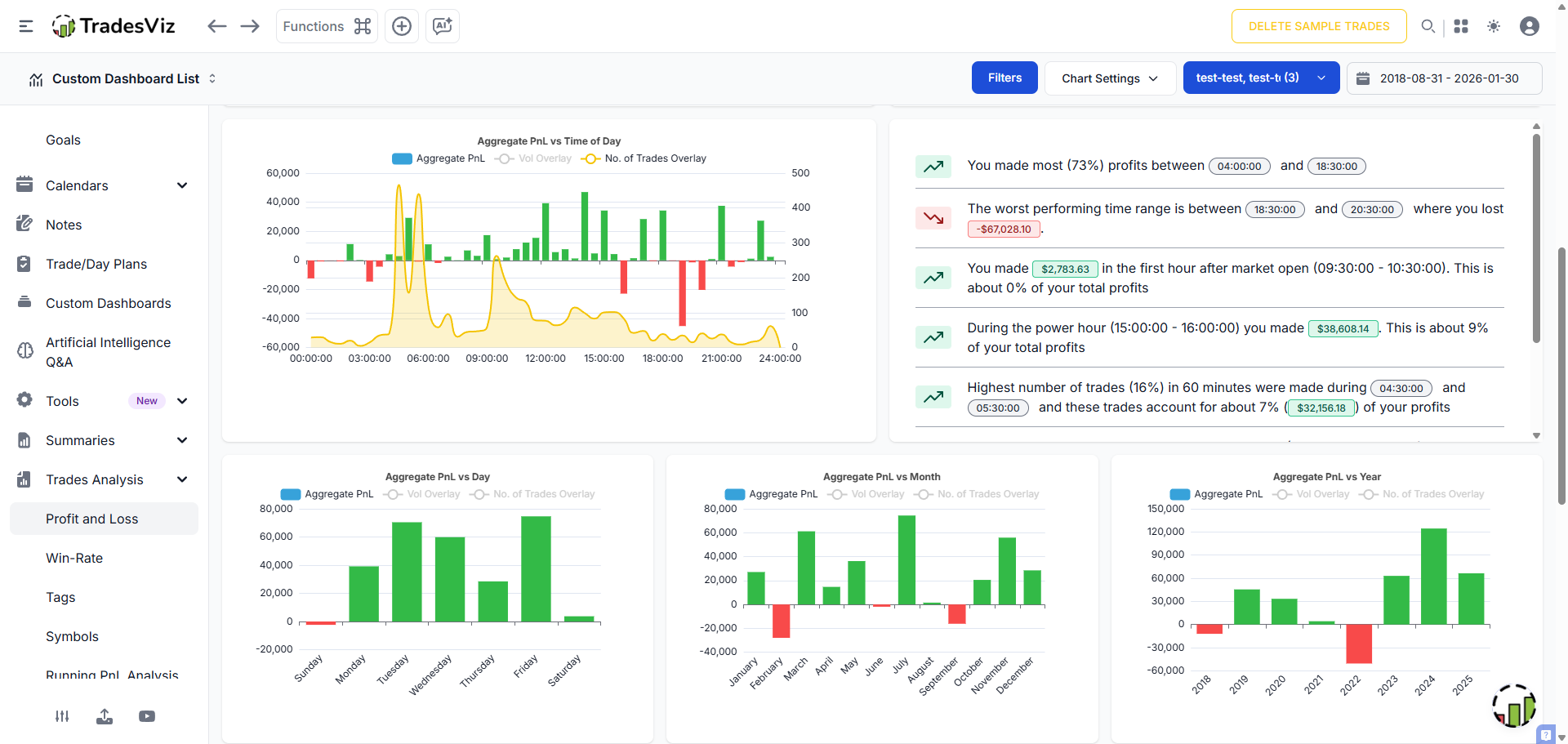

Here's something no journal will tell you. Many of these metrics can be misleading without proper context and depth. Other journals/gurus: "Red pnl from 10:30-11:30? stop trading that hr" 🤡 Reality: Actually, 95% of losses came from 2 trades out of 20... 🤓 TradesViz helps you get exactly the insight you need and makes you understand it :)

TradesViz

The journal that grows with you. 🚀 You might switch brokers, but you shouldn't have to switch journals. TradesViz is built to handle the entire industry ecosystem. We already support the vast majority of major platforms, but we don't stop there. If you don't see your specific platform listed, simply contact us and we will add it for you. We are committed to ensuring your trading history remains intact, regardless of who facilitates your orders. Your data. Your terms.

TradesViz

Are you capturing the move, or just a fraction of it? 🤏 The gap between your "Actual PnL" and the "Best Possible PnL" is your room for growth. The Best Exit Dashboard calculates the theoretical maximum profit for every trade you took, allowing you to compare your performance against perfection. The "Best Exit PnL vs Time of Day" chart (top left) helps you spot patterns: Are you consistently selling too early in the morning session while the trend continues to rip? Don't just be profitable. Be efficient.

TradesViz

Stop switching tabs to do your homework. 📚 A complete trading plan requires more than just a chart. You need to know the engine under the hood. The Fundamental Data dashboard integrates institutional-grade research directly into your workflow. From Valuation & TTM metrics like PE Ratios and EBITDA to critical Share Structure details like Float and Short Interest, everything is accessible on a single screen. You even get direct links to SEC 10K and 10Q Filings so you can verify the source without leaving the platform. Streamline your research. execute with confidence.