A trading journal should comprise all related data of a particular trade/execution. More data = more context and information about the events that unfolded when trade was executed thus you can naturally get more insights about your good and bad trades and learn more from them. This new update brings options greeks to TradesViz. TradesViz is currently the only online trading journal that has spot greeks stats for all options executions!

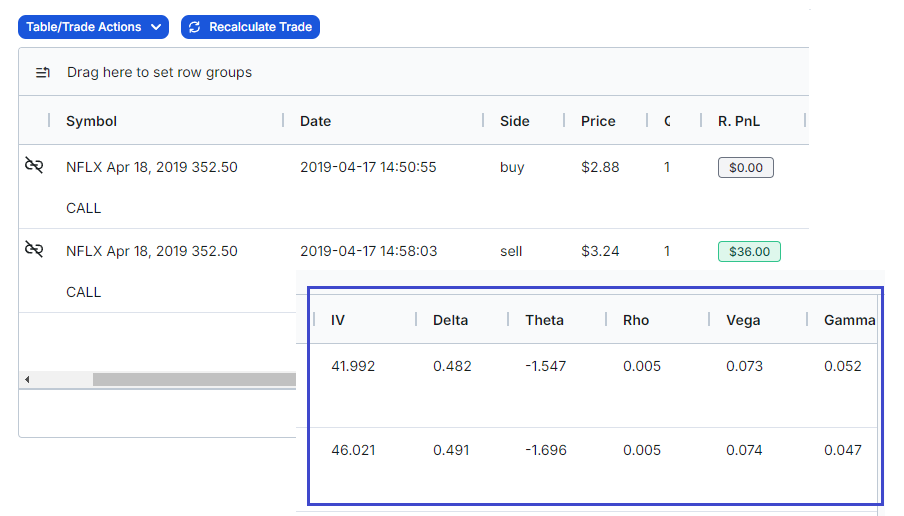

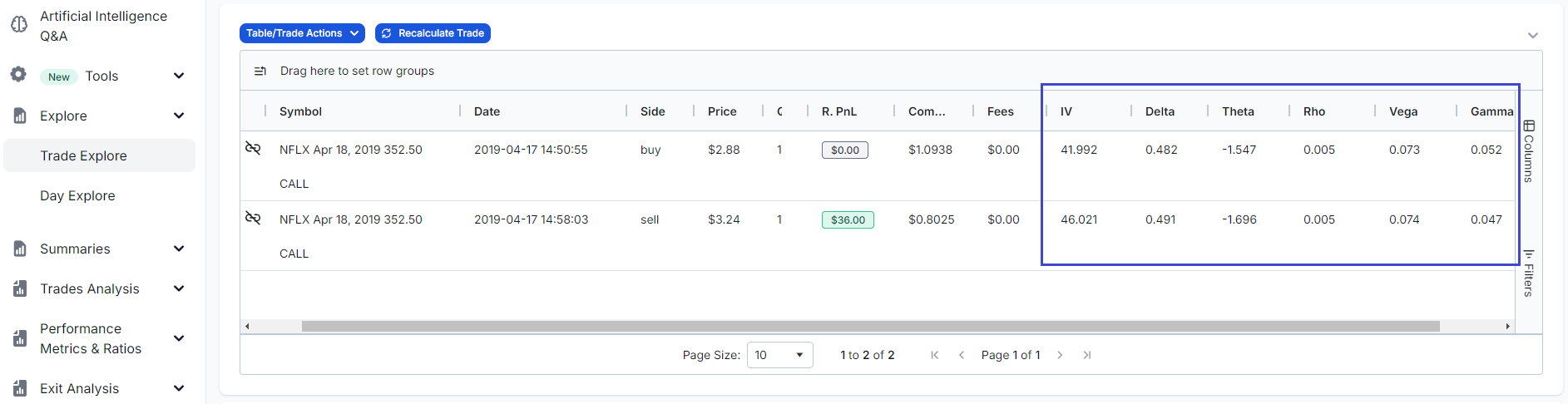

The options greeks can be accessed in the executions table in the trade explore tab. To get to the trade explore tab, click on the target icon of any trade in any trades table.

As of now, greeks are only generated for executions. In the following updates, we will generate greeks for entire options trades and use them for generating option greek based analysis plots. With these features, TradesViz along with advanced analytics in stock price/volume/market-based analytics will also have advanced options-based analytics which makes it a complete analysis solution for a vast majority of options and stock traders!

Here are some notes for your information about the greeks generation feature:

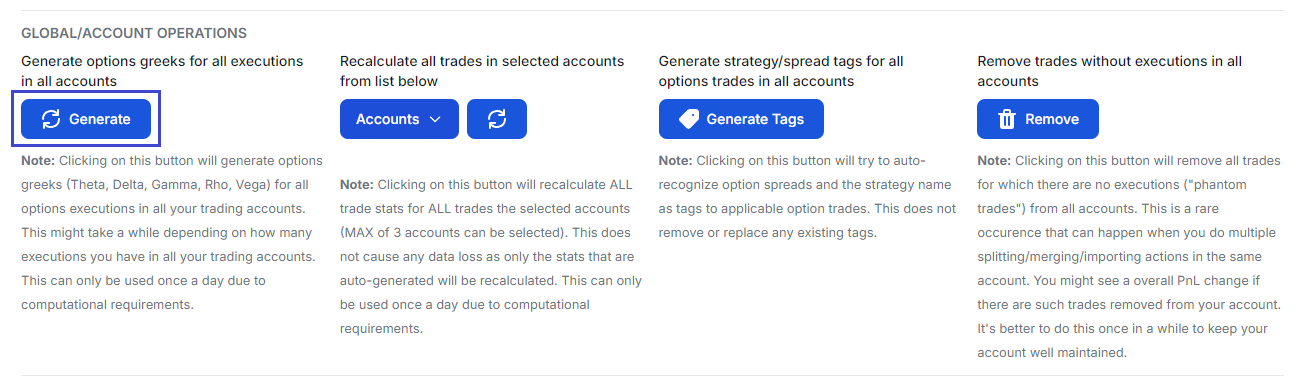

- You can generate option greeks for your entire account by accessing your global account settings page and clicking on the generate greeks button.

- You can also generate option greeks for executions in individual trades using the recalculate buttons above the table in the trade explore tab.

- By default, all the imported options executions will have greeks automatically generated for them. You only have to generate them manually for the manually added trades (via Add trade in the dashboard or from the import/export page).

- These greeks are generated based on the Black-Scholes model of options pricing. They will not always be exactly the same as the trading platform you use but will be very close to them this is due to the use of different parameters of the Black-Scholes model in different platforms.

- The greeks calculated are for the option at the time of execution so they can be used for entry/exit analysis. There is no way to update the greeks as they change for an option. Since we are focused on providing data at the time of execution, only spot greeks are available.

- For almost all US stocks, the greeks can be generated with very good accuracy. Exceptions at the moment are some index options for which we cannot guarantee accuracy and sometimes even generate the greeks at all - this is very rare. In future updates, you will be able to manually update greeks for all options executions if you feel any greeks are wrong reported or are missing.

- If you are not used to looking at options greeks or don't know about it, we would highly suggest learning it if you are a frequent options trader. We would recommend starting with Investopedia's courses/guides: https://www.investopedia.com/terms/g/greeks.asp.

That's it for the introduction to the option greeks feature! Stay tuned to our Twitter account (@TradesViz) for more updates and tips about how to use best use TradesViz to make your trades journaling easy! If you have any suggestions, feedback, or issues with using the option greeks features, please let us know by emailing us at [email protected]!