TradesViz

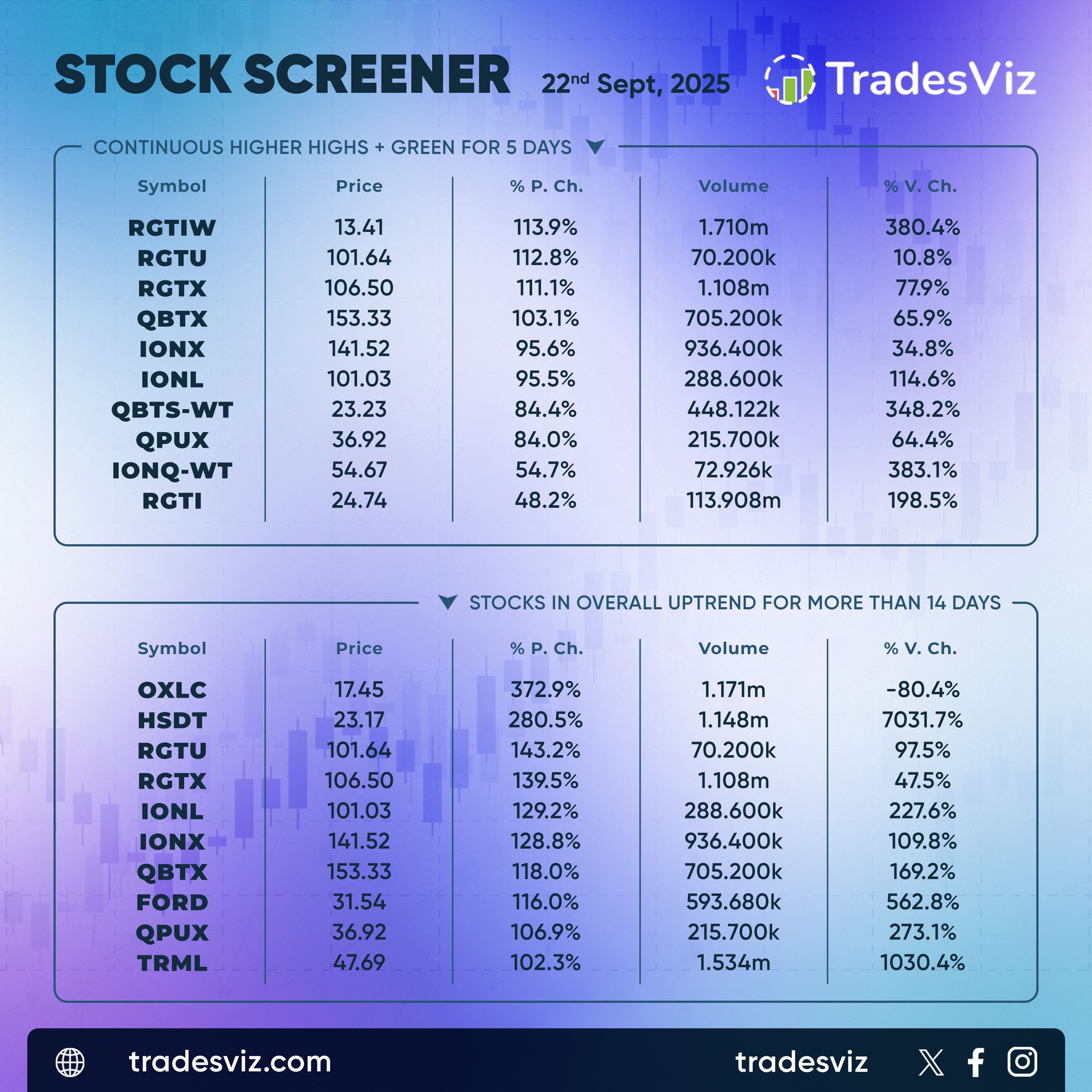

Big moves lighting up the scanner today with 20%+ price jumps across multiple names. $AGMH, $FATN, and $VRME headline with triple-digit gains and massive volume surges. $OKLL and $QUBX appear on both momentum and Bollinger Band breakouts — momentum + volatility combo. Watch for continuation setups and potential intraday reversals from extended moves. Plenty of action to dig into — pick your spots with purpose.